Drilling & Completions | Quarterly / Earnings Reports | Third Quarter (3Q) Update | Capital Markets | Drilling Activity | Capex Increase | Drilling Program-Rig Count | Capital Expenditure - 2018

QEP Ups 2018 Capex for More Permian Wells, Williston Refracs; Minimal Output Growth

QEP Resources reported its Q3 2018 results.

Increases 2018 Capex for Permian Wells, Williston Refracs

Increased full year 2018 capital expenditure guidance by 4% at the midpoint to include additional wells drilled and put on production in the Permian Basin as a result of efficiency gains and additional refrac activity in the Williston Basin.

Impact of Uinta Basin Divestiture on updated production guidance:

Equivalent production: 0.9 MMboe

- Gas production: 4.3 Bcf

- Oil & condensate production: 0.2 MMbbl

- NGL production: 0.04 MMbbl

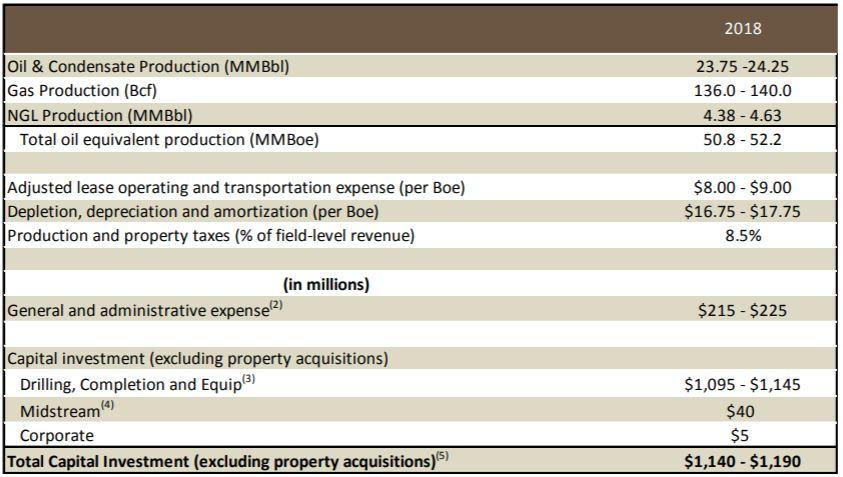

QEP's updated full year 2018 guidance is detailed below.

Rig Count:

Permian Basin - four rigs and one frac crew in the fourth quarter 2018

Wells Put on Production (full year 2018):

Company: approximately 121 net operated wells

Permian Basin: approximately 105 net operated wells

Refracs:

Four net refracs in the Williston Basin in the fourth quarter 2018

Minimal Production Growth YOY Despite Jump in Permian Output

- Q3 production of 156.5 MBOEPD - up a slight +2% YOY and flat from 2Q18

- Delivered record quarterly oil and condensate production of 6.6 million barrels (MMbbls), including a record 3.5 MMbbls in the Permian Basin

- Permian Basin net oil equivalent production averaged a record of approximately 52.1 Mboed (89% liquids) during the third quarter 2018, an 18% increase compared with the second quarter 2018 and a 104% increase compared with the third quarter 2017. A portion of the increase is driven by higher gas capture rates compared to prior quarters as a result of completion of midstream infrastructure and reduced tie-in activities.

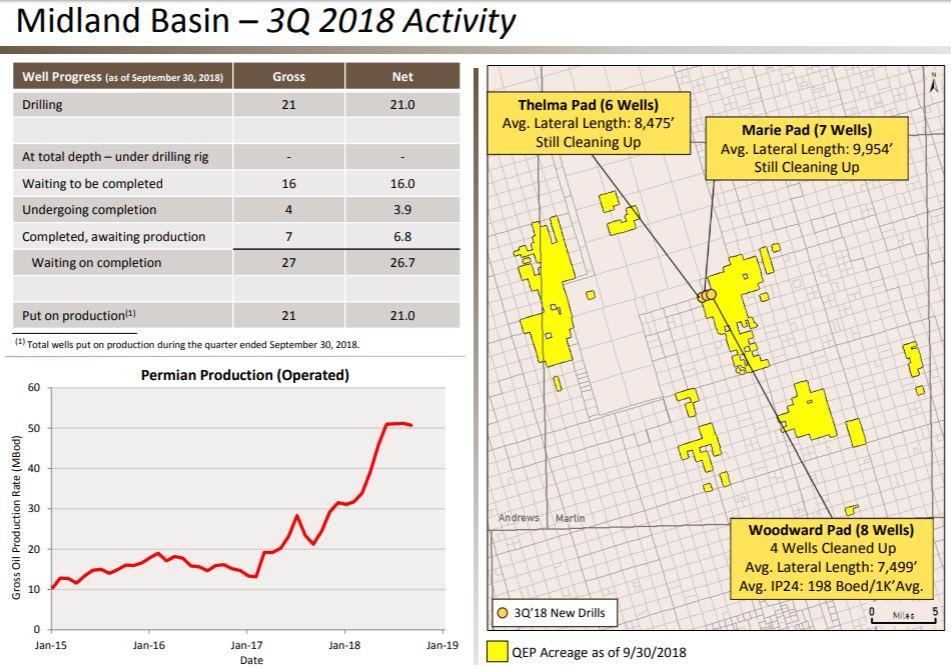

Permian Basin - Increased Efficiencies

In the third quarter 2018, the Company put on production 21 gross-operated horizontal wells, all on Mustang Springs, four more than forecast for the third quarter 2018 (average working interest 100%). The greater than planned delivery of new producing wells in the third quarter 2018 was a result of a continued increase in drilling and completion efficiency.

At the end of the third quarter 2018, 17 of the 21 wells put on production on Mustang Springs during the quarter were still in the process of cleaning up. The 21 wells were located in three discrete drilling spacing units (DSUs), one with a 31 well/mile density, one with a 24 well/mile density and one with a 23 well/mile density. These three DSUs have "lower than normal" density due to their location on the western edge of the Company's Mustang Springs acreage position which required certain setbacks and well placement to facilitate 'tank development'. The four wells that cleaned up reached average peak 24-hour IP of 198 Boed per 1,000 lateral feet (86% oil) from an average lateral length of 7,499 feet.

With regard to the performance of the 37 wells placed on production in the second quarter 2018, which at that time were in various stages of flowback; eight wells on County Line reached average peak 24-hour IP of 150 Boed per 1,000 lateral feet (82% oil) and an average peak 30-day IP of 138 Boed per 1,000 lateral feet (78% oil) from an average lateral length of 7,244 feet. At Mustang Springs, the 29 wells achieved average peak 24-hour IP of 152 Boed per 1,000 feet (85% oil) and an average peak 30-day IP of 118 Boed per 1,000 lateral feet (83% oil) from an average lateral length of 7,430 feet.

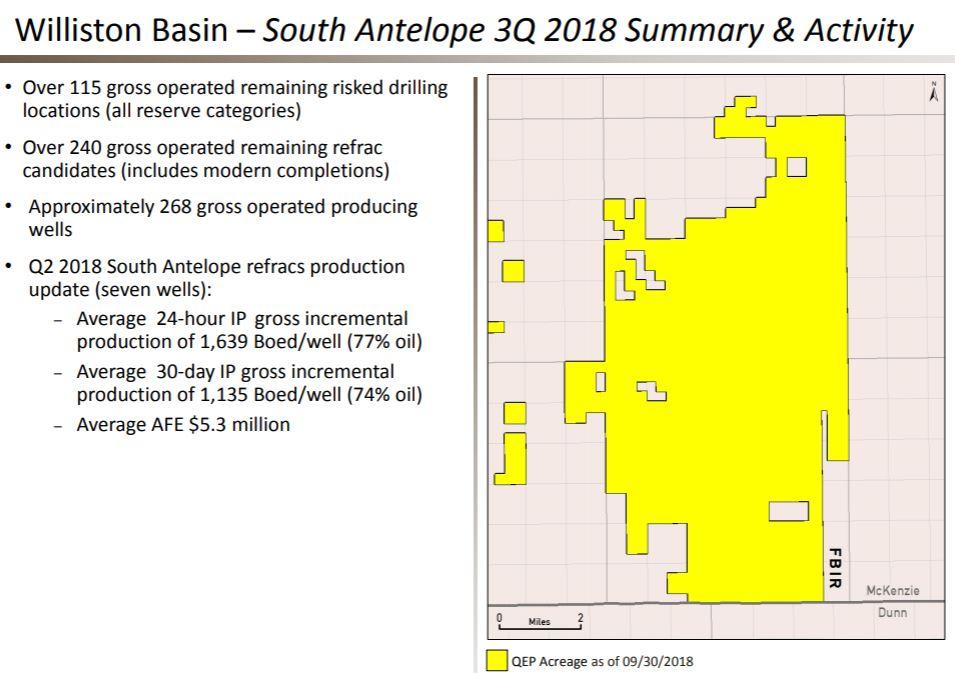

Williston Basin - No Rigs Active

Williston Basin net oil equivalent production averaged approximately 47.6 Mboed (83% liquids) during the third quarter 2018, a 3% decrease compared with the second quarter 2018 and a 3% increase compared with the third quarter 2017.

The Company plans to complete four additional refracs on South Antelope during the remainder of 2018. Current average gross QEP-operated Williston Basin refrac costs are approximately $5.3 million per well.

At the end of the third quarter 2018, the Company had no drilling rigs in the Williston Basin.

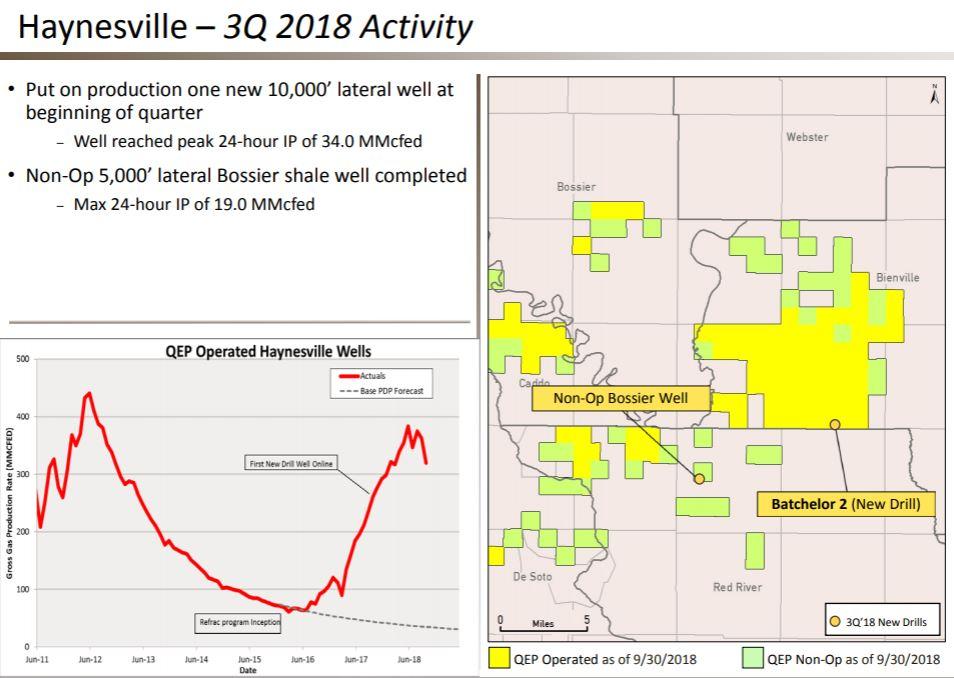

Haynesville/Cotton Valley

Haynesville/Cotton Valley net gas equivalent production averaged approximately 296.9 MMcfed (49.5 Mboed) (0% liquids) during the third quarter 2018, a 5% decrease compared with the second quarter 2018 and a 37% increase compared with the third quarter 2017.

The Company put one gross operated well on production during the third quarter 2018 (average working interest 100%). The well had a peak 24-hour IP rate of 34.0 MMcfed (100% gas) with a lateral length of 10,622 feet.

At the end of the third quarter, the Company had no drilling rigs in Haynesville/Cotton Valley.

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

Ark-La-Tex News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -