Capital Markets | Capital Expenditure | Capital Expenditure - 2021

Whiting Cutting Spending by $20MM (-8%) for 2021; IDs Capex of $240 Million

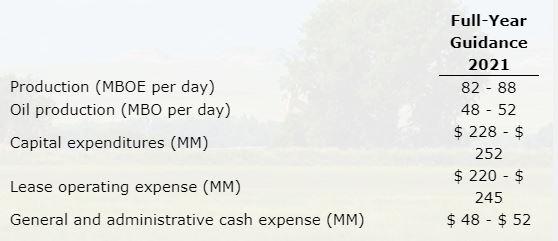

Whiting Petroleum Corp. announced its 2021 capital, operating costs and production guidance, reflecting an operating plan focused on delivering sustainable free cash flow.

2021 Guidance Highlights

- Forecasted annual oil production of 50 MBO per day, 85 MBOE per day at the mid-point (equivalent is down 6% from 2020 estimates)

- Estimated capital expenditures of $240 million (down $20MM or 8% from 2020)

- Plan to drill 37 gross (24.0 net) operated wells; turn-in-line 56 gross (36.8 net) operated wells, including 39 gross (23.6 net) operated drilled uncompleted wells carried over from 2020.

Commenting on the operational plan, Lynn A. Peterson, President and CEO of Whiting, said "We believe Whiting is well positioned financially and operationally as we enter 2021. We exited 2020 with $360 million of revolver debt, providing $390 million of liquidity. With this 2021 capital program we anticipate holding production flat on an annual average, as compared to our 2020 exit levels. We have protected our capital program by hedging the prices of approximately 60% of our expected crude oil volumes. With additional contractual arrangements, we've taken steps to further mitigate the potential for wider differentials in the Williston Basin while ensuring flow of our crude oil production. We expect 2021 wellhead deducts for oil to be similar compared to what we realized in the second half of 2020 with potential variability resulting from possible transportation disruptions. The 2021 program is designed to generate significant free cash flow, which will be used to pay down revolver debt and provide liquidity to look for opportunities.

"We continue to make changes to our compensation structure with the goal of aligning our executive pay with shareholder interests. Our variable compensation will be heavily performance weighted and equity will comprise a larger part of the total compensation package."

Related Categories :

Capital Expenditure - 2021

More Capital Expenditure - 2021 News

-

Pine Cliff Energy Ups Spending, Production Plans by 10% for 2022

-

Whitecap Resources Unveils 2022 Budget; Up 12% vs. 2021

-

Southwestern Closes Acquisition of Indigo Natural Resources; Ups Capex

-

Altura Energy First Quarter 2021 Results

-

Razor Energy Corp. First Quarter 2021 Results

Rockies News >>>

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

-

Devon Said To be In Talks to Acquire Enerplus

-

Chevron To Cut D&C Activity in U.S. Shale In 2024; Here is Where. -

-

An Early Look at Company 2024 Capital & Development Plans