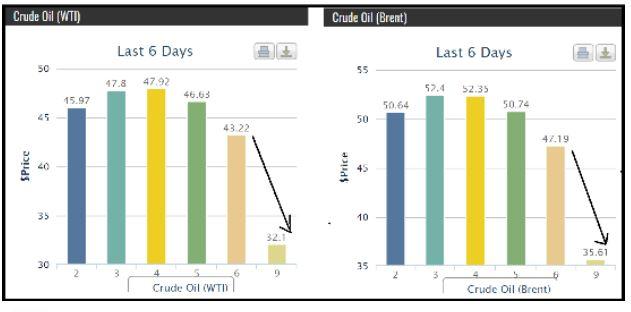

Oil prices fell this weekend from Friday's lows of $43 WTI to $32 WTI (early morning trading) - a decrease of 26%.

This is in large part to Russia's decision last Friday to not support OPEC's 1.5 million barrel per day oil production (mmbbls/d).

Let's revisit what happened over the last month:

- 2/10/2020: Even as the Coronavirus decimated oil demand, U.S. E&Ps guided that they plan on growing light oil by +8% (roughly 600,000 - 700,000 barrels per day).

- 2/28/2020: U.S. places sanctions on Rosneft over alleged Venezuela oil exports.

- 3/6/2020: Russia says no to OPEC's proposed 1.5 MMbbl/d cut and oil falls to $43.

- 3/7/2020: Saudi Arabia cuts April crude oil prices

- 3/9/2020: Crude oil falls (-23%) from Friday close to $32 by Sunday.

U.S. E&Ps Already Responding to $30s WTI

This morning, a large Permian E&P said it plans to cut it rig count from 21 to 18 and reduced it frac fleets to 6 from the 9.

We expect more companies to respond by cutting drilling and completion programs over the next few days / weeks.

Eyes are on companies like EOG Resources, who has no hedges in place and is currently operating 31 rigs, and plans to grow oil (+10%).

Centennial Resources and Continental Resources, who both operate 6 & 18 rigs, respectively, will also have to reduce activity significantly as well.

Related Categories :

Geopolitics

More Geopolitics News

-

Chairman of Russia's Lukoil Dead After 'Fall from Hospital Window'

-

Biden to Release One Million BPD from Reserves for Six Months; Push for Federal Leasehold Production

-

Energy Firms Exit Russian Projects En Masse, Citing Ukraine Invasion (Updated 3/4/22)

-

TotalEnergies Will Make No New Investments in Russia

-

Equinor to Exit Russian JVs, Halt New Investments in Country

United States News >>>

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Battalion Oil Corporation First Quarter 2023 Results

5.jpg&new_width=60&new_height=60&imgsize=false)

-

Amplify Energy Corporation First Quarter 2023 Results -

-

Denbury Inc., First Quarter 2023 Results

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results