Devon Energy to Acquire WPX Energy In All Stock Deal

Multiples

Transaction Details:

Devon Energy and WPX Energy have entered into an agreement to combine in an all-stock merger of equals transaction.

This deal closed on January 7, 2021.

Deal Highlights

WPX shareholders will receive a fixed exchange ratio of 0.5165 shares of Devon common stock for each share of WPX common stock owned. This transaction will create an enterprise value for the combined entity of $12 billion.

Devon shareholders will own approximately 57 percent of the combined company and WPX shareholders will own approximately 43 percent of the combined company on a fully diluted basis.

The transaction, which is expected to close in the first quarter of 2021. Funds managed by EnCap Investments L.P. own approximately 27 percent of the outstanding shares of WPX and have entered into a support agreement to vote in favor of the transaction.

The combined company will be led by Muncrief (current CEO of WPX) and Hager will serve as exec. Chairman.

2021 Oil exit rate is expected to be 280 Mbl/d and will require $1.7 billion to keep 2021 flat.

Asset Details:

- Q2 2020 Oil Production: 124 Mbbl/d (61% Permian, 39% Williston Basin)

- Q2 2020 Total Production: 207 Mboe/d

- Net Debt (TTM): $3.2 billion

- Gross Locations : 5100

- Proved Reserves : 1014 MMBOE

- Permian Basin: 184,000 net acres

- Bakken: 125,000 net acres

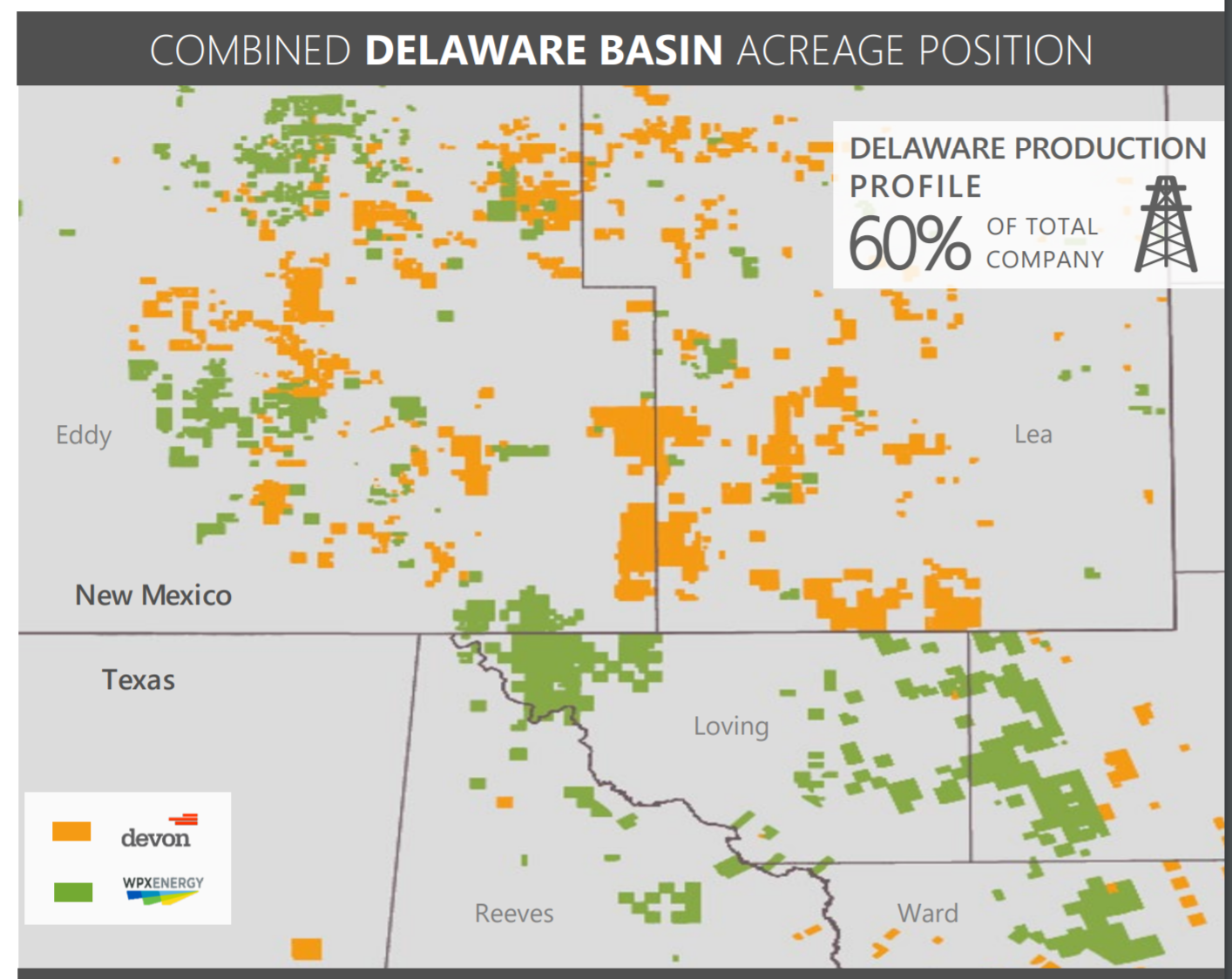

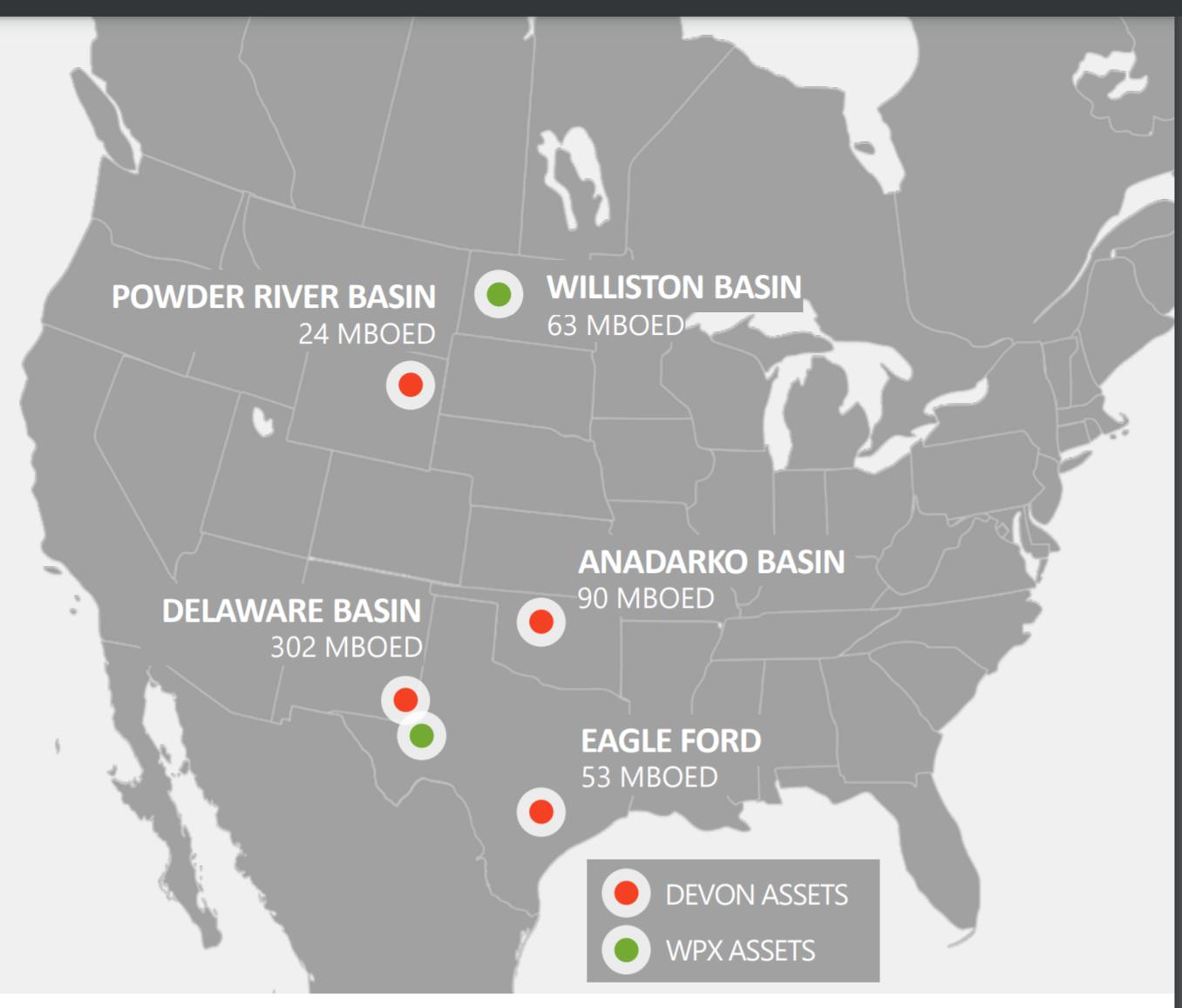

Proforma Map

CEO COMMENTARY

"This merger is a transformational event for Devon and WPX as we unite our complementary assets, operating capabilities and proven management teams to maximize our business in today's environment, while positioning our combined company to create value for years to come," said Dave Hager, Devon's president and CEO. "Bringing together our asset bases will drive immediate synergies and enable the combined company to accelerate free cash flow growth and return of capital to shareholders. In addition to highly complementary assets, Devon and WPX have similar values, and a disciplined returns-oriented focus, reinforcing our belief that this is an ideal business combination."

"This merger-of-equals strengthens our confidence that we will achieve all of our five-year targets outlined in late 2019," said Rick Muncrief, WPX's chairman and CEO. "The combined company will be one of the largest unconventional energy producers in the U.S. and with our enhanced scale and strong financial position, we can now accomplish these objectives for shareholders more quickly and efficiently. We will create value for shareholders of both companies through the disciplined management of our combined assets and an unwavering focus on profitable, per-share growth."

LEADERSHIP AND HEADQUARTERS

Following the merger, the board of directors will consist of 12 members, 7 directors from Devon and 5 from WPX including the lead independent director. Dave Hager will be appointed executive chairman of the board, and Rick Muncrief will be named president and CEO. The combined company's executive team will include Jeff Ritenour as executive vice president and chief financial officer, Clay Gaspar as executive vice president and chief operating officer, David Harris as executive vice president and chief corporate development officer, Dennis Cameron as executive vice president and general counsel, and Tana Cashion as senior vice president of human resources. The combined company will be headquartered in Oklahoma City.

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Apr-03-2023 | Grayson Mill Adds More Bakken, Acquires Ovintiv's Assets For $825 Million | -  |

-  |

| Sep-06-2022 | Sitio Royalties, Brigham to Merge in All-Stock Deal Worth $4.8 Billion | -  |

-  |

| Jun-08-2022 | Devon Acquires Williston Assets from PE-Backed E&P in $865 Million Cash Deal | -  |

-  |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Dec-16-2019 |

-  |

-  |

Click here | Texas | E&P |

| May-05-2019 |

-  |

-  |

Click here | Texas | E&P |

| Feb-04-2019 |

-  |

-  |

Click here | Texas | E&P |

| Feb-05-2018 |

-  |

-  |

Click here | Colorado | E&P |

| Dec-08-2017 |

-  |

-  |

Click here | Colorado | E&P |

Other Devon Energy Corp Deals

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Aug-09-2022 |

-  |

-  |

Click here | Texas | E&P |

| Jun-08-2022 |

-  |

-  |

Click here | North Dakota | E&P |

| Dec-29-2020 |

-  |

-  |

Click here | Wyoming | E&P |

| Dec-18-2019 |

-  |

-  |

Click here | Texas | E&P |

| Dec-10-2019 |

-  |

-  |

Click here | Oklahoma | E&P |