Well Lateral Length | Top Story | Quarterly / Earnings Reports | Fourth Quarter (4Q) Update | Financial Results | Capital Markets | Capital Expenditure | Drilling Program - Wells | Drilling Program-Rig Count | Capital Expenditure - 2020

Pioneer Focusing on Midland Ops for 2021, Capex Flat YOY; Talks 2020 Results

Pioneer Natural Resources Co. reported its 2021 capital plan and Q4/full year 2020 results.

2021 Plan

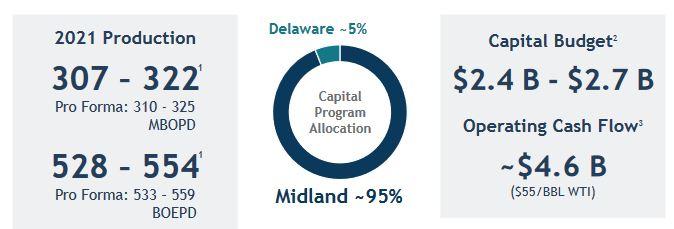

- Capex: $2.5-2.8 billion - relatively flat vs. Parsley/Pioneer combined 2020 spending of ~$2.5B

- Operational Capital: $2.4-2.7 billion

- Parsley Integration Expenses: $100 million

By Play:

- Midland Basin (95%): $2.28-2.565 billion

- Delaware Basin (5%): $120-135 million

- Production: 528-554 MBOEPD (pro forma Parsley acquisition: 533-559 MBOEPD)

- Oil Production: 307-322 MBOPD (pro forma Parsley acquisition: 310-325 MBOEPD)

- Wells Put on Production: 385-415 wells

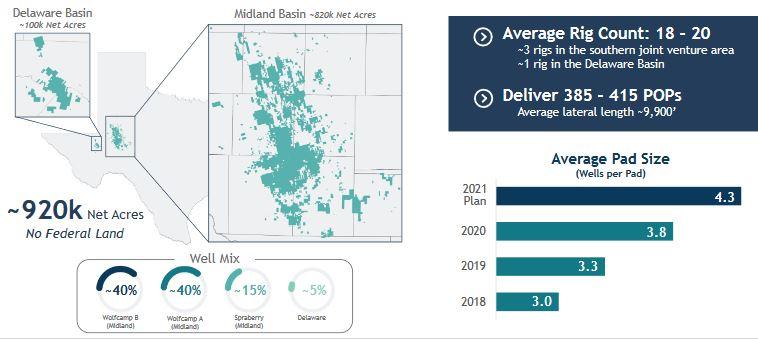

- Rig Count: 18-20 rigs running

- Midland: 14-16 rigs

- Delaware: 1 rig

- Southern JV Area: 3 rigs

First quarter 2021 oil production is forecasted to average between 259 to 274 MBOPD and total production is expected to average between 444 to 470 MBOEPD, which excludes Parsley production prior to the Parsley acquisition close date of January 12, 2021, and includes the expected production impact attributable to the recent winter storm of approximately 30 MBOPD and 55 MBOEPD. Production costs are expected to average $6.50 per BOE to $8.00 per BOE. DD&A expense is expected to average $11.25 per BOE to $13.25 per BOE.

Total exploration and abandonment expense is forecasted to be $10 million to $20 million. G&A expense is expected to be $65 million to $75 million. Interest expense is expected to be $38 million to $43 million. Other expense is forecasted to be $10 million to $20 million. Accretion of discount on asset retirement obligations is expected to be $2 million to $5 million. The cash flow impact related to purchases and sales of oil and gas, including firm transportation, is expected to be a loss of $30 million to $60 million, based on forward oil price estimates for the first quarter. The Company's effective income tax rate is expected to be between 21% to 25%. Cash income taxes are expected to be nominal.

2020 Results

Pioneer reported fourth quarter net income attributable to common stockholders of $43 million, or $0.26 per diluted share. These results include the effects of noncash mark-to-market adjustments and certain other unusual items. Excluding these items, non-GAAP adjusted income for the fourth quarter was $177 million, or $1.07 per diluted share. Cash flow from operating activities for the fourth quarter was $537 million. For the full year 2020, the Company reported a net loss attributable to common stockholders of $200 million, or $1.21 per diluted share. Cash flow from operating activities for the full year 2020 was $2.1 billion.

Highlights:- Delivered strong fourth quarter and full year 2020 free cash flow1 of $294 million and $689 million, respectively

- Achieved a reinvestment rate of 69% in 2020, while maintaining full year Permian oil production at 211 thousand barrels of oil per day (MBOPD)

- Returned $521 million of capital to shareholders during 2020, or 76% of full year free cash flow

- Averaged fourth quarter oil production of 204 MBOPD, in the upper half of guidance

- Averaged fourth quarter production of 364 thousand barrels of oil equivalent per day (MBOEPD), in the upper half of guidance

- Initiating a long-term variable dividend2 policy that allows for the distribution of up to 75% of free cash flow, after the base dividend is paid, while maintaining a strong balance sheet

CEO Scott D. Sheffield stated, "Pioneer delivered an excellent fourth quarter, generating $294 million in free cash flow and continuing our strong track record of execution. While 2020 was a challenging year, our immediate actions kept our employees safe, protected the balance sheet, generated significant free cash flow and ensure that Pioneer is well positioned for the future.

Pioneer's 2021 plan builds on this success, with a program that is capital efficient and is underpinned by our premier acreage position and scale in the Permian Basin. The highly accretive Parsley transaction further strengthens our investment framework, leading to a plan that is expected to generate $2 billion of free cash flow in 2021. As part of our commitment to return capital to shareholders, we are excited to formalize a new variable dividend policy, augmenting our stable and growing base dividend.

Our compelling investment proposition, coupled with our strong focus on environmental, social and governance initiatives, ensures Pioneer will continue to provide low-cost, environmentally friendly energy to the world, while enhancing value for shareholders."

Financial Highlights

Pioneer continues to maintain a strong balance sheet, with unrestricted cash on hand at the end of the fourth quarter of $1.4 billion and net debt of $1.9 billion. The Company had $2.9 billion of liquidity as of December 31, 2020, comprised of $1.4 billion of unrestricted cash and a $1.5 billion unsecured credit facility (undrawn as of December 31, 2020). After closing the acquisition of Parsley Energy and bond refinancing in January, the Company had net debt of approximately $5.2 billion.

During the fourth quarter, the Company's drilling, completion and facilities capital expenditures totaled $336 million. The Company's total capital expenditures3, including water infrastructure, totaled $351 million. For the full year 2020, the Company's drilling, completion and facilities capital expenditures totaled $1.4 billion. The Company's total capital expendituresfor the full year, including water infrastructure, totaled $1.5 billion.

Cash flow from operating activities during the fourth quarter and full year 2020 was $537 million and $2.1 billion, respectively, leading to free cash flow of $294 million for the fourth quarter and $689 million for the full year.

The Company's Board of Directors approved an increase to the Company's quarterly cash dividend to $0.56 per share. The 2021 quarterly dividend increase represents the fourth consecutive year that Pioneer has increased its dividend.

In addition to Pioneer's increase in its quarterly cash dividend to $0.56 per share, the Company is initiating a long-term variable dividend policy in 2021 that is expected to increase the Company's return of capital to shareholders. Consistent with Pioneer's long-term investment framework, the Company expects to annually distribute up to 75% of the prior year's annual free cash flow, after the payment of the base dividend2, assuming the Company's leverage metrics remain low. Pioneer expects to begin to pay the quarterly variable dividend distributions in 2022. For 2022, the Company expects to distribute up to 50% of 2021 free cash flow, after the payment of base dividends, assuming the average 2021 West Texas Intermediate (WTI) oil price is greater than $42 per barrel.

Pioneer continues to capture synergies from the acquisition of Parsley Energy, Inc. (Parsley) and is increasing the Company's synergy target by $25 million to $350 million of expected total annual synergies. These annual synergies include interest savings of $100 million, G&A savings of $100 million and operational synergies of $150 million.

Financial Results

For the fourth quarter of 2020, the average realized price for oil was $40.94 per barrel. The average realized price for natural gas liquids (NGLs) was $18.51 per barrel, and the average realized price for gas was $2.37 per thousand cubic feet. These prices exclude the effects of derivatives.

Production costs, including taxes, averaged $7.01 per barrel of oil equivalent (BOE). Depreciation, depletion and amortization (DD&A) expense averaged $11.81 per BOE. Exploration and abandonment costs were $12 million. General and administrative (G&A) expense was $64 million. Interest expense was $36 million. The net cash flow impact related to purchases and sales of oil and gas, including firm transportation, was a loss of $32 million. Other expense was $48 million, or $15 million excluding unusual items4.

The Company recently identified two marketing contracts that should have been accounted for as derivatives in the Company's historical consolidated financial statements. The contracts provided for the transportation and sale of purchased oil at lower transport and storage costs as compared to similar costs in the Company's other contracts. The contracts were executed during the fourth quarter of 2019, but transactions under the contract did not begin until January 2021. The Company plans to restate its consolidated financial statements for the three and nine months ended September 30, 2020 to reflect the noncash mark-to-market corrections related to the derivative treatment of the contracts. The noncash mark-to-market adjustments to the other periods impacted were not material. The adjustments did not impact the Company's reported cash flows from operating, investing or financing activities for any period. See the attached schedules for a description of the marketing derivatives.

Operations Update

Pioneer continued to deliver strong operational efficiency gains that enabled the Company to place 58 horizontal wells on production during the fourth quarter and 255 wells on production for the full year. During 2020, drilling operations averaged approximately 1,150 drilled feet per day and completion operations averaged approximately 1,850 completed feet per day, an increase 15% and 16%, respectively, when compared to 2019. Pioneer's fully burdened facilities costs per well also continued to decrease as the Company makes further progress on its facilities optimization program that began in 2019. When compared to 2018, Pioneer's facilities cost per well has decreased approximately 40%, from over $1.6 million per well to approximately $1 million per well. The efficiency and cost improvements in drilling, completions and facilities continue to improve the Company's overall capital efficiency.

The Company's controllable cash costs, inclusive of lease operating expense, G&A and interest expense, continue to trend lower and represent a combined 23% reduction per BOE in 2020 when compared to 2019. As the Company realizes the expected synergies associated with the acquisition of Parsley, controllable cash costs are forecasted to decrease an additional 8% in 2021.

During 2021, the Company plans to operate an average of 18 to 20 horizontal drilling rigs in the Permian Basin, including a one-rig average program in the Delaware Basin and a three-rig average program in the southern Midland Basin joint venture area. The 2021 program is expected to place 385 to 415 wells on production, predominantly in the Midland Basin, with a well mix of approximately 40% Wolfcamp B, 40% Wolfcamp A and 15% Spraberry in the Midland Basin and the remaining 5% in the Delaware Basin. Pioneer will continue to evaluate its drilling and completions program on an economic basis, with future activity levels assessed regularly and governed by its reinvestment framework.

Proved Reserves

The Company added proved reserves totaling 357 million barrels of oil equivalent (MMBOE) during 2020, excluding acquisitions and price revisions. These proved reserve additions equate to a drillbit reserve replacement ratio of 263% when compared to Pioneer's full-year 2020 production of 136 MMBOE, including field fuel. The drillbit finding and development (F&D) cost was $4.37 per BOE in 2020, with a drillbit proved developed F&D costs of $4.09 per BOE.

As of December 31, 2020, the Company's total proved reserves were estimated at 1,271 MMBOE, of which 95% are proved developed.

Environmental, Social & Governance (ESG)

Pioneer views sustainability as a multidisciplinary focus that balances economic growth, environmental stewardship and social responsibility. The Company emphasizes developing natural resources in a manner that protects surrounding communities and preserves the environment.

Consistent with Pioneer's sustainable practices, the Company has incorporated greenhouse gas (GHG) and methane emission intensity reduction goals into its ESG strategy, with goals to reduce the Company's GHG emissions intensity by 25% and methane emissions intensity by 40% by 2030, inclusive of the assets Pioneer acquired from Parsley. These emission intensity reduction targets are aligned with the Task Force on Climate-related Financial Disclosures criteria for target setting.

In addition, the Company is building on its leadership position related to minimizing flaring and has formally adopted a goal to maintain the Company's flaring intensity to less than 1% of natural gas produced. Pioneer also plans to end routine flaring, as defined by the World Bank, by 2030 with an aspiration to reach this goal by 2025.

Socially, Pioneer maintains a proactive safety culture, supports a diverse workforce and inspires teamwork to drive innovation. The Board of Directors has a Health, Safety and Environment (HSE) Committee and a Nominating and Corporate Governance Committee to provide director-level oversight of these activities. These committees help to promote a culture of continuous improvement in safety and environmental practices. Consistent with the high priority placed on HSE and ESG, the Board of Directors has increased the executive annual incentive compensation weighting for these metrics from 10% to 20% beginning in 2021.

In addition to the increased weighting towards HSE and ESG metrics, Pioneer's executive incentive compensation continues to be aligned with shareholder interests. Beginning in 2021, return on capital employed (ROCE) has been included along with cash return on capital invested (CROCI), which was added in 2020, with a combined weighting of 20%, while production and reserves goals previously included as incentive compensation metrics have been removed.

Pioneer has amended executive equity compensation as well, with the S&P 500 index being added into the total stockholder return (TSR) peer group for performance awards beginning in 2021, and for the second consecutive year the long-term equity compensation for the Company's Chief Executive Officer will be 100% in performance awards, with 100% of such awards at risk based on performance relative to the TSR peer group. These updates to Pioneer's executive incentive and equity compensation programs demonstrate the Company's continuing commitment to aligning total executive compensation with the interests of our shareholders.

Related Categories :

Capital Expenditure - 2021

More Capital Expenditure - 2021 News

-

Pine Cliff Energy Ups Spending, Production Plans by 10% for 2022

-

Whitecap Resources Unveils 2022 Budget; Up 12% vs. 2021

-

Southwestern Closes Acquisition of Indigo Natural Resources; Ups Capex

-

Altura Energy First Quarter 2021 Results

-

Razor Energy Corp. First Quarter 2021 Results

Permian News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -