Penn Virginia Corp. detailed a preliminary update for Q1 2021.

Preliminary Q1 Highlights:

- Sold 16,324 BOPD for the first quarter of 2021, exceeding the high end of the most recent guidance range. Total sales volumes for the first quarter of 2021 were 20,534 BOEPD. Total production for the seven days ending March 31, 2021 averaged over 20,000 BOPD and 25,000 BOEPD

- Estimated capital expenditures for the first quarter of 2021 of approximately $54 million, which was below the low end of the most recent guidance range

- Realized oil price for the first quarter of 2021 of $44.80 per barrel, including effects of derivatives, net

- Generated Free Cash Flow(2) for the sixth consecutive quarter, which lowered Long-term debt to $376 million and Net Debt(3) to $364 million as of March 31, 2021

- The Company recently obtained an updated reserve report from DeGolyer and MacNaughton as of April 1, 2021.

Darrin Henke, President and Chief Executive Officer of Penn Virginia, commented, "Our strong sales volumes for the quarter were largely due to the outperformance of wells brought online during the period, which used our improved completion designs along with an adjusted approach to drilling and flowback. Volumes for the quarter were also less impacted from the February winter storm than we previously anticipated, largely due to the outstanding efforts of the Penn Virginia operational team. In addition to maintaining our existing production and bringing on some impressive wells, we have continued to focus on additional operational and cost efficiencies, which translated into lower than expected capital expenditures for the quarter. Importantly, our production growth was not achieved by increasing our capital expenditures. Rather, it is due to the improvement of our execution on our existing assets, which required less capital than we anticipated. Given this strong outperformance in the first quarter, and expectations of future positive well performance using our improved techniques, we have increased our production guidance for the full year 2021. We continue to believe our premium asset base combined with our commitment to free cash flow, capital discipline, and maximizing cash-on-cash returns will create long-term value for all stakeholders."

Proved Reserves and Drilling Inventory

As a result of the contribution of certain assets from Rocky Creek Resources, as well as significant developments in the first quarter of 2021, Penn Virginia obtained an updated third-party reserve report from D&M.

Penn Virginia's total proved reserves as of April 1, 2021, were approximately 136.5 million barrels of oil equivalent ("MMBOE"). The proved reserves were calculated in accordance with Securities and Exchange Commission ("SEC") guidelines using the pricing of $39.99 per barrel for oil and $2.16 per million British Thermal Units (MMBtu) for natural gas.

Using flat pricing of $55 per barrel for oil and $2.50 per MMbtu for natural gas as of April 1 2021, the PV-10 Value(4) of the Company's total proved reserves and PDP reserves were $1,660 million and $912 million, respectively.

D&M currently estimates the Company has approximately 500 identified future drilling locations, which represents approximately 12 years of development potential at the Company's expected 2021 drilling pace. Using D&M type curves, Penn Virginia estimates that two-thirds of those drilling locations average more than a 55% well level rate of return at $55 per barrel WTI. Current production from wells turned online in 2020 and 2021 continues to materially outperform D&M type curves.

Balance Sheet and Liquidity

As of March 31, 2021, Penn Virginia had cash of $11.9 million and total debt of $375.8 million, including borrowings under its revolving credit facility of $228.9 million. Liquidity was $132.6 million as of March 31, 2021, including cash of $11.9 million and $120.7 million available under the Company's revolving credit facility.

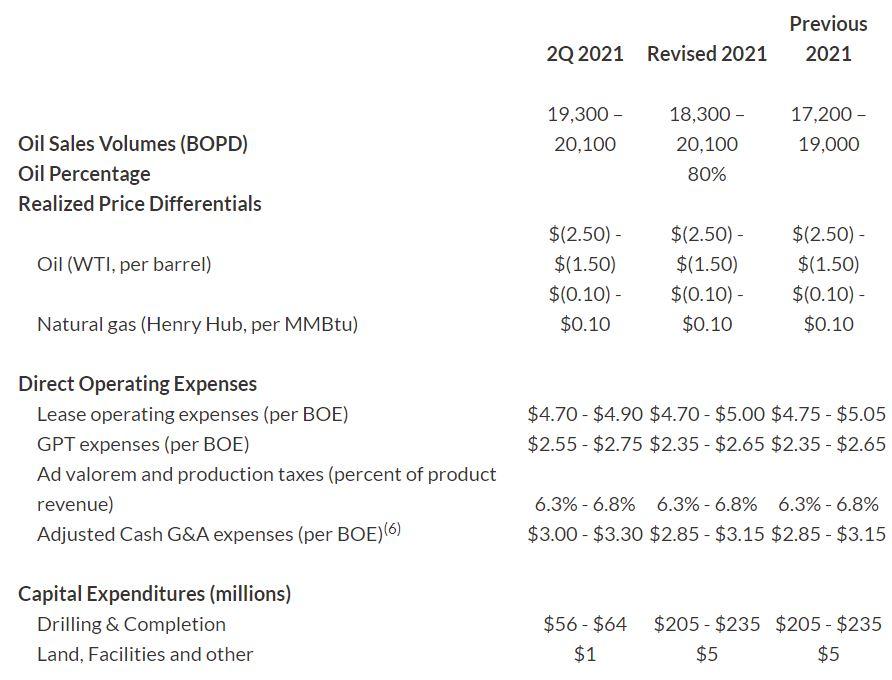

Revised 2021 Outlook

The table below sets forth the Company's operational and financial guidance(5):

Related Categories :

Quarterly - Preliminary

More Quarterly - Preliminary News

-

Talos Details Preliminary Q2 Estimates; 65 MBOEPD in Production

-

Ring Energy Details Preliminary 1Q22 Results; Production Beats Expectations

-

HighPeak Energy Preliminary Fourth Quarter Results, Reserve Update

-

Ring Energy Details Preliminary 4Q21 Results, Hedging Update

-

Earthstone Energy Preliminary Fourth Quarter Results, Reserves

Gulf Coast News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

-

Eagle Ford Operator Cuts 2024 Well Planned by 30% -

-

An Early Look at Company 2024 Capital & Development Plans