Drilling & Completions | Quarterly / Earnings Reports | Second Quarter (2Q) Update | Financial Results | Capital Markets | Capital Expenditure | Drilling Activity

PHX Minerals Fiscal Second Quarter 2021 Results

PHX Minerals Inc. reported financial and operating results for the second quarter ended March 31, 2021.

Highlights:

- Production volumes for the second fiscal quarter of 2021 were 2,297 Mmcfe, decreased from 2,373 Mmcfe in the second fiscal quarter of 2020 and increased from 2,074 Mmcfe in the first fiscal quarter of 2021.

- Net loss in the second fiscal quarter of 2021 was $0.5 million, or $0.02 per share, as compared to net loss $20.5 million, or $1.24 per share, in the second fiscal quarter of 2020 and net loss of $0.6 million, or $0.03 per share, in the first fiscal quarter of 2021.

- Adjusted EBITDA excluding gain on asset sales(1) for the second quarter of 2021 was $3.4 million, increased from $2.4 million in the second fiscal quarter of 2020 and $2.7 million in the first fiscal quarter of 2021.

- On April 30, 2021, the Company closed on the previously announced acquisition of 2,514 net royalty acres in the SCOOP play of Oklahoma for approximately $8.5 million in cash and 1.2 million shares of PHX stock.

- Reduced total debt 13% from $27.0 million as of Dec. 31, 2020, to $23.5 million as of March 31, 2021. As of April 30, 2021, debt had been further reduced by $1.75 million to $21.75 million.

- Debt to adjusted EBITDA (TTM) (1) ratio was 2.34x at March 31, 2021.

- Approved the payment of a one cent per share dividend payable on June 4, 2021, to stockholders of record on May 20, 2021.

Chad L. Stephens, President and CEO, commented, "PHX continues to achieve excellent results towards its stated objectives of growing the company through the strategic acquisition of producing minerals with line-of-sight development in our core focus areas, high grading our asset base by divesting of lower margin assets outside of our core focus areas and reducing our debt to strengthen our financial position.

"During the quarter, production volumes increased 11% sequentially. Significantly, for the first-time in the last 10 years, royalty production volumes exceeded working interest production volumes, which illuminates our stated mineral-only growth strategy. The increase in our volumes and the improved realized commodity prices, resulted in adjusted EBITDA(1) excluding gain on asset sales of $3.4 million, which was an increase of approximately 26%, or $0.7 million, over the first quarter of fiscal 2021.

"With our improved financial performance, we were able to reduce our debt by $3.5 million, or 13%, from the end of the first quarter of fiscal year 2021, which continues to improve our financial strength. Since the end of the second quarter, we paid down debt an additional $1.75 million, bringing our total borrowings to $21.75 million as of April 30, 2021. We now believe that our Debt to adjusted EBITDA (TTM) (1) will approximate 1.0x by calendar year end 2021. Overall, our credit profile has significantly improved, as compared to one year ago. We believe this puts us in a stronger position to allocate more of our capital to our stated strategy.

"Further, since quarter end, we completed our second equity offering over the last seven months which allowed us to fund our previously announced SCOOP-focused mineral acquisition in Oklahoma. This acquisition closed on Friday, April 30, 2021. We continue to see good deal flow and look forward to keeping you apprised of our efforts to continue to drive shareholder value."

Fiscal Q2 Results

The Company recorded a second quarter 2021 net loss of $499,723, or $0.02 per share, as compared to a net loss of $20,454,814, or $1.24 per share, in the second quarter 2020. This change in net loss was principally the result of increased natural gas, oil and NGL sales and decreased general and administrative expenses (G&A), lease operating expenses (LOE), transportation, gathering and marketing expenses, depreciation, depletion and amortization (DD&A) and impairment expense, partially offset by a decrease in gain (losses) on derivative contracts and income tax benefit.

Natural gas, oil and NGL revenue increased $1,128,207, or 16%, for the second quarter 2021, compared to the corresponding 2020 quarter due to increases in natural gas, oil and NGL prices of 54%, 24% and 101%, respectively, and an increase in natural gas production volumes of 13%, partially offset by decrease in oil and NGL production volumes of 40% and 22%, respectively.

The decrease in oil production was primarily due to naturally declining production in high-interest wells brought online during the first quarter of 2020 in the Bakken play, as well as reduced drilling and completion activity in 2021, compared to 2020 in the Eagle Ford and SCOOP plays due to prevailing economic conditions. The decrease in NGL production was primarily attributable to production downtime and curtailments in high-interest wells in response to market conditions in the SCOOP and STACK plays, as well as naturally declining production in liquid-rich gas areas of the Anadarko Granite Wash play. Natural gas volumes increased as a result of acquisitions in the Haynesville Shale, which were partially offset by naturally declining production in the Fayetteville Shale, production downtime and curtailments in high-interest wells in response to market conditions in the STACK and SCOOP plays.

The Company had a net loss on derivative contracts of $2,348,143 in the 2021 quarter, as compared to a net gain of $4,071,577 in the 2020 quarter. The net loss on derivative contracts in the current period was principally due to the natural gas and oil collars and fixed price swaps being less beneficial in relation to their respective contracted volumes and prices at the beginning of the period, compared to such natural gas and oil collars and fixed price swaps being more beneficial in the comparative period causing a net gain.

The 22% decrease in total cost per Mcfe in the 2021 quarter, relative to the 2020 quarter, was primarily driven by a decrease in DD&A. DD&A decreased $1,595,701, or 47%, in the 2021 quarter to $0.77 per Mcfe, as compared to $1.42 per Mcfe in the 2020 quarter. $108,393 of the decrease was a result of production decreasing 3% in the 2021 quarter and $1,487,308 of the decrease was as a result of a $0.65 decrease in the DD&A rate per Mcfe. The rate decrease was mainly due to impairments taken at the end of the 2020 second quarter, which lowered the basis of the assets. The rate decrease was partially offset by lower natural gas, oil and NGL prices utilized in the reserve calculations during the 2021 quarter, as compared to prices used for the 2020 quarter, shortening the economic life of wells. This resulted in lower projected remaining reserves on a significant number of wells causing increased units of production DD&A.

Six Months 2021 Results

The Company recorded a six-month net loss of $1,096,443, or $0.05 per share, in the 2021 period, as compared to a net loss of $18,562,700, or $1.12 per share, in the 2020 period. The change in net loss was principally the result of decreased G&A, LOE, transportation, gathering and marketing expenses, DD&A and impairment expense, partially offset by a decrease in natural gas, oil and NGL sales, gain (losses) on derivative contracts, gain on asset sales and income tax benefit.

Natural gas, oil and NGL sales remained relatively consistent with decreases in oil and NGL volumes of 28% and 10%, respectively, partially offset by increases in natural gas and NGL prices of 29% and 41%, respectively.

The decrease in oil production was primarily due to naturally declining production in high-interest wells brought online during the first quarter of 2020 in the Bakken play, as well as reduced drilling and completion activity in 2021, compared to 2020 in the Eagle Ford and SCOOP plays due to prevailing economic conditions. The decrease in NGL production was primarily attributable to production downtime and curtailments in high-interest wells in response to market conditions in the SCOOP play as well as naturally declining production in liquid-rich gas areas of the Anadarko Granite Wash play. Natural gas volumes increased as a result of acquisitions in the Haynesville Shale, which were partially offset by naturally declining production in the Fayetteville Shale, production downtime and curtailments in high-interest wells in response to market conditions in the STACK and SCOOP plays.

The Company had a net loss on derivative contracts of $2,602,179 in the 2021 period, as compared to a net gain of $3,253,683 in the 2020 period. The net loss on derivative contracts in the current period was principally due to the natural gas and oil collars and fixed price swaps being less beneficial in relation to their respective contracted volumes and prices at the beginning of the period, compared to such natural gas and oil collars and fixed price swaps being more beneficial in the 2020 period causing a net gain.

The 17% decrease in total cost per Mcfe in the 2021 period, relative to the 2020 period, was primarily driven by a decrease in DD&A. DD&A decreased $2,290,753, or 36%, in the 2021 period to $0.92 per Mcfe, as compared to $1.36 per Mcfe in the 2020 period. $381,457 of the decrease was a result of production decreasing 6% in the 2021 period and $1,909,296 of the decrease was as a result of a $0.44 decrease in the DD&A rate per Mcfe. The rate decrease was mainly due to impairments taken at the end of the 2020 second quarter, which lowered the basis of the assets. The rate decrease was partially offset by lower natural gas, oil and NGL prices utilized in the reserve calculations during the 2021 period, as compared to prices used for the 2020 period, shortening the economic life of wells. This resulted in lower projected remaining reserves on a significant number of wells causing increased units of production DD&A.

Ops Update

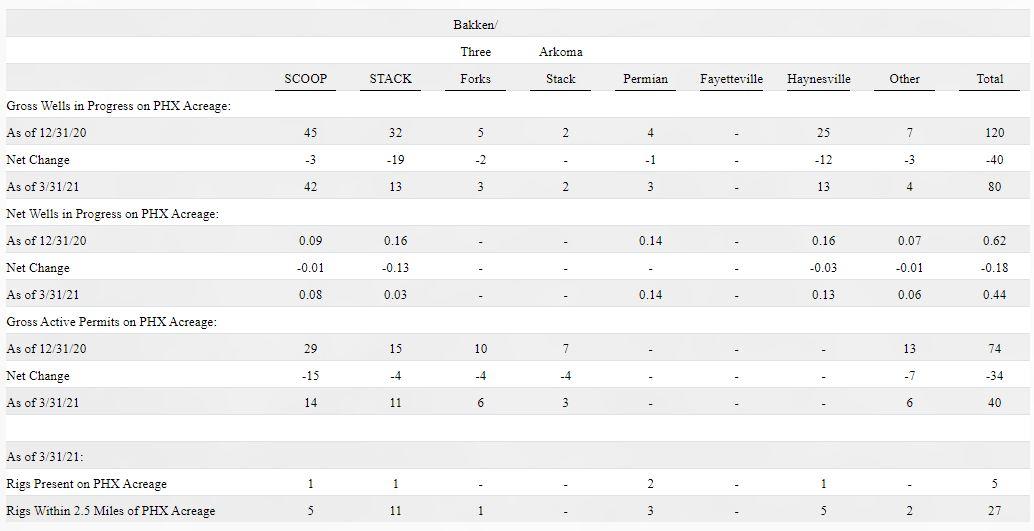

During the quarter ended March 31, 2021, we converted 37 gross and 0.16 net wells in progress to producing wells. Our inventory of wells in progress decreased to 80 gross wells and 0.44 net wells.

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

Saturn Oil & Gas Second Quarter 2022 Results

-

Empire Petroleum Second Quarter 2022 Results

-

ProFrac Holding Corp. Second Quarter 2022 Results

-

InPlay Oil Corp. Second Quarter 2022 Results

-

Vermilion Energy Inc. Second Quarter 2022 Results

Ark-La-Tex News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -