KKR-backed Venado Bolts-On Eagle Ford Property from Texas American

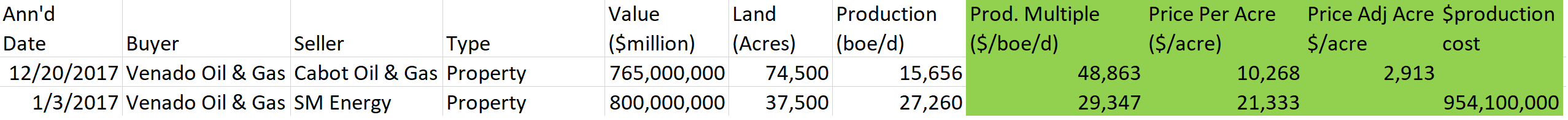

Multiples

Transaction Details:

KKR backed-Venado Oil and Gas is at it again. The company is acquiring Eagle ford Shale assets from Texas American Resources I, LLC a portfolio company of First Reserve.

This deal closed on July 3, 2018.

The financial terms of the deal were not disclosed, however Shale Experts estimate the deal was around $250 - $290 million based on current trend on a price per acre basis.

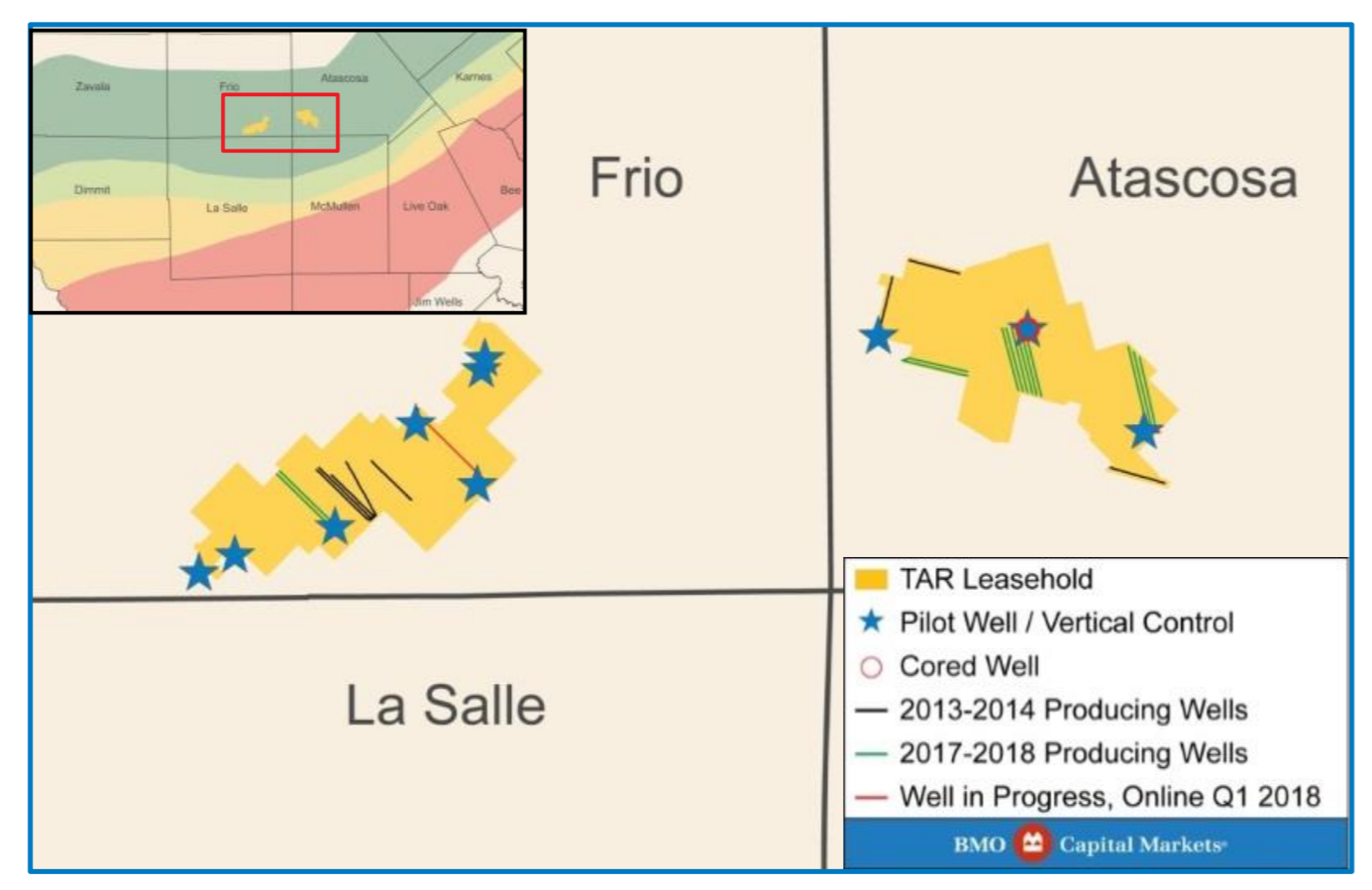

Asset Details. (according to BMO marketing materials)

Locations : 171 gross operated Lower Eagle Ford drilling locations at 500’ lateral spacing providing ample running room for years of

development

Acreage : Contiguous 23,164 net acre position in the prolific black oil window located in southwest Atascosa and southeast Frio counties,

Texas ideal for future development

Production : April 2018E net production of ~4,800 boe/d (83% oil) from 22 operated wells

Counties : Atascosa and Frio, TX

As of the closing date, the Venado and KKR partnership manages an asset position comprising approximately 136,000 net acres producing approximately 43,000 barrels of oil equivalent per day from the Eagle Ford trend of South Texas.

BMO Capital Markets Corp. acted as financial advisor to Texas American in this transaction.

This deal will mark the forth acquisition for Venado Oil and Gas in the Eagle Ford play. The company has spent some $1.5 billion (not including the current deal).

January of 2017 it acquired 37,500 net acres (non-op) from SM Energy for $800 million.

December 20, 2017, it also aquired 74,500 net acres from Cabot for $765 million

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Nov-03-2022 |

-  |

-  |

Click here | Texas | E&P |

| Jul-09-2021 |

-  |

-  |

Click here | Texas | E&P |

| Nov-03-2020 |

-  |

-  |

Click here | Texas | E&P |

| Aug-18-2020 |

-  |

-  |

Click here | Texas | E&P |

| Jul-20-2020 |

-  |

-  |

Click here | Colorado | E&P |

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Aug-14-2023 | Silverbow Increase Eagleford Footprint , Chesapeake Exits | -  |

-  |

| May-03-2023 | Crescent Energy Acquires Eagle ford Assets For $600 Million | -  |

-  |

| Feb-28-2023 | Baytex Acquires Pure Play Eagle Ford Operaor Ranger Oil | -  |

-  |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Dec-19-2016 |

-  |

-  |

Click here | Texas | E&P |

| Aug-13-2014 |

-  |

-  |

Click here | Texas | E&P |

| Jul-12-2011 |

-  |

-  |

Click here | Colorado | E&P |

Other Venado Oil & Gas Llc Deals

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Dec-20-2017 |

-  |

-  |

Click here | Texas | E&P |

| Jan-03-2017 |

-  |

-  |

Click here | Texas | E&P |

| Feb-04-2013 |

-  |

-  |

Click here | Texas | E&P |