Wilks Brothers LLC intends to make a formal takeover bid to acquire all of Calfrac Well Services Ltd.'s issued and outstanding shares.

The bid comes in at C$0.18 per share, which would ensure Shareholders receive a premium-to-market recovery even if Calfrac refuses to pursue Wilks' Superior Alternative Proposal or voluntarily commences a CCAA proceeding.

Wilks has decided to make the Premium Offer in order to provide Shareholders with a clear path to financial recovery if the Management Transaction is voted down at the Shareholders meeting to be held on September 17, 2020 and is not ultimately approved by the Court of Queen's Bench of Alberta.

Wilks Brothers commented: "It is clear to Wilks that the entrenched board and management of Calfrac have no intention of ever engaging with Wilks regarding the Superior Alternative Proposal that was put to Calfrac by Wilks on August 4, 2020. In light of that, Shareholders may be unduly influenced by the threats made by the entrenched board and management of Calfrac."

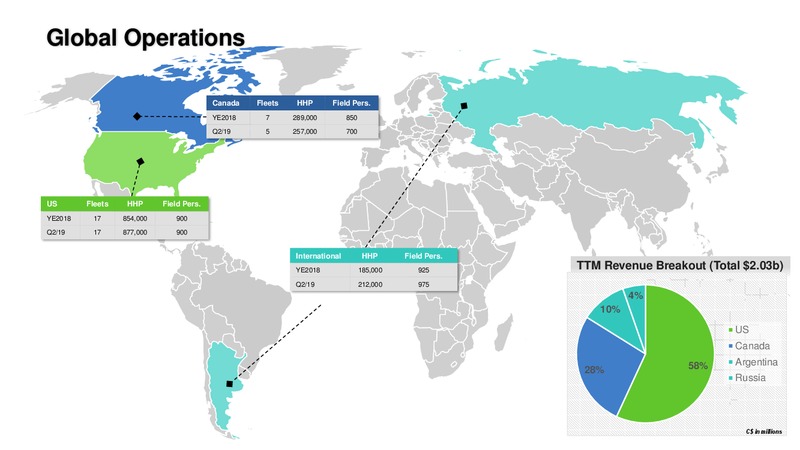

Calfrac's Global Footprint

--------------- Press Release -------------------

Wilks Brothers, LLC ("Wilks") announced today that it intends to provide the Shareholders of Calfrac Well Services Ltd. ("Calfrac" or the "Company") (TSX: CFW) with an unobstructed path to receive a premium-to-market recovery, in cash, if the coercive, insider-led transaction that has been proposed to them by the entrenched board and management of Calfrac (the "Management Transaction") does not proceed.

Wilks intends to make a formal take-over bid (the "Premium Offer") to acquire all of the issued and outstanding common shares of Calfrac that it does not currently own for cash consideration of C$0.18 per share. The Premium Offer will be made in accordance with the provisions of National Instrument 62-104 "Take Over Bids and Issuer Bids" of the Canadian securities regulators. Wilks anticipates that the bid circular and related materials will be filed and mailed to shareholders of Calfrac within the next 10 days.

Wilks has decided to make the Premium Offer in order to provide Shareholders with a clear path to financial recovery if the Management Transaction is voted down at the Shareholders meeting to be held on September 17, 2020 (the "Meeting") and is not ultimately approved by the Court of Queen's Bench of Alberta.

The entrenched board and management of Calfrac have threatened Shareholders, stating (in the Management Information Circular dated August 17, 2020) that if the Management Transaction is not approved, "…the Company may be required to consider or proceed with one or more alternative transactions that result in a reduced or no recovery to Shareholders."

It is clear to Wilks that the entrenched board and management of Calfrac have no intention of ever engaging with Wilks regarding the Superior Alternative Proposal that was put to Calfrac by Wilks on August 4, 2020. In light of that, Shareholders may be unduly influenced by the threats made by the entrenched board and management of Calfrac.

Wilks commits to their fellow Shareholders that, if the Management Transaction is not approved by shareholders at the Meeting and the Management Transaction is not approved by the Court, Shareholders will have a clear path to a premium recovery via the Premium Offer. The Premium Offer provides a highly attractive cash recovery to Shareholders if Calfrac will not move forward with the Wilks Superior Alternative Proposal and even if Calfrac makes good on its implied threat to commence proceedings under the Companies Creditors Arrangement Act (Canada) (the "CCAA") should the Management Transaction not proceed. Under the terms of the Premium Offer, Shareholder recovery will NOT be threatened by a CCAA filing.

The consideration per common share that Wilks intends to offer pursuant to the Premium Offer is fully payable in cash and is at a premium to the August 28, 2020 closing price of the common shares and an overwhelming premium to the per common share value that Wilks estimates Shareholders would receive if the Management Transaction were implemented. Through the Premium Offer, Wilks is prepared to allow Shareholders the option of receiving their pro rata percentage of the allotment set forth in the Superior Alternative Proposal. Details concerning the Superior Alternative Proposal are available at www.afaircalfrac.com.

Wilks anticipates that its obligation to take up and pay for shares under the Premium Offer will be subject to normal conditions (including the statutorily-required 50% minimum tender condition) and a condition that the Management Transaction shall not have been completed and shall have been terminated without material liability to Calfrac.

More importantly, Wilks confirms its intention to take up and pay for shares under the Premium Offer (to the fullest extent permitted by law) even if Calfrac files for protection from its creditors under the CCAA, provided all other conditions to the Premium Offer are satisfied.

Also, and in response to statements made by Calfrac, Wilks also wants to make it clear to all stakeholders that, if its Superior Alternative Proposal is implemented, its intention as majority owner would be to keep the Company intact and focus on delivering the best outcomes for all stakeholders. Should the Board and management of Calfrac continue to block the Superior Alternative Proposal, Shareholders will have the opportunity to receive a premium pursuant to the Premium Offer - a premium Shareholders are unlikely to see if management's inferior proposal is approved, especially given the poor track record of Calfrac's current management team and Board. That leadership team has presided over the near-complete destruction of Shareholder and noteholder value through mismanagement and reckless financial over-leverage. Wilks believes Shareholders and lenders would fare better with a significantly de-levered Calfrac under Wilks' prudent and transparent leadership.

Related Categories :

Frac Markets

More Frac Markets News

-

What to Expect From Frac Activity in 2H'23 & 2024 -

-

Top Frac Companies Talk Slowdown In Gas Basin; Oversupplied Permian -

-

E&P Companies Talk Increase In 2023 Plans; Rigs, Frac Crews and Capital Budgets -

-

ProFrac Holding Corp. Second Quarter 2022 Results

-

ProPetro Holding Corp. Second Quarter 2022 Results

North America News >>>

-

Large Permian E&P Cuts Capex;Outlines New D&C Plans, 2024

-

Bonterra Eneergy Corporation First Quarter 2023 Results

-

Hammerhead Energy Inc. First Quarter 2023 Results

-

Spartan Delta Corp. First Quarter 2023 Results -

-

Baytex Energy Corp. First Quarter 2023 Results