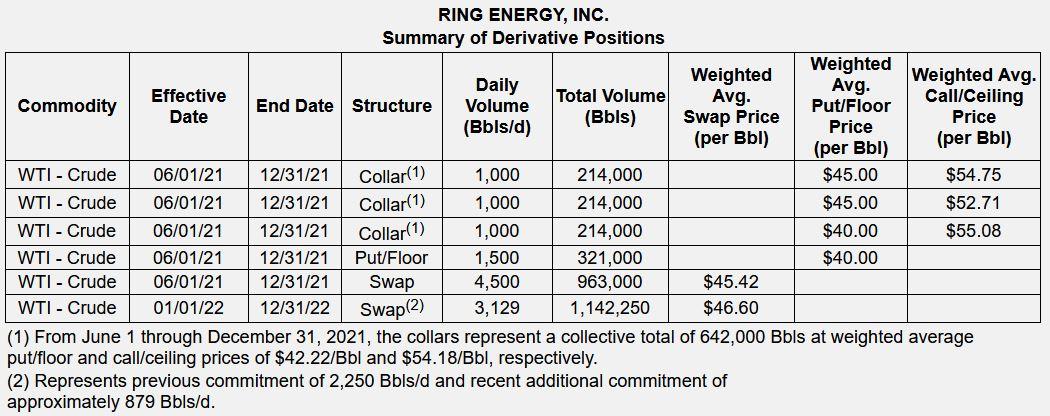

Ring Energy, Inc. provided an update on its derivate positions for 2021 and 2022 in response to the oil price environment.

Key Changes to Hedge Book

- Bought back a 1,500 barrels of oil per day ("Bbl/d") call option for June 1 through December 31, 2021, and entered into an approximate 879 Bbls/d calendar 2022 swap contract for no net cost;

- Anticipate more than 320,000 barrels of crude oil sales for June 1 through December 31, 2021, to be realized at a higher level than the $55.35 per barrel ceiling price previously in place;

- Additionally, the 2022 swap position is priced higher than the $45.66 per barrel collective average price previously in place; and

- Expected increase to cash flow from higher realized pricing in 2021 will primarily be used to further pay down debt.

Mr. Paul D. McKinney, Chairman of the Board and Chief Executive Officer, commented, "When we entered into contracts to substantially fill our hedge book for expected 2021 production in late fall of last year, we were operating in a backdrop of $45 per barrel WTI primarily due to the economic impacts of COVID-19. Moving into our fall bank redetermination process, our hedging strategy was appropriately designed to lock in 2021 pricing that fully funded our targeted work program while guaranteeing the necessary cash flow to pay down debt. Substantially driven by the dramatic improvement in economic activity with the worldwide recovery from COVID-19, there has been an almost 50% increase in WTI crude oil pricing over the past six months. This much-improved price environment has allowed us to pivot to a more opportunistic hedging strategy. The hedging transactions that we recently executed will generate additional free cash flow in 2021, further strengthen our financial and market position, and drive meaningful returns to our shareholders. We remain focused on steadily paying down debt, divesting of non-core assets, and continuously improving our debt-to-EBITDA metrics."

Updated Derivative Positions

Related Categories :

Hedging

More Hedging News

-

Earthstone Energy Talks 2022 Results; Plans Five-Rig Program for 2023

-

Vermilion Energy Inc. Second Quarter 2022 Results

-

Crescent Energy Co. Second Quarter 2022 Results

-

Murphy Oil Second Quarter 2022 Results

-

Silverbow Resources Second Quarter 2022 Results

Permian News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

Permian - Midland Basin News >>>

-

New Permian E&P Company Score Capital; On The Hunt For Assets -

-

Chevron To Cut D&C Activity in U.S. Shale In 2024; Here is Where. -

-

An Early Look at Company 2024 Capital & Development Plans

-

EOG Resources Reports Third Quarter 2023 Results

-

A Look at Capital Spending By Company In First Half 2023; Budget Exhausion?