Drilling & Completions | Quarterly / Earnings Reports | Second Quarter (2Q) Update | Financial Results | Capital Markets | Capital Expenditure | Drilling Activity

Penn Virginia Second Quarter 2021 Results

Penn Virginia Corp. announced its financial and operational results for the second quarter 2021.

Recent Significant Highlights:

- After raising oil guidance in the first quarter of 2021, the Company again exceeded the high end of oil sales guidance, with 20,117 barrels of oil per day ("bbl/d") for the second quarter of 2021. Total sales volumes for the same period were 24,844 barrels of oil equivalent per day ("boe/d");

- Reduced estimated per well costs by approximately 4% compared to initial guidance estimates for wells completed in the second quarter of 2021;

- Lowered operating expenses per barrel of oil equivalent ("boe") by approximately 19% compared to the first quarter 2021;

- Announced agreement to acquire Lonestar Resources US Inc. ("Lonestar") in an all-stock transaction that is expected to be highly accretive across key metrics and significantly increase Penn Virginia's Free Cash Flow, production, and drilling inventory (the "Merger"). The Merger is anticipated to close in the second half of 2021;

- The combination with Lonestar is expected to result in over $20 million in annual cost synergies, with incremental near-term operational synergies from longer laterals, shared facilities, and capital efficiencies, after the close;

- Priced inaugural $400 million of senior unsecured notes (the "Notes") with net proceeds anticipated to be used to refinance Lonestar's existing long-term debt and Penn Virginia's Second Lien Term Loan, creating access to high yield capital markets and facilitating the launch of an upsizing of the borrowing base to enhance liquidity upon closing of the Merger;

- Generated significant Free Cash Flow(1) for the seventh consecutive quarter, lowering Net Debt(2) by approximately $30 million to $334 million as of June 30, 2021;

- Generated net income of $8 million (including a non-cash mark-to-market loss on derivatives of $38 million); and

- Reported adjusted EBITDAX(3)(4) of over $77 million for the second quarter of 2021.

Darrin Henke, President and Chief Executive Officer of Penn Virginia, commented, "I couldn't be more proud of our team. This quarter has been one of the best performing quarters for the Penn Virginia team to date and could not have been achieved without the tireless efforts of our entire employee base. It's not often that within one month, we get to announce we significantly exceeded production expectations, lowered our capital costs, improved our operating costs, announced a transformational merger, gained access to high yield capital markets, expanded liquidity, and had one of our highest Free Cash Flow quarters in recent history. Our commitment to continuous improvement through a disciplined focus on cash-on-cash returns continues to produce both operational and financial outperformance to the benefit of all of our stakeholders.

"As proud as we are of recent results, we are even more excited about what we believe the future holds. We continue to see ongoing operational efficiencies on our pad sites as we consistently optimize our development program utilizing the latest drilling and completion techniques resulting in continuous improvement in well performance. Our latest well results in our Northeast and Southwest portions of our acreage position have validated our extensive inventory in these areas, and our recent wells there have outperformed even our own expectations. Our pending acquisition will expand our scale in both the Northeast and Southwest areas, creating large contiguous blocks for optimized development using longer laterals, shared facilities, and significant cost and operating synergies. Lastly, our track record of robust operational performance, strong Free Cash Flow position, balance sheet strength, and access to capital markets has positioned us as a disciplined consolidator in one of the premier oil basins in North America."

Second Quarter 2021 Operating Results

Total sales volumes for the second quarter of 2021 were 2.3 million barrels of oil equivalent, or 24,844 boe/d (81% crude oil). During the second quarter of 2021, the Company completed and turned to sales 10 gross (8.2 net) wells(5).

Second Quarter 2021 Financial Results

Operating expenses were $57.4 million, or $25.39 per barrel of oil equivalent ("boe"), in the second quarter of 2021 including $12.74 per boe of depreciation, depletion and amortization expenses. Total cash direct operating expenses(6), which consist of lease operating expenses ("LOE"), gathering, processing, and transportation ("GPT") expenses, production and ad valorem taxes, and cash general and administrative ("G&A") expenses, were $27.6 million, or $12.23 per boe, in the second quarter of 2021. Total G&A expenses for the second quarter of 2021 were $3.09 per boe, which included $1.0 million of non-cash share-based compensation. For the second quarter of 2021, adjusted cash G&A expenses(7), which excludes non-cash share-based compensation, were $2.66 per boe, and LOE was $4.30 per boe.

Net income for the second quarter of 2021 was $7.6 million, and net income attributable to common shareholders was $3.0 million, or $0.20 per share and per diluted share, compared to a net loss of $94.7 million, or $6.24 per share, in the second quarter of 2020. Adjusted net income(8) was $40.2 million, or $1.05 per diluted share, in the second quarter of 2021 versus $19.6 million, or $1.29 per diluted share in the second quarter of 2020.

Adjusted EBITDAX(3)(4) was $77.1 million in the second quarter of 2021, compared to $66.8 million in the second quarter of 2020, up primarily due to higher production and higher crude oil prices.

Balance Sheet, Liquidity and Capital Spending

As of June 30, 2021, Penn Virginia had cash of $49.7 million and total debt of $383.9 million, including borrowings under its revolving credit facility of $238.9 million. Liquidity was $160.4 million as of June 30, 2021, including cash and $110.7 million available under the Company's revolving credit facility. As of June 30, 2021, the Company had a Net Debt(2) to LTM adjusted EBITDAX ratio of approximately 1.3x(9) on a standalone basis, targeting approximately 1.0x, including the effects of the Lonestar acquisition, in early 2022.

During the second quarter of 2021, the Company incurred $68.7 million of capital expenditures.

- Penn Virginia reduced estimated per well costs by approximately 4% compared to initial guidance estimates for wells completed in the second quarter of 2021, driven primarily by utilizing simulfrac operations and improvements in cycle times. The more efficient operational cadence allowed Penn Virginia to complete two additional multi-well pads at the end of the quarter, originally scheduled for completion in early July;

- The cycle time improvements shifted approximately $12.2 million in capital expenditures from the third quarter into the second quarter of 2021, resulting in total capital expenditures in the second quarter of approximately $68.7 million (equating to the low-end of guidance without the effect of cycle time improvements);

- Both pads were turned to sales in the third quarter; and

- Penn Virginia is maintaining its 2021 capital expenditure guidance for the full year, and the Company remains focused on capital discipline with a consistent two-rig development plan.

Senior Unsecured Notes

Following the end of the second quarter, Penn Virginia priced $400 million of senior unsecured notes with net proceeds anticipated to be used to refinance Lonestar's existing long-term debt and Penn Virginia's Second Lien Term Loan. Upon closing the Merger, Penn Virginia's capitalization is expected to include the Notes and an upsized revolving credit facility to enhance liquidity .

Acreage

As of June 30, 2021, the Company had approximately 102,400 gross (90,400 net) acres. Approximately 91% of Penn Virginia's acreage is held by production.

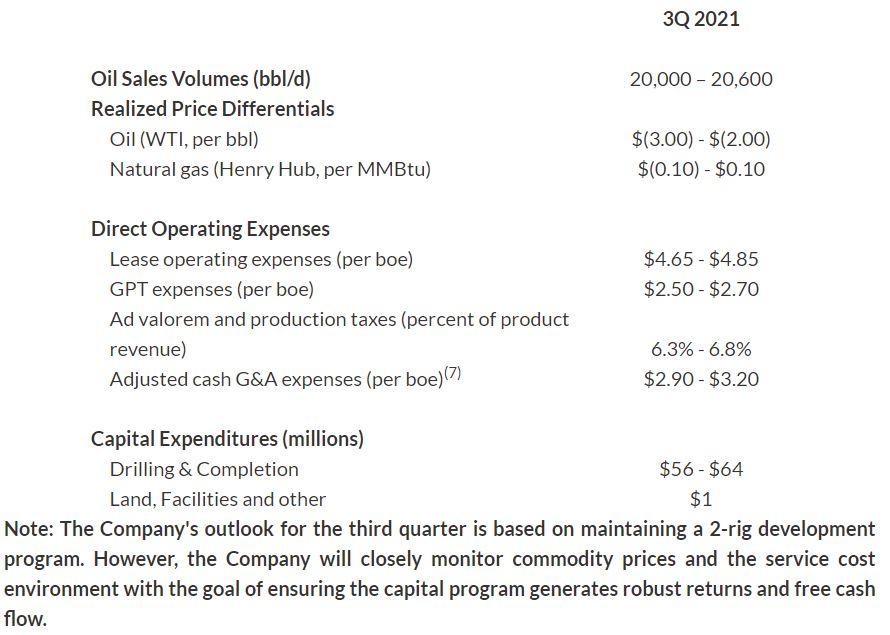

Q3 2021 Outlook

The table below sets forth the Company's operational and financial guidance for the third quarter 2021(4):

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

Saturn Oil & Gas Second Quarter 2022 Results

-

Empire Petroleum Second Quarter 2022 Results

-

ProFrac Holding Corp. Second Quarter 2022 Results

-

InPlay Oil Corp. Second Quarter 2022 Results

-

Vermilion Energy Inc. Second Quarter 2022 Results

Gulf Coast News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

-

Eagle Ford Operator Cuts 2024 Well Planned by 30% -

-

An Early Look at Company 2024 Capital & Development Plans