Top Story | Private Equity | Deals - Acquisition, Mergers, Divestitures | Capital Markets | Capex Increase | Capital Expenditure - 2021

Southwestern Closes Acquisition of Indigo Natural Resources; Ups Capex

Southwestern Energy Co. has closed the $2.7B acquisition of Indigo Natural Resources.

The acquisition adds 149,000 net acres and 1,000 drilling locations in the Haynesville to Southwestern's portfolio.

Updated Guidance

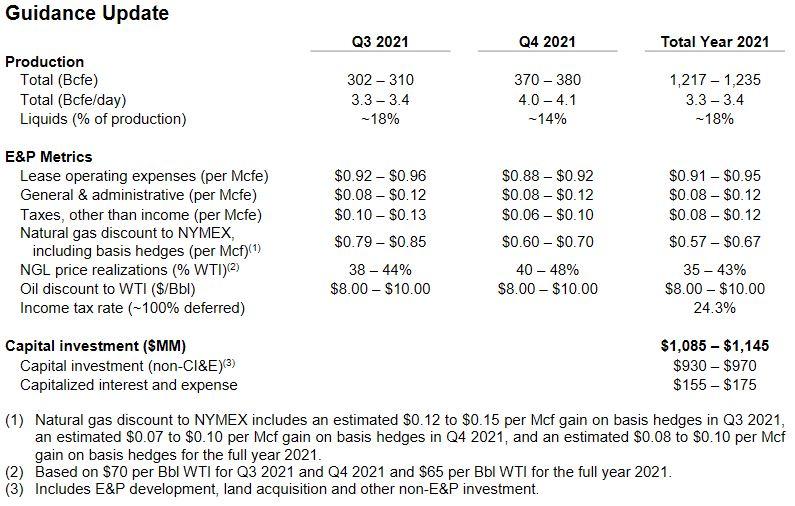

Southwestern Energy is providing updated 2021 guidance, which incorporates the acquired Haynesville assets starting on September 1, 2021. Free cash flow generation for 2021 is expected to increase to a range of $425 to $475 million. The Company plans to use this increased cash flow for debt reduction, which is expected to drive its leverage below its 2 times net debt to EBITDA target by the end of 2021.

In Haynesville, the Company expects to complete the 2021 capital investment program currently in progress, and will average 6 rigs and approximately 2 completion crews, placing 15 to 20 gross wells to sales.

To incorporate the investment in Haynesville, the Company's expected 2021 capital investment range has increased to $1,085 to $1,145 million, which also includes the associated increase in capitalization of interest and expense.

CEO Bill Way commented: "We are excited to incorporate Indigo's assets into SWN's premier US natural gas portfolio. More importantly, we want to welcome many of its talented people to Southwestern. They complement our high performance culture and share our collective passion to stretch the limits of what is possible.

"With these assets and newly expanded team, we are well positioned to take the Company to the next level. This acquisition materially expands our opportunity set, adding high-margin Haynesville production and substantial core drilling inventory while providing additional global market access through the LNG corridor. It also further de-risks our enterprise, increases free cash flow, extends our maturity profile and accelerates our deleveraging goals. Looking ahead, we will continue to pursue opportunities to further increase our scale and enhance our ability to responsibly and sustainably drive additional value for our shareholders."

| Category | 2023 | 2024Est. Initial | Updated 2024 Guidance | %Difference (2023 vs 2024) |

| Total Capital Expenditure($mm) |

|

|

|

|

Related Categories :

Deals - Deal Close

More Deals - Deal Close News

-

Ring Energy Finalizes Acquisition of Stronghold Energy II

-

Centennial, Colgate Finalize $3.9B Merger; Debut as Permian Resources Corp.

-

Diamondback Seals Rattler Midstream Deal; Takes Company Private

-

Riverbend Finalizes $1.8B Sale of Portfolio Companies

-

Northern Oil Closes $158MM Bolt-On Deal for Williston Assets

Ark-La-Tex News >>>

-

E&P Company Slash 2024 Capex & Frac Crews by 50%

-

What to Expect From Frac Activity in 2H'23 & 2024 -

-

Top Drilling Contractors Talk 2H '23 and 2024 -

-

Empire Petroleum First Quarter 2023 Results

-

Amplify Energy Corporation First Quarter 2023 Results -