Service & Supply | Quarterly / Earnings Reports | Oilfield Services | First Quarter (1Q) Update | Financial Results | Capital Markets

Schlumberger First Quarter 2021 Results; Revenue by Segment

Schlumberger Limited reported results for the first-quarter 2021.

- Worldwide revenue was $5.2 billion

- International revenue was $4.2 billion and North America revenue was $972 million

- EPS was $0.21

- Cash flow from operations was $429 million and free cash flow was $159 million

- Board approved quarterly cash dividend of $0.125 per share

Schlumberger CEO Olivier Le Peuch commented, “We started the year with conviction in our strategic direction and our resulting outlook for 2021. The combination of the promising first-quarter results and an increasingly constructive macroeconomic view are strengthening this conviction. With recovery sentiment improving and the execution of our returns-focused strategy progressing well, I am extremely proud of the women and men of Schlumberger for delivering yet another solid quarter.

“First-quarter revenue declined 6% sequentially, reflecting the expected reduction in North America following divestitures during the fourth quarter of last year that were focused on the high-grading and rationalizing of our business portfolio to expand our margins, minimize earnings volatility, and focus on less capital-intensive businesses. Excluding the impact of these divestitures, our global revenue was essentially flat sequentially as the impact of seasonally lower activity in the Northern Hemisphere was fully offset by growth in multiple countries. Notwithstanding the effects of seasonality, the first quarter affirmed the activity recovery that commenced last quarter.

“In North America, excluding the effects of divestitures, revenue grew 10% sequentially driven by land revenue which increased 24% due to higher drilling activity, despite the Texas freeze. Offshore revenue declined 10% sequentially following the seasonal fourth-quarter year-end product sales.

“International revenue in the quarter reflects the usual seasonal dip, though China and Russia experienced a particularly severe winter. However, the sequential revenue decline was less pronounced than in prior years due to strong growth in Latin America and in several key countries in the Middle East and Africa. The first-quarter revenue sequential decline was the shallowest since 2008, while international rig count experienced the strongest first-quarter sequential growth since 2011, affirming the international recovery.

“First-quarter revenue was also characterized by growth in Well Construction and Reservoir Performance, excluding the effects of divestitures and despite seasonality in the Northern Hemisphere. Well Construction revenue increased 4% sequentially due to higher drilling activity in North America and Latin America. Reservoir Performance decreased 20% due to the OneStim® divesture in North America—but excluding this, the Division grew by 3% driven by robust international land and offshore activity. Digital & Integration revenue decreased 7% sequentially due to seasonally lower sales of software and multiclient seismic data licenses. Production Systems revenue declined 4%, mostly due to lower product sales following the strong year-end sales of the previous quarter.

“Sequentially, despite the revenue decline, first-quarter pretax segment operating income increased 1%. Pretax segment operating income margin expanded by 88 bps to 13% while EBITDA margin was maintained at 20%. These margins represent a more than 200 basis-point improvement compared to the first quarter of 2020 despite a 30% revenue decline year-on-year. This performance represents a promising start to our margin expansion ambition this year and highlights the impact of our capital stewardship and cost-out measures, which provide us with significant operating leverage.

“First-quarter cash flow from operations was $429 million and free cash flow was $159 million despite severance payments of $112 million and typical first-quarter consumption of working capital. We are pleased with the cash flow performance this quarter and expect cash flow to grow further throughout the year, allowing for net debt reduction.

“Looking ahead, we continue to be encouraged by constructive macroeconomic drivers. While the world is still grappling with COVID-19 infection rates, vaccination programs and fiscal stimulus packages are expected to support a rebound of economic activity and oil demand recovery through the year. Industry analysis estimates 5–6 million bbl/d of oil demand will be added by the end of the year as demand recovery is projected to improve in the second quarter, exiting the year just 2 million bbl/d short of 2019 levels.

“With the gradual return of oil demand, we anticipate North America activity to level off at production maintenance levels, while international activity is poised to ramp up through year-end 2021 and beyond. We expect to significantly benefit from this anticipated shift to increased international activity due to the strength and breadth of our international franchise. Consequently, we are increasingly confident that our international revenue will see double-digit growth in the second half of 2021 as compared to the same period last year, which implies potential upside to the already robust growth that is anticipated in 2022 and beyond.

“There is an increasingly positive sentiment in the industry outlook as the recovery strengthens despite the lingering concerns regarding the COVID-19 crisis. The strategic pivot we initiated two years ago has proven effective and positions us to outperform in this vastly different landscape that presents new imperatives and opportunities that play to our strengths.

“Building on the strength of our Well Construction and Reservoir Performance Divisions, we are accelerating our digital offerings, positioning the company to lead in the production and recovery market, and building our New Energy portfolio to embrace the energy transition—all fully aligned with our customers. A new growth cycle has finally commenced, and we are prepared to deliver growth and returns that outperform the market.”

Other Events

On April 22, 2021, Schlumberger’s Board of Directors approved a quarterly cash dividend of $0.125 per share of outstanding common stock, payable on July 8, 2021 to stockholders of record on June 2, 2021.

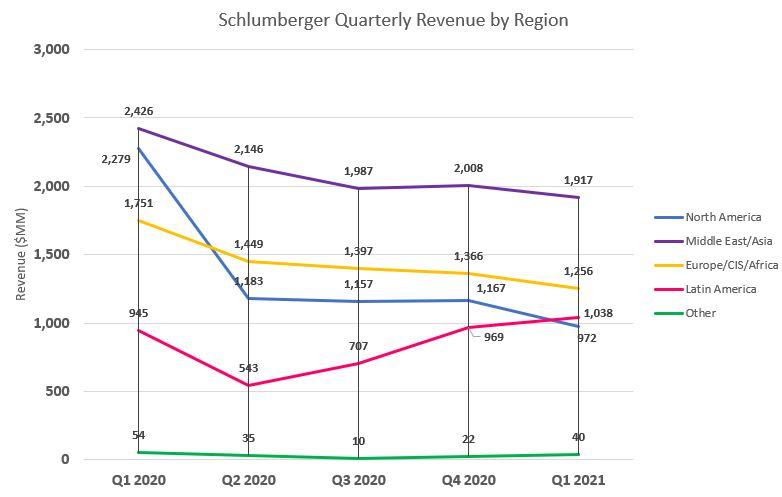

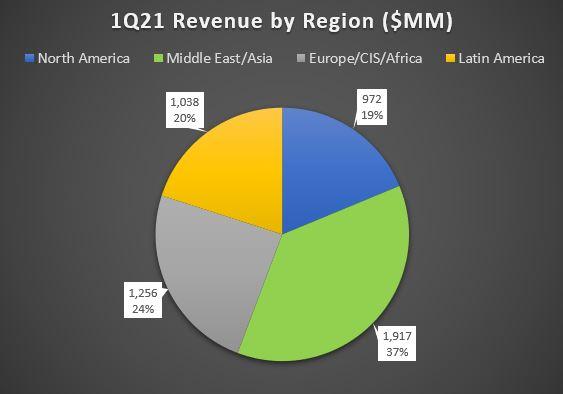

Revenue by Geographical Area

North America revenue of $972 million decreased 17% sequentially following divestitures that were focused on the high-grading and rationalizing of our business portfolio to expand our margins, minimize earnings volatility, and focus on less capital-intensive businesses. Excluding the impact of the fourth-quarter divestitures, first-quarter revenue grew 10% sequentially with land revenue growing 24% due to higher Well Construction drilling activity and increased Asset Performance Solutions (APS) project revenue. Offshore revenue declined 10% sequentially due to reduced sales of subsea production systems and multiclient seismic data licenses.

International revenue had the usual seasonal dip, particularly in China and Russia, which experienced a severe winter. The sequential revenue decline was less pronounced than in prior years because of offsets from strong revenue growth in Latin America and in several key countries in the Middle East and Africa. The international revenue decrease was the shallowest first-quarter revenue decline since 2008 and international rig count experienced the strongest first-quarter sequential growth since 2011.

Revenue in Latin America of $1.0 billion increased 7% sequentially due to higher sales of production systems in Brazil, increased intervention and stimulation activity in Argentina, and higher well construction drilling activity in Ecuador. Mexico revenue was modestly higher sequentially, as stronger drilling activity was offset by reduced sales of multiclient seismic data licenses.

Europe/CIS/Africa revenue of $1.3 billion decreased 8% sequentially mainly due to the seasonal winter drilling slowdown in Russia & Central Asia. Excluding the effects of seasonality, activity increased across most Divisions, particularly in Scandinavia and Africa.

Revenue in the Middle East & Asia of $1.9 billion decreased 5% sequentially due to seasonally lower winter activity in China and a decline in offshore drilling in Australia due to the cyclone season. Additionally, there were lower sales of production systems in India. These revenue declines were partially offset by robust activity growth in Saudi Arabia and Qatar.

Results by Division

Digital & Integration

Digital & Integration revenue of $773 million decreased 7% sequentially due to seasonally lower sales of digital solutions, software, and multiclient seismic data licenses.

Digital & Integration pretax operating margin of 32% was essentially flat sequentially. Despite the revenue decline, operating margin was maintained as the effects of digital solutions and multiclient revenue declines were largely offset by improved profitability from APS projects.

Reservoir Performance

Reservoir Performance revenue of $1.0 billion declined 20% sequentially. The revenue decline reflected the divestiture that was focused on the high-grading and rationalizing of our business portfolio in North America to expand our margins, minimize earnings volatility, and focus on less capital-intensive businesses. Excluding the impact of the OneStim divestiture, revenue grew 3% sequentially despite the impact of seasonally lower activity in Russia and China. Revenue increased from higher activity in Latin America, North America, Sub-Sahara Africa, and the Middle East.

Reservoir Performance pretax operating margin of 10% expanded 261 bps sequentially. Profitability was boosted by the divestiture of the OneStim business, which was previously dilutive to margins.

Well Construction

Well Construction revenue of $1.9 billion increased 4% sequentially. The revenue increase was due to robust activity in North America land. Revenue growth in Latin America and the Middle East, mainly in Qatar, Saudi Arabia, Iraq, and Oman, has more than offset the seasonal slowdown in drilling activity in Russia & Central Asia, China, and Australia.

Sequentially, Well Construction pretax operating margin of 11% improved by 103 bps, mainly in North America, due to higher drilling activity on land while international margin was essentially flat.

Production Systems

Production Systems revenue of $1.6 billion decreased 4% sequentially. The revenue decrease was across North America offshore, Europe/CIS/Africa, and Asia, partially offset by strong activity in Latin America—mainly in Brazil and Argentina—and the Middle East, mostly in Saudi Arabia and Qatar. Lower production system sales were posted in subsea, well production, and surface while midstream production systems grew sequentially in Latin America, North America land, and the Middle East.

Despite the revenue decline, pretax operating margin only decreased 71 basis points to 9%, as a result of cost measures as well as improved profitability in midstream production systems due to higher activity.

Quarterly Highlights

Schlumberger continues to harness the power of the cloud to enable a step change in customer productivity and performance—through our digital platforms and the application of artificial intelligence (AI) and internet of things (IoT) solutions to create new insights from data and optimize operations. During the quarter:

- Schlumberger and Equinor announced a strategic project, in collaboration with Microsoft®, to deploy the DELFI* cognitive E&P environment with seamless integration to the OSDU™ Data Platform—the industry’s new data standard. This is the first major deployment of the OSDU Data Platform, which will streamline strategy planning for Equinor. This project aims to accelerate Equinor’s ability to integrate data at scale and improve decision-making, and it will be embedded as a key part of Equinor’s Microsoft Azure enterprise-wide data platform.

- In Mexico, Schlumberger is collaborating with Pemex, using a new digital workflow that can accelerate the time from prospect lead to drilling by at least 30%, transforming the prospect maturation process currently used in the industry. Enabled by the DELFI environment, the workflow—called prospect-focused imaging—is helping Pemex more quickly generate value from its assets in the challenging Gulf of Mexico Campeche Basin by identifying and de-risking exploration opportunities in weeks rather than months. This acceleration is achieved through the DELFI environment, which enables a remote, multidisciplinary team to work in parallel rather than sequence, iterating seismic imaging and exploration knowledge to adjust an earth model in real time.

- In Russia, Schlumberger and Yandex.Cloud announced an industry-first collaboration to deploy the DELFI environment hosted on Yandex.Cloud, the first use of the cloud for the conventional upstream domain in Russia. The deployment includes AI and data solutions to accelerate the digital transformation of energy companies and elevate performance across the industry.

- In one of the largest assets in Ecuador, Agora* edge AI and IoT solutions were leveraged to deliver an 18% increase in production uptime while reducing the carbon footprint of artificial lift surveillance operations. The application of digitally enabled well surveillance and artificial lift optimization workflows in more than 100 wells resulted in a 36% reduction of CO2 equivalent emissions due to reduced trips to the field. Agora solutions enabled digital surveillance of electric submersible pumps and suction rod pumps within a remote well-operation platform that covers the entire asset. Agora solutions are providing an opportunity for operators to achieve a step change in production uptime while reducing the cost and carbon footprint of operations.

Around the world, our differentiated operational execution continues to resonate with customers and is being acknowledged through new contract awards. Awards in the quarter include:

- In Africa, Tullow Oil plc awarded Schlumberger a four-year contract, valued at more than USD 100 million, for combined drilling services offshore Ghana. The comprehensive services contract targets an accelerated drilling restart early in the second quarter of 2021, and includes the full Well Construction Division portfolio, as well as adjacent services from the Reservoir Performance and Digital & Integration Divisions. The contract incorporates a new, performance-based element—the first such contract model deployed in Ghana—aligning Schlumberger and Tullow to collaborate toward additional performance improvements as Tullow unlocks more value from its world-class deepwater assets.

- In South America, Total awarded Schlumberger a contract for services across multiple Divisions for a 4- to 10-well deepwater appraisal and exploration campaign in Block 58 offshore Suriname. The campaign commenced in February 2021 following discoveries in the block during 2020, for which Schlumberger delivered the majority of the Well Construction services.

- In the Middle East, Qatargas awarded Schlumberger a five-year contract for three stimulation vessels in the giant Qatar North Field, with an optional five-year extension. OpenPath Reach* extended-contact stimulation service and MaxCO3 Acid* degradable diversion acid system are key differentiating technologies included in the award that were selected to improve stimulation efficiency.

- In addition, Qatargas awarded Schlumberger a five-year contract for intervention services in the North Field Expansion project. This Reservoir Performance award features a unique fit-for-basin technology with an advanced perforation deployment system that conveys multiple services with ACTive* real-time downhole coiled tubing services. The new design eliminates multiple rig ups and rig downs, reducing health, safety, and environmental exposure and saving up to three days of rig operations per well.

For more than a century, Schlumberger has developed and deployed innovative technology. Our technology solutions continue to enhance customer performance, support basin competitiveness, maximize asset value, and reduce carbon footprint.

In North America land, Schlumberger fit-for-basin Well Construction technology and execution is enabling customer outperformance across multiple basins as the recovery unfolds:

- In the DJ Basin, Schlumberger Well Construction technology enabled Great Western Petroleum to drill the longest footage in the 8.5-in section covering 21,630 ft of vertical, curve, and lateral in a single run, using a bottomhole assembly (BHA) comprising all Schlumberger technology—including NeoSteer* at-bit-steerable system and a drill bit from Smith Bits, a Schlumberger company.

- In the Delaware Basin, Schlumberger Well Construction technology enabled an operator to drill a curve and lateral totaling nearly 24,500 ft in a single run. One BHA comprising all Schlumberger technology—including PowerDrive Orbit G2* rotary steerable system and the xBolt G2* accelerated drilling service as a fit-for-basin solution—remotely drilled the 6.75-in curve and lateral in 6.5 days with Performance Live* digitally connected service. Drilling efficiency saved the operator an average of 5 days of rig time per well and as much as 12 days of rig time on an individual well.

- In the Haynesville Basin, Rockcliff Energy tested the first drill bit from Smith Bits, designed using the combination of data analytics from the Synapse* performance insights optimization service and a new bit design workflow. At-bit performance insights gathered with the Synapse service and the use of StrataBlade* concave diamond element bit and StingBlade* conical diamond element bit technologies enabled the new bit design to achieve a 69% rate of penetration (ROP) improvement while maintaining the required drilled footage, saving the operator more than 40 hours of drilling time.

Internationally, Schlumberger production and recovery technologies are setting new benchmarks and helping customers bring new reserves online:

- In Algeria, Schlumberger Reservoir Performance executed the first horizontal multistage plug and perforate hydraulic fracture in the tight sands of the Hamra Field, significantly contributing to field production for Sonatrach. The application of an integrated suite of Schlumberger stimulation technologies resulted in gas production exceeding offset wells. Using technologies, including Kinetix* reservoir-centric stimulation-to-production software, WellWatcher Stim* stimulation monitoring service, HiWAY* flow-channel fracturing technique and the ACTive DTS* distributed temperature measurement and inversion analysis, the project delivered increased gas production while reducing required proppant and water volumes. This process accessed gas reserves that would not have been monetizable otherwise, setting a path for further development of tight gas resource in the Hamra and similar fields.

- Offshore North West Shelf Australia, the Julimar JV, operated by Woodside with partner KUFPEC, recently used Schlumberger technology to maximize production. In two wells, the Schlumberger OptiPAC XL* extended-length Alternate Path† gravel-pack screen and high-temperature fluid system were implemented to ensure complete packing of the horizontal intervals with downhole temperatures up to 140 degC—a world record for OptiPAC* openhole Alternate Path gravel-pack services. Zonal isolation was achieved with a mechanical packer and completed two producing zones and one non-pay zone in a single pumping operation—reducing the number of wells required and increasing ultimate recovery.

Our solutions encompass sustainability through evolving existing technologies, new technology development, and project design and execution to reduce carbon footprint across industry applications:

- In the first quarter, OneSubsea® built the first all-electric manifold for the BP Trinidad and Tobago LLC Matapal gas project being developed off the coast of Trinidad and Tobago. The combination of a block valve manifold design and standard interfacing drop-in-place electric actuators created a simple solution that also demonstrated optimizations during the manufacturing and testing process. This is a major milestone in the Schlumberger and bp electric technology roadmaps. We continue to develop more sustainable ways of producing hydrocarbons, and electric systems are key to supporting our customers on their net-zero goals. The first all-electric manifold is scheduled to arrive in Trinidad in the second quarter of 2021, with installation expected in the second half of the year.

- Schlumberger Reservoir Performance has deployed a new service to evaluate geologic CO2 storage suitability—an essential step in advancing carbon capture and storage (CCS) projects—during a project for a power facility operator in the United States. This service leverages Reservoir Performance domain expertise by integrating data analysis from a suite of Schlumberger subsurface evaluation technologies, including Quanta Geo* photorealistic reservoir geology service, the Sonic Scanner* acoustic scanning platform, and the Saturn* 3D radial probe. This process evaluates the CO2 injection suitability and storage potential of any geologic formation, while also characterizing CO2 movement in the subsurface. Data from this service supported the research and evaluation required to secure necessary permitting to store CO2 in a deep geologic formation.

- Offshore Norway, Schlumberger installed the industry’s first subsea retrofit multilateral wells to reach new production without adding new infrastructure in the mature Goliat Field for Vår Energi. Using the RapidX* TAML 5 high-strength, hydraulic-sealed multilateral junction, Schlumberger and Vår Energi collaborated on a well construction and completion design that accessed 7–8 million additional barrels of oil from different targets of the Snadd and Goliat West discoveries. Two producing wells were retrofitted as multilaterals, each maintaining production from their original bores while adding new production from a lateral. An intelligent completion provides independent control of each branch that can be tuned for ultimate recovery. This operation saved the customer millions of US dollars of capex and an estimated 5,000–10,000 metric tons of CO2 equivalent emissions by avoiding the drilling of two new subsea wells and procuring and installing the associated infrastructure.

Related Categories :

First Quarter (1Q) Update

More First Quarter (1Q) Update News

-

Petrus Resources Ltd. First Quarter 2023 Results

-

Cardinal Energy Ltd. First Quarter 2023 Results

-

Headwater Exploration Inc. First Quarter 2023 Results

-

Rubellite Energy Inc. First Quarter 2023 Results

-

Bonterra Eneergy Corporation First Quarter 2023 Results

United States News >>>

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Battalion Oil Corporation First Quarter 2023 Results

5.jpg&new_width=60&new_height=60&imgsize=false)

-

Amplify Energy Corporation First Quarter 2023 Results -

-

Denbury Inc., First Quarter 2023 Results

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results