Quarterly / Earnings Reports | Fourth Quarter (4Q) Update | Reserves | Financial Results | Capital Markets

PetroShale Fourth Quarter, Full Year 2020 Results; Reserves

PetroShale Inc. reported its Q4 and full year 2020 results.

The company commented: "While 2020 proved to be one of the most challenging operating environments for energy companies globally, PetroShale's performance through the year demonstrated the quality of the Company's asset base, the strength of the business strategy and the execution capability of the PetroShale team. During a period of adverse commodity pricing and economic uncertainty the Company was able to maintain production, meet annual guidance, increase proved plus probable ("2P") reserves, maintain the Company's senior loan borrowing base and continue to generate compelling economics while prudently limiting capital expenditures. With the recently announced recapitalization transaction, summarized below, PetroShale will enter what the Company believes will be a period of unprecedented opportunity, with a growth inventory in the core of the Bakken Shale intact and the financial flexibility to enable the Company to develop this inventory.

"A part of the recently announced recapitalization transaction is a rights offering available to all eligible common shareholders. Such shareholders will acquire fully trading shares when they exercise their allocated rights at a price of $0.20 per right and can supplement their acquisition of common shares by taking advantage of the additional rights subscription whereby they may elect to exercise additional rights also at a price of $0.20 per right. PetroShale's share price was $0.25 at close of trading on March 12, 2021. "

Q4/Year End 2020 Highlights:

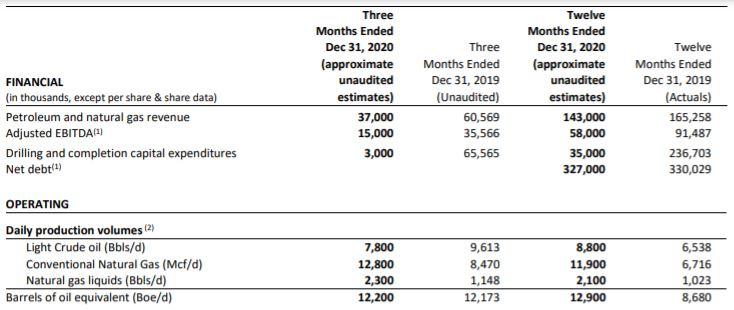

- Fourth quarter production of approximately 12,200 barrels of oil equivalent per day ("Boe/d") remained stable relative to both the third quarter of 2020 and the comparative period in 2019. Average full year production of approximately 12,900 Boe/d was above guidance and approximately 50% higher than 2019, despite reduced capital spending during 2020.

- Revenue from petroleum and natural gas totaled approximately $143 million in 2020, despite 35% lower realized crude oil prices but supported by higher production volumes. In the fourth quarter of 2020 the Company generated approximately $37 million of revenue (before royalties) compared to $61 million in the comparative period of 2019 with similar production levels but lower realized crude prices.

- Adjusted EBITDA1 was approximately $15 million ($0.08 per fully diluted share) in the fourth quarter of 2020, while full year Adjusted EBITDA1 totaled approximately $58 million ($0.30 per fully diluted share).

- Operating netback prior to hedging was approximately $17.65 per Boe in the fourth quarter of 2020, and approximately $14.50 per Boe for 2020.

- Net capital expenditures totaled approximately $3 million in the fourth quarter and approximately $35 million in 2020, largely directed to the completion of 3.2 net non-operated wells, reflecting the Company's prudent decision to minimize discretionary expenditures and preserve long-term value by deferring capital spending during weak commodity markets.

- Bank debt for year-end 2020 was $221.9 million (US$174.1 million) and cash for year-end 2020 was $2.8 million.

2020 Reserves

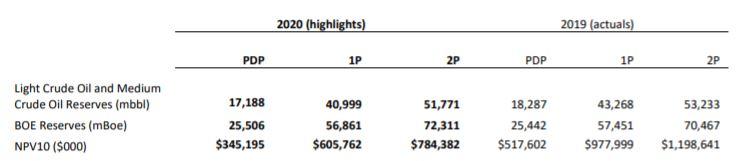

Net present value estimates presented herein reflect an average of three independent engineer forward price decks.

With limited capital expenditures during the year, PetroShale modestly increased 2P reserves, and maintained stability in total proved ("1P") and proved developed producing ("PDP") reserves, as a result of the quality and predictability of the Company's assets.

- PetroShale posted favourable capital efficiencies in 2020, including FD&A3 costs on PDP of approximately $7.30/Boe (40% lower than 2019), approximately $3.50/Boe on 1P (72% lower than 2019), and 2P FD&A costs of ($0.38)/Boe4. F&D3 costs reflected similar year-over-year results, averaging approximately $7.30/Boe on PDP, approximately $3.70/Boe on 1P and were ($0.41)/Boe4 for 2P.

- FD&A recycle ratios3 were 2 times for PDP and 4 times on a 1P basis based on PetroShale's unaudited annual operating netback5 prior to hedging of $14.50/Boe5.

- The reserve additions and capital efficiencies realized by the Company in 2020 are a reflection of the value creation potential within PetroShale's Bakken core area, evidenced by the ability to maintain stable reserve volumes year over year, while committing limited capital and achieving top quartile finding costs.

- At year end 2020, PetroShale had a reserve life index ("RLI")3 of approximately 16 years on a 2P basis and 13 years on a 1P basis, (based on annualized fourth quarter 2020 average production of approximately 12,200 Boe/d).

- PetroShale's year end 2020 2P reserves were 87% light crude oil and natural gas liquids, and 1P reserves were 87% light crude oil and natural gas liquids, positioning the Company with strong torque to improving crude oil prices.

SUBSEQUENT EVENT - RECAPITALIZATION TRANSACTION

On March 4, 2021 PetroShale announced a transformational recapitalization transaction designed to significantly improve the Company's financial flexibility and sustainability (the "Transaction"). By way of a private placement to the Company's two largest shareholders and a rights offering to the remaining common shareholders, the Company will raise a minimum of $30.0 million and up to $60.6 million of new common equity.

These proceeds will be directed to the reduction of outstanding bank indebtedness and to substantially increase the Company's financial flexibility. Additionally, the Company's outstanding preferred shares (the "Preferred Shares") will be converted to common shares of PetroShale at a significant premium to the current trading price of the common shares, thereby eliminating the payment of approximately $10 million in preferred dividends annually and eliminating the repayment obligation of US$86.9 million due in January 2023. The conversion of the preferred shares will also meaningfully simplify the Company's capital structure. As a result of the Transaction, PetroShale also reached an agreement in principle with the Company's lenders under its senior secured credit facility, providing additional certainty with respect to maintaining the borrowing base at US$177.5MM for at least the next fourteen months and extending the tenure of the credit agreement to June 2023, further enhancing the Company's liquidity.

Related Categories :

Fourth Quarter (4Q) Update

More Fourth Quarter (4Q) Update News

-

Endeavor Talks 2023 Development Program; Rigs, Frac Crews -

-

Crescent Energy 4Q, Full Year 2022 Results; Maintenance Capital for 2023

-

W&T Offshore Fourth Quarter, Full Year 2022 Results; 2023 Guidance

-

Sitio Royalties Fourth Quarter, Full Year 2022 Results; IDs 2023 Guidance

-

Ranger Oil Fourth Quarter, Full Year 2022 Results

Rockies News >>>

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

-

Devon Said To be In Talks to Acquire Enerplus

-

Chevron To Cut D&C Activity in U.S. Shale In 2024; Here is Where. -

-

An Early Look at Company 2024 Capital & Development Plans