Service & Supply | Quarterly / Earnings Reports | Oilfield Services | Third Quarter (3Q) Update | Financial Results | Capital Markets

Schlumberger Q3: 2021 Outlook for North America, International; Renewables Strategy

Schlumberger Limited reported results for the third quarter of 2020.

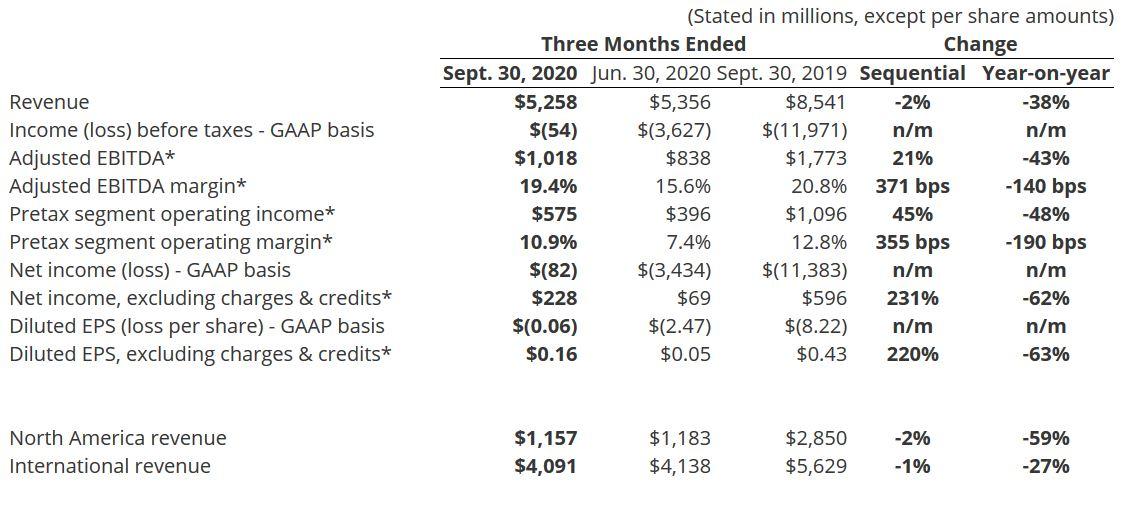

Revenue Snapshot

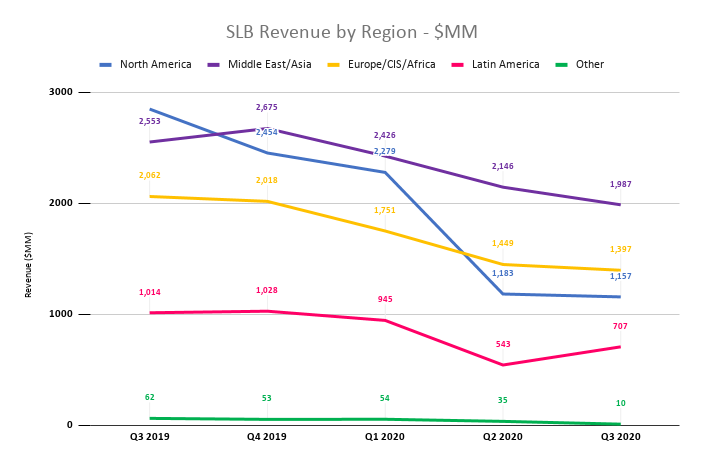

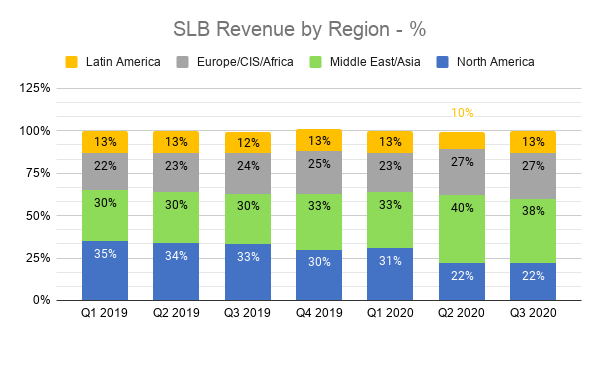

Similar to what Halliburton is seeing this quarter, Schlumberger's Q3 regional revenues seem to be stabilizing after dropping sharply earlier in the year.

All regions showed less revenue decline in comparison to recent quarters. Most encouraging was the increase in revenue in the Latin America region (which Halliburton also saw for 3Q20).

By Region

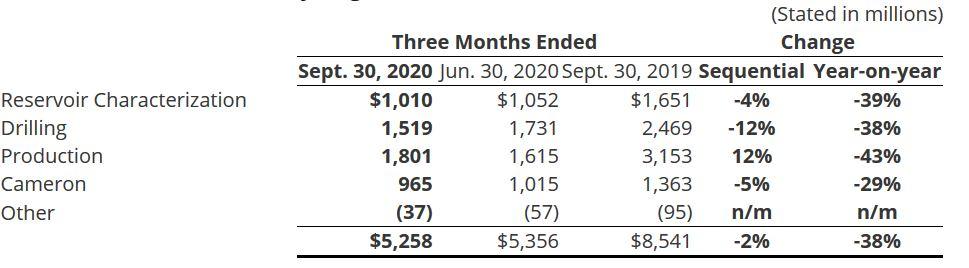

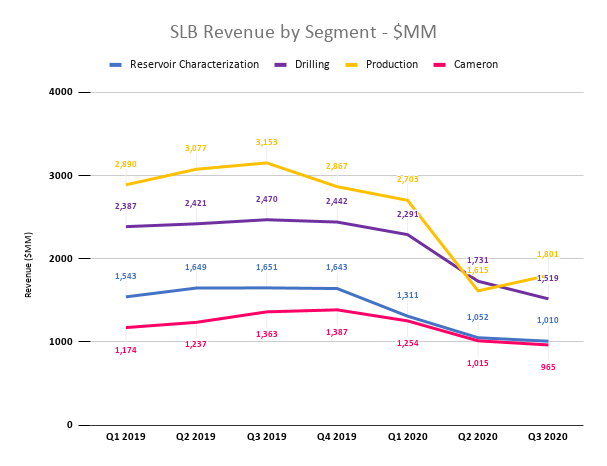

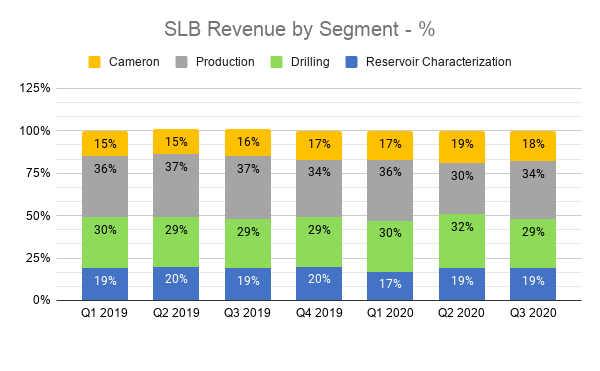

By Segment

2021 Outlook

- How sharp of a rebound you would expect and maybe what geographic regions you would think would lead the way?

"Yes. I think what we see is that, clearly, I think the level of investment that's currently going into international is not sustainable, I think for two reason. I think that the demand/supply will rebalance and will create a pull on supply worldwide, and I think this will be pulling on international as well as the U.S. The North America has suffered from a setback that is creating a gap in the future supply.

"So I think short cycle is set to come back first, and then long cycle. The timing of this and the magnitude, I think, will depend on the -- obviously, on the demand -- oil demand pace, recovery pace. But what we can say is that customers are already engaging and are asking us to be ready for mobilization, be it in short or midterm, to make sure that we're not getting in the wrong direction to cut capacity beyond what they will need in the short to mid-term.

"So, I will expect the low-cost producer country on the core of OPEC plus to be the first to react and to rebound when the market will be there. So that includes Middle East, that includes Russia, obviously. Beyond that, I think we will see short cycle everywhere. China will continue to be executing on their energy strategy, so I don't expect this to be slowing down. And then we will see gradually infield drilling. We will see the shallow water coming back. And there's a lot of FID ready to be approved that will then accelerate back to the border. So, I think there will be a sequence in this, but short-cycle will come back, both onshore and offshore, and will come back certainly sometime in 2021 and clearly, in 2022."

- Should we think there's much left in 2021 from that and is that international or, I imagine that's mostly international basis? But is there any progress there in North America as well?

"There is -- yes, we were above -- quite a bit above 80%. So, there is a bit left. There will be still a bit left going into Q1. It is mostly on the international, the tail end of it. And North America is mostly complete. So, you will see a bit more push from this in Q4, but some remainder are going into the first half next year."

- At this point, do you think international revenues in 2021 are up year-over-year?

"I think the way you look at -- we look at it, is to look at the current level of activity. And we use more or less the second half of this year as a baseline. Because I think the reset for international oil company has happened in the second quarter, for independent has happened in the second and the third and for national oil company has happened in the third. So, the reset of activity has happened in the last six months.

"Now we believe that we have stabilized, and we have seen it in the last few weeks, and we don't believe that, aside from seasonal impact, we don't believe that there will be structural adjustment in the short term. And that's our baseline. So, from that baseline, we will anticipate this to get an upside from that baseline and to gradually recover from that baseline [of work].

"Now to compare it year-on-year, including the first quarter of this year up to the mix international second quarter, including the significant effort in Middle East to increase supply early Q2, I don't think it's realistic. We have to take a baseline of the second half of this year and project forward. And from that base build back a recovery."

Pricing

- Is there still some concern around pricing as contracts roll into next year? Is there some concern that maybe customer spending abroad won't lift that much over the course of '21? So why shouldn't we consider the 20% EBITDA margin a relatively low bar, just given your 3Q performance?

"No. First, the way we define it is a full-year target we are taking. It will happen before the end of 2021. We believe the trajectory of the year with a gradual recovery will give us the opportunity to create a full year target that will be set at this level, or exceed. Do we anticipate and see more pricing? No. I think the pricing has been -- the pricing pressure has been with us for the last six years. I think, as I commented before, I think we have been giving away and the industry at large have been under pressure for this.

"The industry now is realizing that there's so much we can give, and we are working more collaboratively with our customers to find solutions to eliminate waste. Now obviously, large integrated contracts are still competitively priced, but we see that through performance, through technology, and through smart engagement and alignment with our customer, we're able to offset those pricing and competitive pressure and realize margin resilience.

"So pricing is and will remain with us in these years to come, possible headwinds but mostly on large integrated contracts. And I believe that when activity will come back, we’ll get opportunity to get back pricing in the right market."

A Diverse Strategy for Tackling Renewables

- So I was just wondering if you could give us a little bit more insights on how you view potentially the clean energy business evolving over time?

"I think, obviously, we see it's not only a trend that we want to capture with our existing customers. I think, obviously, some of our customer segments are transitioning into a different role as energy company and want to add to that portfolio beyond oil and gas, including some technology and some renewables in which we also have interest. And I think at large, what we have realized is that we have a technology platform. We have an ability to deploy at scale technology. We have a subsurface knowledge.When you combine all of this, we believe that we have market position that we can take, develop into the New Energy business, be it on renewable, be it on the energy storage or be it on hydrogen. And I think this is where we are developing our venture today.

"We are developing it in geothermal, both low-heat and deep geothermal. So that's where we're heading. The hydrogen is very, very interesting for us because it's a huge opportunity, partially led by EU, with Green Deal and there are two avenues there. One avenue is the green hydrogen or electrolyzer where we believe we, with our new venture, Genvia, are in a position to create differentiated offering in the market to provide the market with higher efficiency and more versatile electrolyzer that can feed this 40-gigawatt capacity that EU is planning for 2030.And finally, I think we will continue to also look into CCS, which is again close to our core. But not CCS application for oil and gas, but CCS application to decarbonize the hard-to-abate sector, ammonia or SMR for hydrogen production through gas."

- Do you have an aspiration for renewables to be a certain percentage of revenues by, pick your year, 2025, 2030? What does this mean for CapEx spend, R&D spend? And overall, how do you think about balancing it?

"Yes, absolutely. I think it's too early to quote a number. I think it's something that we are working, and we are continuing to develop our strategy. But I think I will not call it renewable. I think it's more than renewable. And it's not--intersects renewable, but I think it's the technology approach we have and it's not necessarily -- don't expect us to buy wind farms and go after capital projects. So that's not our intent. Our intent is to continue to play and build on our strengths, strength being our technology, being a technology partner for a renewable company, being technology partner for some of our current existing customers and being technology partner for addressing a new economy, such as hydrogen economy. I think this is where we want to be. And we'll take a bigger position on the one we believe have the most potential in the coming years."

Full Q3 2020 Press Release:

- Worldwide revenue of $5.3 billion decreased 2% sequentially

- International revenue of $4.1 billion decreased 1% sequentially

- North America revenue of $1.2 billion decreased 2% sequentially

- GAAP loss per share, including charges and credits of $0.22 per share, was $0.06

- EPS, excluding charges and credits, was $0.16

- Cash flow from operations was $479 million and free cash flow was $226 million

- Board approved quarterly cash dividend of $0.125 per share

Schlumberger CEO Olivier Le Peuch commented, “Our results in the third quarter clearly demonstrate our focus on execution, returns, and customer performance. Margins expanded sequentially while pretax segment operating income and adjusted EBITDA grew 45% and 21%, respectively, highlighting notable progress in the reset of our earnings power and further demonstrating our execution capabilities as we transition to our new organization.

“Through this cycle, we are leading technology innovation for our customers and reinventing ourselves to deliver a return above our cost of capital through the combination of capital stewardship, margin expansion, and free cash flow generation.

“In North America, we have exhibited capital discipline, and are high-grading and rationalizing our portfolio, with a focus on reduced volatility of earnings and less capital-intensive businesses as demonstrated by two key milestones we achieved during the quarter. The first is the agreement to combine our OneStim® pressure pumping business with Liberty Oilfield Services Inc. The second is an agreement to divest our low-flow artificial lift business in a cash transaction.

“Internationally, our fit-for-basin approach continues to extend our leadership position built on the largest and most diverse footprint in the industry. Despite the rig count decline during the quarter, we have experienced significant new technology uptake, achieved new performance benchmarks for our customers, and captured higher performance incentives on multiple projects. In addition, our international business continues to generate resilient, accretive margins and significant free cash flow. Upon the close of the two North America transactions, we expect our international revenue to represent more than 80% of consolidated revenue, up from an average of approximately 65% over the past decade. The combination of our fit-for-basin strategy, digital technology innovation, and scale puts us in the best position to leverage the anticipated shift of spending growth toward the international market.

“Third-quarter revenue declined 2% sequentially, as North America revenue was 2% lower and international revenue declined 1%. In North America land, increased completions activity on drilled but uncompleted (DUC) wells was offset by reduced drilling in US land. North America offshore was affected by reduced rig activity, lower multiclient seismic license sales, and hurricane disruption.

“International revenue was driven by higher activity in Latin America, boosted by the resumption of production in our Asset Performance Solutions (APS) projects in Ecuador and increased seasonal summer activity in the North Sea and Russia. These increases were offset by the effects of rig count declines and extended COVID-19 disruptions in Africa and in the Middle East & Asia.

Third-Quarter Revenue by Segment

“Sequentially, by business segment, third-quarter Production revenue increased 12%, driven by the gradual recovery in DUC well completions activity in US land and the resumption of APS production in Ecuador, which was further boosted by digital technology, improving project performance and efficiency. Reservoir Characterization, Drilling, and Cameron decreased 4%, 12%, and 5%, respectively, due to lower WesternGeco® multiclient seismic license sales, the US land drilling activity decline, hurricane disruption in the US Gulf of Mexico, and persistent COVID-19 disruptions internationally.

“Our cost-reduction program, which will permanently remove $1.5 billion of structural costs on an annual basis, is progressing well. We expect to realize the vast majority of these savings as we exit this year. This represents a critical step toward our intermediate goal of restoring 2019 adjusted EBITDA margins before the end of 2021.

“I am extremely proud of our operational and financial performance during the quarter, as we continue to build the foundation of our future success.

“As we look to the fourth quarter, we expect to continue to benefit from the effectiveness of our strategy, disciplined approach to North America, and broad strength of our international business, as reflected in our third-quarter results. In North America, the conditions are set for continued momentum, with improving DUC well completion activity in US land and a modest drilling resumption in the US and Canada. International activity is steady following the budget resets completed in the third quarter and activity will be affected by the seasonal decline in the Northern Hemisphere, partly offset by muted year-end product and multiclient license sales.

“Overall internationally, we view the next two quarters as a period of transition for our industry at the trough of this cycle. Improving demand recovery supported by various government measures to stimulate economic activity and continued supply discipline from the major producers set the conditions for a long-term activity rebound. However, while the global lockdowns are evolving and vaccine development is progressing, the near-term recovery remains fragile owing to potential subsequent waves of COVID-19 that could pose a significant risk to this outlook.

“Therefore, in this flattening near-term activity outlook, we will continue to execute on a path toward restoring our 2019 adjusted EBITDA margins and generating robust free cash flow—through our restructuring measures, the high-grading of our portfolio, and the further strengthening of our broad international portfolio.

“As our industry emerges from this trough, the ability to deliver new performance benchmarks—to innovate and collaborate in every basin—will define success for the coming decades. Schlumberger will lead this innovation and the path to recovery. Our performance and returns-focused strategy will allow us to capitalize upon the emerging growth cycle and deliver industry-leading returns, through our capital stewardship, fit-for-basin technology, digital leadership, and a unique talent pool supporting our global execution. In addition, we are accelerating the expansion of our New Energy portfolio as we develop avenues to contribute to the sustainable energy mix of the future, leveraging our technology, expertise, and execution platform to reduce our environmental impacts while helping our customers reach their environmental goals.

“The crisis has served as a catalyst for reinventing Schlumberger. We are executing our performance strategy and are determined to continue taking bold actions to secure resilience and reposition ourselves as clear leaders—both in performance measured by our customers and in returns measured by our shareholders.”

Other Events

During the third quarter, Schlumberger issued $500 million of 1.400% Senior Notes due 2025 and $350 million of 2.650% Senior Notes due 2030.

On August 31, 2020, Schlumberger and Liberty Oilfield Services Inc. (Liberty) signed an agreement for the contribution to Liberty of OneStim, Schlumberger’s onshore hydraulic fracturing business in the United States and Canada, including its pressure pumping, pumpdown perforating, and Permian frac sand businesses, in exchange for a 37% equity interest in Liberty. The transaction is expected to close in the fourth quarter of 2020 and is subject to Liberty stockholder approval and other customary closing conditions.

On October 15, 2020, Schlumberger’s Board of Directors approved a quarterly cash dividend of $0.125 per share of outstanding common stock, payable on January 14, 2021 to stockholders of record on December 2, 2020.

Results by Area

North America

North America area consolidated revenue of $1.2 billion was 2% lower sequentially. On land, an uptick in DUC well completions was partially offset by reduced drilling activity. OneStim fracturing revenue grew on higher fleet utilization driven by a US-market stage count increase of more than 30% as customers worked on their DUCs in the Permian and in the resilient gas basins in the Haynesville. Land drilling activity was lower as the average US land rig count declined 29% sequentially, though the rig count had increased slightly by quarter end. In addition, sales in Surface Systems and Valves & Process Systems, mainly on land, decreased sequentially due to reduced drilling activity. North America offshore revenue decreased 13% sequentially due to the combination of reduced rig count, lower WesternGeco multiclient seismic license sales, and hurricane disruption.

International

Consolidated revenue in the Latin America area of $707 million increased 30% sequentially, primarily due to the resumption of production in our APS projects in Ecuador. Argentina revenue increased as activity rebounded following the easing of COVID-19 lockdown restrictions while revenue in both Mexico and Brazil declined.

Europe/CIS/Africa area consolidated revenue of $1.4 billion decreased 4% sequentially as increased seasonal summer activity in the North Sea and Russia was offset by rig count declines and extended COVID-19 disruptions in Africa and the Caspian region. Resilient activity in Russia and the North Sea was driven by summer drilling and pressure pumping activity campaigns, partially offset by disruptions and delays in Kazakhstan and in Sakhalin. The seasonal activity increase in the Northern Hemisphere, however, was offset by a significant drop in activity in Sub-Sahara Africa from COVID-19 disruptions, reduced rig count, and project delays.

Consolidated revenue in the Middle East & Asia area of $2.0 billion decreased 7% sequentially, primarily due to extended COVID-19 disruptions and project delays in Asia and as customers reduced spending and activity due to budget adjustments, particularly in the Middle East.

Reservoir Characterization

Reservoir Characterization revenue of $1.0 billion, 85% of which came from the international markets, decreased 4% sequentially. North America and international revenues declined 14% and 2%, respectively. This was mainly due to lower WesternGeco multiclient seismic license sales in North America offshore. Revenue was also lower in the Middle East due to reduced WesternGeco activity as a result of a completed project and lower Testing Services activity due to project cancellations and delays. Sequentially, Wireline activity was essentially flat while Software Integrated Solutions (SIS) revenue was higher.

Reservoir Characterization pretax operating margin of 17% contracted 90 basis points (bps) sequentially due to lower sales of WesternGeco multiclient seismic licenses, which impacted North America margin, while international margin was flat sequentially.

Drilling

Drilling revenue of $1.5 billion, 83% of which came from the international markets, decreased 12% sequentially. North America and international revenues declined 16% and 11%, respectively. The revenue decline in North America was primarily due to lower activity in US land as rig count dropped 29%, along with rig count reductions and activity disruptions in the US Gulf of Mexico due to a more active hurricane season. In addition, extended COVID-19 disruptions caused drilling activities to be suspended or deferred in several international GeoMarkets.

Sequentially, Drilling pretax operating margin of 10% was essentially flat, despite the significant revenue decline. Margin was resilient both in North America and internationally supported by prompt cost reduction measures.

Production

Production revenue of $1.8 billion, 74% of which came from the international markets, increased 12% sequentially. North America and international revenues increased 13% and 11%, respectively. This was driven primarily by the gradual recovery in DUC well completions activity in US land and the resumption of APS production in Ecuador, which was further boosted by digital technology, improving project performance and efficiency. OneStim revenue grew more than 50% sequentially as US-market stage counts increased by more than 30%. Artificial Lift Solutions revenue increased, also benefitting from the US land recovery. These increases were offset by international declines in Well Services and Completions revenue, resulting from lower spending and activity due to customer budget adjustments, particularly in the Middle East, and from extended COVID-19 lockdown disruption across several GeoMarkets.

Production pretax operating margin of 13% expanded by 1,107 bps sequentially, posting a 108% incremental operating margin. The margin expansion was due to the resumption of production in our APS projects in Ecuador and improved profitability across each of Completions, Artificial Lift Solutions, and Well Services, supported by cost reduction measures. OneStim margin improved due to better operating leverage as revenue increased by more than 50%. Margins improved both in North America and internationally.

Cameron

Cameron revenue of $965 million, 67% of which came from the international markets, decreased 5% sequentially. This was primarily due to revenue declines in the long-cycle businesses of OneSubsea® and Drilling Systems, driven by projects ending in Asia and Europe, coupled with the extended COVID-19 disruptions. Despite lower equipment sales in North America, the short-cycle businesses of Surface Systems and Valves & Process Systems were resilient, driven by growth internationally.

Cameron pretax operating margin of 6% declined by 162 bps sequentially. The margin contraction was primarily due to the unfavorable mix where contribution from the long-cycle businesses of OneSubsea and Drilling Systems was lower due to reduced activity. The margins of the short-cycle businesses of Surface Systems and Valves & Process Systems were flat.

Quarterly Highlights

During the quarter, Schlumberger continued to deploy innovative technology and digital enablement to help move the industry toward safer and more efficient operations with lower environmental impact. Schlumberger’s digital platform for the industry continued to gain adoption, as Schlumberger helped customers at various stages of their digital journeys:

- Kuwait Oil Company (KOC) awarded Schlumberger a five-year contract for the ability to implement digital solutions, including the Petrel* E&P software platform and other petrotechnical domain applications. The contract, valued at USD 109 million, furthers KOC’s objective to deploy best-in-class software solutions that increase asset team efficiency while reducing overall cost per barrel. KOC seeks to improve cross-discipline collaboration between geosciences, reservoir engineering, production engineering, and drilling to facilitate better investment decisions based on a clear understanding of opportunities and risks.

- Suncor Energy signed a multiyear agreement to use the Schlumberger DELFI* cognitive E&P environment for the multidomain integration of reservoir engineering, production, and geomechanics in Canada’s large-scale unconventional thermal reservoirs. The agreement includes a heavy oil research and development collaboration for Schlumberger to develop new digital technologies for these complex environments.

- The Angolan Agência Nacional de Petróleo, Gás e Biocombustíveis (ANPG) issued a contract award to Schlumberger for the agency’s first-ever digital transformation project. ANPG’s vision is to move to a cloud-based platform to improve the efficiency and performance of oil and gas exploration activities in Angola. The project comprises a technology landscape review, digital readiness evaluation, and an implementation roadmap. A Schlumberger digital transformation consulting team will conduct the reviews and then define a path to advance the digitalization of ANPG, enabled by the Schlumberger DELFI environment.

New technology, workflows, and digitally enabled hardware—including artificial intelligence (AI) and internet of things (IoT) solutions at the edge—continue to positively impact our internal delivery, our performance for customers, and the environment:

- In Ecuador, Schlumberger accelerated adoption of digital solutions through its integrated business model by implementing Agora* edge AI and IoT solutions on its own APS project. By combining digital technologies within an integrated environment, production performance was increased while operational and environmental footprint were reduced. To solve production challenges with high gas/oil ratio wells, Agora solutions were used to deliver an automated electrical submersible pump (ESP) gas-handling process. Using a securely connected, solar-powered skid running predictive AI at the edge to optimize well and ESP performance, production was increased 30% in wells connected by the Agora solution, while reducing field crew visits to these wells by 97%—an example of the performance made possible by combining digital and integration.

- Offshore Malaysia, PETRONAS Carigali Sdn Bhd (PCSB), a subsidiary of PETRONAS, has deployed the Agora platform on mature assets to improve its wellsite safety and productivity while reducing greenhouse gas emissions. By using an artificial-intelligence-based video analytics solution, PCSB has achieved a step change in safety and productivity with zero facilities modification. This solution has enabled mature assets to be successfully digitalized. An Agora platform gateway connected to an edge-empowered camera and stand-alone sensors reduced human exposure in the field while providing continuous access to critical equipment data.

- In Saudi Arabia, the DrillPlan* well construction planning and DrillOps* automation well delivery solutions surpassed 63,000 ft drilled, achieving a key milestone for our Integrated Well Construction LSTK operations. The on-bottom rate of penetration (ROP) with AutoROP* was 17% higher than previous wells drilled by the same rigs' field average. Furthermore, DrillOps controlled the preconnection, reaming, and backreaming operations, significantly reducing nonproductive time, optimized well delivery time, and contributed to a 30% improvement in on-bottom ROP and shoe-to-shoe run in a recent section of a horizontal well.

- Onshore Thailand, Schlumberger used Performance Live* digitally connected service on four rigs for PTT Exploration and Production Plc., Ltd. (PTTEP), reducing crew HSE exposure while sustaining improved ROP. To overcome pandemic-related operational challenges while maintaining drilling execution, Performance Live service enabled PTTEP to conduct most analytical tasks from an office rather than at the wellsite, resulting in a wellsite crew reduction of 50% during directional drilling operations. When combined with upgraded and optimized bottomhole assembly tools with digitally connected capability, Performance Live service also helped PTTEP consistently achieve ROP in excess of 1,500 ft/d.

- In Brazil, Drilling & Measurements deployed TerraSphere* high-definition dual-imaging-while-drilling service for the first time in the country to log presalt carbonates for Total. TerraSphere service enabled acquisition of high-definition borehole images—while drilling—de-risking the logging operations on depleted and complex reservoirs. This technology enables well completion optimization and unprecedented reservoir characterization detail for Total’s Lapa field development.

- In the US Gulf of Mexico, Byron Energy began production from its SM58 G1 well, crediting a WesternGeco data enrichment initiative with leading to the successful discovery in 2019. The well, which is producing 19.4 MMcf/d of gas and 385 bbl/d of condensate, was drilled on a prospect identified using a velocity model combined with reverse time migration technology. Byron has identified other prospects on the SM58 block using the same exploration dataset.

During the quarter, Schlumberger was awarded a variety of contracts, particularly internationally. Operators are engaging Schlumberger to employ capital-efficient, shorter-cycle methods to enhance recovery and generate more value from their assets:

- OneSubsea has been awarded an engineering, procurement, and construction (EPC) contract by BHP Petroleum (BHP) for a subsea boosting system to increase recovery from the deepwater Shenzi Field in the US Gulf of Mexico. The Shenzi Field, located approximately 190 km offshore Louisiana, began producing in 2009. The multiphase boosting system will enable a significant drawdown on existing wells to facilitate increased production from the field. The boosting system, rated at 3.6 MW, is a compact, reliable, and capital-efficient solution to increase BHP’s value from this proven asset.

- In Scandinavia, Schlumberger secured a contract for stimulation vessel services. The three-year contract includes optional extensions through 2026 to provide stimulation services in the Greater Ekofisk Area in the North Sea. Service delivery following the initial award combined with key technologies are assessed to reduce costs and improve efficiency.

- In Oman, Occidental of Oman, Inc. awarded Schlumberger a multiyear contract for the supply of artificial lift production systems and services for the Mukhaizna Oil Field. As part of our commitment to in-country value, we will train and support our local Omani services partner to deliver our fit-for-purpose artificial lift solutions.

In addition to these awards, Schlumberger received contracts from operators focused on efficient development as well as improving production and recovery to achieve their long-term goals:

- The Kingdom of Bahrain awarded a performance-based extension contract to a joint team of Tatweer Petroleum and Schlumberger Integrated Performance Management for 15 wells following the success of the pilot project in the Awali Field. This joint engagement integrates services across subsurface, drilling, and hydraulic fracturing to unlock the potential of a key reservoir in the field using fit-for-purpose technologies, including advanced logging and core analysis, extreme extended-reach wells, and fracture stimulation techniques.

- In Indonesia, Schlumberger was awarded a three-year contract with an optional one-year extension for drilling operations by Pertamina Hulu Mahakam (PHM). This award follows Schlumberger’s previous success in one of PHM’s mature fields, increasing production and reducing total system cost through enhanced drilling performance. The new award includes integrated delivery of performance-focused technologies—such as StethoScope* formation pressure-while-drilling service and PowerDrive Orbit G2 vorteX* motorized rotary steerable system—which will be coupled with a cost optimization strategy tailored to the field.

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

United States News >>>

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Battalion Oil Corporation First Quarter 2023 Results

5.jpg&new_width=60&new_height=60&imgsize=false)

-

Amplify Energy Corporation First Quarter 2023 Results -

-

Denbury Inc., First Quarter 2023 Results

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results