Top Story | Fourth Quarter (4Q) Update | Financial Results | Hedging | Capital Markets | Capital Expenditure | Drilling Program - Wells | Capital Expenditure - 2021

Southwestern Keeping Capex, D&C Activity Flat for 2021; $900MM, 100 Wells

Southwestern Energy Co. announced financial and operating results for the fourth quarter and full year 2020 and issued 2021 guidance.

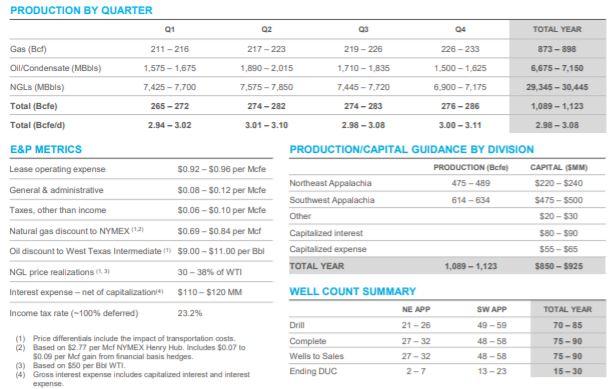

2021 Plan

- Capex: $850-925 million - relatively flat vs. 2020 levels

- NE Appalachia: $220-240 million

- SW Appalachia: $475-500 million

- Other: $20-30 million

- Capitalized Interest/Expense: $135-155 million

- Production: 2,980-3,080 Mmcfe/d - flat from full year 2020 output

- Oil/Condensate: 18.3-19.6 MBOPD

- NGLs: 72.2-83.4 MBbls/d

- Gas: 2,392-2,460 Mmcf/d

Production By Area:

- NE Appalachia: 1,301-1,339 Mmcfe/d

- SW Appalachia: 1,682-1,737 Mmcfe/d

- Wells Drilled: 70-85 wells

- NE Appalachia: 21-26 wells

- SW Appalachia: 49-59 wells

- Wells Completed/TIL: 90-100 gross wells- flat vs. 2020

- NE Appalachia: 27-32 wells

- SW Appalachia: 48-58 wells

- DUCs at Year-End 2021: 15-30 wells

- NE Appalachia: 2-7 wells

- SW Appalachia: 13-23 wells

- Guidance based on $2.77 per Mcf NYMEX Henry Hub and $50 per barrel WTI; expect to deliver free cash flow of over $275 million, which is expected to be utilized for debt reduction;

- Prices of $3.00 per Mcfe NYMEX Henry Hub and $58 per barrel WTI would increase free cash flow estimate to more than $375 million and results in achieving targeted leverage ratio of 2.0x;

- Capital investment of $850 to $925 million; expect 3.05 Bcfe per day average fourth quarter 2021 net production, flat with fourth quarter 2020;

- Estimate 75 to 90 wells to sales including 12 to 15 in dry gas Ohio Utica; approximately 50% of total capital investment in dry gas and 50% in liquids-rich acreage;

- Continued focus on costs, expect G&A per Mcfe to decrease 20%;

- Expected to reduce well costs another 10% to an average of approximately $600 per lateral foot for all wells to sales inclusive of Ohio Utica; expect average lateral length of 14,000 feet;

- Hedges in place for approximately 85%, 60% and 95% of expected natural gas, natural gas liquids and oil production, respectively; approximately 80% of natural gas hedges allow for participation in upside from improving prices;

- Protecting 75% of natural gas basis through physical and financial basis hedges and out of basin transportation portfolio; expect financial basis hedge gain of $0.07 to $0.09 per Mcf; and

- Continued commitment to corporate responsibility, investing in human capital and our communities, and developing energy responsibly with a focus on reduced air emissions and water conservation, including maintaining top quartile performance in the industry for GHG and methane intensity.

Quarterly Results

CEO Bill Way said: "In 2020, Southwestern Energy delivered on its commitments, exceeding expectations on all key metrics while navigating the uncertainties of a global pandemic and the associated challenging commodity price and operating environments. We have positioned the Company to deliver material free cash flow going forward through an enduring conviction to our returns-driven strategy. We delivered strong results across all of our strategic pillars, including an accretive acquisition, a meaningfully lower cost structure and an increased underlying asset value.

"Southwestern Energy has entered 2021 with greater scale and resilience, prepared to capture increasing value from more than one trillion cubic feet equivalent of expected annual production flowing into diverse and key markets. The free cash flow we expect to deliver this year will be used to reduce debt as we progress towards our goal of sustainable 2 times leverage. Consistent with our disciplined approach, any further improvement in cash flow from higher commodity prices will accelerate the delivery of that objective," Way continued.

2020 Highlights

- Completed acquisition of Montage Resources, delivering over $30 million in G&A synergies, while maintaining balance sheet strength through associated capital market transactions;

- Delivered $55 million of free cash flow in the fourth quarter;

- Realized $90 million in additional expense reductions including a 33% decrease in G&A to $0.12 per Mcfe;

- Reported total production of 880 Bcfe; 3.05 Bcfe per day pro forma fourth quarter net production rate;

- Invested capital of $899 million and delivered 100 wells to sales;

- Generated $362 million of realized hedge gains, including $76 million from basis;

- Repurchased $107 million of senior notes for $72 million, a 33% discount;

- Enhanced liquidity with borrowing base increased to $2.0 billion following acquisition;

- Reduced well costs, averaged $637 per lateral foot in the second half of 2020; annual reduction of 19% to $670 per lateral foot with an average lateral length of 12,154 feet;

- Lowered Proved Developed F&D costs by 25% to $0.40 per Mcfe through well cost reductions and increased well productivity;

- Realized 26% of WTI on full year NGL prices, above the high end of guidance, and 36% of WTI in the fourth quarter, both associated with strengthening market fundamentals and NGL marketing optimization;

- Reported proved reserves of 12.0 Tcfe, including 1.4 Tcfe of positive performance revisions and 741 Bcfe of reserve additions, partially mitigating the impact of backward-looking SEC prices;

- Released our 7th annual corporate responsibility report; key environmental highlights included top quartile GHG and methane intensity among AXPC peers; and

- Recorded the fifth consecutive year of freshwater neutrality; have now replaced over 14 billion gallons of freshwater in communities where we work and live.

Fourth Quarter 2020 Financial Results

For the quarter ended December 31, 2020, Southwestern Energy recorded a net loss of $92 million, or ($0.14) per diluted share, including $335 million of non-cash impairments and a $134 million non-cash gain on unsettled mark to market derivatives. This compares to net income of $110 million, or $0.20 per diluted share in the fourth quarter of 2019.

Adjusted net income (non-GAAP), which excludes non-cash items noted above and other one-time charges, was $119 million or $0.18 per diluted share in 2020 and $99 million or $0.18 per share for the same period in 2019. The increase was primarily related to increased production volumes and a decrease in average unit operating costs, partially offset by wider natural gas basis differentials. For the fourth quarter of 2020, adjusted EBITDA (non-GAAP) was $276 million, net cash provided by operating activities was $121 million and net cash flow (non-GAAP) was $249 million, resulting in $55 million in free cash flow.

As indicated in the table below, fourth quarter 2020 weighted average realized price, including $0.37 per Mcfe of transportation expenses, was $1.93 per Mcfe before the impact of derivatives, down 9% compared to $2.12 per Mcfe in 2019. The decrease was primarily due to widened basis differentials in the Appalachia basin. Fourth quarter weighted average realized price before transportation expense was $2.30 per Mcfe.

The Company realized $52 million in cash-settled derivative gains during the fourth quarter of 2020, a $0.21 per Mcfe uplift. Included in the fourth quarter settled derivative gains is a $47 million gain related to natural gas basis hedges, which protected the Company from widening basis differentials.

Full Year 2020 Financial Results

The Company recorded a net loss of $3.1 billion, or ($5.42) per share, for the year ended December 31, 2020 compared to net income of $891 million, or $1.65 per share in 2019. In 2020, the Company recorded non-cash impairments of $2.8 billion and $138 million of non-cash loss on unsettled derivatives, and had an $818 million change in its deferred tax provision. Excluding these non-cash and other one-time items, adjusted net income for 2020 was $221 million, or $0.38 per share, compared to $328 million, or $0.61 per share, in 2019. The decrease in adjusted net income compared to prior year was primarily the result of a decrease in commodity prices, partially offset by a $182 million increase in settled derivatives impact, increased production volumes and decreased G&A and depreciation, depletion and amortization expense. In 2020, Adjusted EBITDA (non-GAAP) was $742 million, net cash provided by operating activities was $528 million and net cash flow (non-GAAP) was $662 million.

For the full year 2020, weighted average realized price, including $0.37 per Mcfe of transportation expense, was $1.53 per Mcfe before the impact of derivatives, a 30% decrease compared to $2.18 per Mcfe in 2019, due to decreased prices across all commodities. In 2020, the weighted average realized price before transportation expenses was $1.90 per Mcfe.

Cash-settled derivative gains totaled $362 million in 2020, a $0.41 per Mcfe uplift, bringing the weighted average realized price including the impact of derivatives to $1.94 per Mcfe in 2020, compared to $2.42 per Mcfe in 2019.

As of December 31, 2020, Southwestern Energy had total debt of $3.15 billion and a cash balance of $13 million. At the end of 2020, the Company had $700 million of borrowings under its $2.0 billion revolving credit facility with $233 million in outstanding letters of credit.

| Category | 2023 | 2024Est. Initial | Updated 2024 Guidance | %Difference (2023 vs 2024) |

| Total Capital Expenditure($mm) |

|

|

|

|

Related Categories :

Capital Expenditure - 2021

More Capital Expenditure - 2021 News

-

Pine Cliff Energy Ups Spending, Production Plans by 10% for 2022

-

Whitecap Resources Unveils 2022 Budget; Up 12% vs. 2021

-

Southwestern Closes Acquisition of Indigo Natural Resources; Ups Capex

-

Altura Energy First Quarter 2021 Results

-

Razor Energy Corp. First Quarter 2021 Results

Northeast News >>>

-

Large Marcellus E&P Talk 2024 Development Plan, Rigs, Wells & Frac Crews

-

Devon Said To be In Talks to Acquire Enerplus

-

CNX Resources Talks 2024 Rigs, Frac Crews & Well Count -

-

An Early Look at Company 2024 Capital & Development Plans

-

A Look at Capital Spending By Company In First Half 2023; Budget Exhausion?