Pipestone Ups 2021 Budget by $10MM; Details Full Year 2020 Results

Pipestone Energy Corp. reported its Q4 and full year 2020 financial and operational results, as well as provide an update to its development program and corporate guidance for 2021 and its three-year outlook.

2021 Plans

- Capex: $155-165 million - up 54% vs. 2020 spending of $104MM

- D&C: $140-149 million

- Other: $16-17 million

- Production: 24-26 MBOEPD - up 60% from 2020 output of 15.6 MBOEPD

- Wells Drilled: 25 gross wells

- Wells Completed: 21 gross wells

- Wells TIL: 27 gross wells

The budget has been increased from $145 – $155 million guidance previously. The increased capital reflects additional wells drilled in the second half of 2021, increased average lateral length and additional 3.5 T/M high intensity completion tests based on the performance of previous high intensity well results observed thus far.

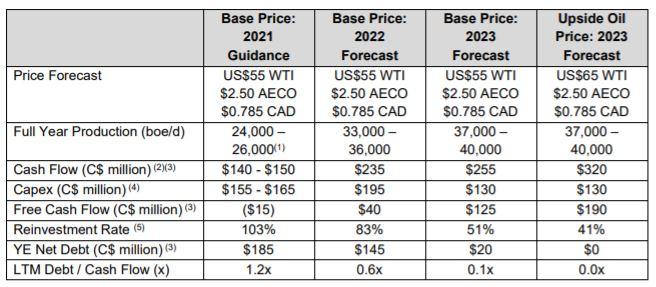

Three Year Development Plan

Pipestone Energy has modified its three-year development plan to reflect the improvements in WTI futures prices and a stronger medium-term fundamental outlook for crude oil. Capital spending in 2021 and 2022 has been increased moderately with a commensurate decrease in expected 2023 capital expenditures, resulting in virtually the same total spending over the 3-year period. This shift in capital allows Pipestone to reach its infrastructure and processing capacity by early 2023, improving free cash flow generation and providing the Company with flexibility to evaluate options to deliver shareholder value. At US$55 WTI, Pipestone forecasts free cash flow of $40 million in 2022 and $125 million in 2023 (5%/17% free cash flow yield(1)), which would increase to $75 million in 2022 and $190 million in 2023 (10%/26% free cash flow yield(1)) at US$65 WTI.

Q4/Full Year 2020 Results

Paul Wanklyn, President and CEO, said: "I am very excited to provide our fourth quarter and full year 2020 results, as well as revised 2021 guidance and an updated three-year business plan. Due to the improvement in forecast oil and condensate prices, we have shifted the fully-financed three-year capital spending profile forward, accelerating the timeframe to reaching our production target of ~40,000 boe/d and material free cashflow generation. At our base price forecast of US$55 WTI, free cash flow of $40 million is expected in 2022, increasing to $125 million of free cash flow in 2023. At US$65 WTI, in line with current oil prices, this would increase to approximately $190 million of free cash flow in 2023. Pipestone expects to be well positioned to accelerate shareholder value through initiatives including, but not limited to, accelerated de-leveraging, share buybacks or paying a dividend.”

Q4 2020 Corporate Highlights:

- Pipestone Energy achieved record production results in Q4 2020 and on a full year basis in 2020. Production averaged 15,570 boe/d (comprised of 30% condensate and 43% total liquids) for the year ended December 31, 2020. In Q4 2020, production averaged 17,734 boe/d (comprised of 31% condensate and 44% total liquids). Production has continued to ramp-up into calendar 2021 with January and February averaging approximately 20,500 boe/d (comprised of 33% condensate and 46% total liquids);

- As a result of improved commodity pricing from the third quarter of 2020, the Company generated revenue and adjusted funds flow from operations of $45.9 million and $11.1 million, respectively, during the three months ended December 31, 2020;

- The Company executed the remainder of its 2020 capital program, including all planned projects except for the drilling of 1.0 well (gross & net) that was deferred into Q1 2021. Pipestone Energy continued to deliver improved capital efficiencies and enhance value through the drillbit as it deployed a total of $43.7 million of capital in the fourth quarter of 2020;

- In 2020, as previously reported, Pipestone Energy delivered 71% growth in Proved Developed Producing reserves with a strong recycle ratio of 2.0 times. This was achieved during a very challenging year for industry cashflows and capital spending with WTI averaging approximately US$39 per barrel and condensate differentials experiencing significant volatility. The Company also increased Proved plus Probable reserve volumes by 24% to 228 MMboe, while the associated Future Development Costs decreased 16% to $936 million; and

- On December 16, 2020, Pipestone Energy completed its up listing and began trading on the TSX. The Company’s graduation to the TSX marks an important milestone in the continued growth and evolution of the business.

Ops Update

Production & Facilities:

During Q4 2020, production averaged 17,734 boe/d (31% condensate, 44% total liquids), a quarterly record for Pipestone Energy. During January and February 2021, production continued to ramp up and averaged approximately 20,500 boe/d (comprised of 33% condensate and 46% total liquids) for the two months, based on field estimates, as the six-well 3-12 pad was gradually brought on production in January 2021 followed by the three well 8-15 pad brought on in late February 2021. Early performance results on both new pads are at or above type curve expectations. March 2021 month to date production is estimated at >23,000 boe/d.

Pipestone has commenced procurement and construction of the gathering pipeline and associated facilities that will connect the 6-30 pad to the Veresen Midstream battery and compressor station. Currently, operations are on track to meet the expected start-up timing of Q4 2021.

Drilling & Completions:In mid-January 2021, the Company commenced its 2021 drilling campaign by drilling 3 wells on the 6-13 pad-site, which finished in February 2021. The three wells on the 6-13 pad were drilled for an average cost of $2.0 million per well with an average lateral length of 2,633 metres. Completion operations for the 6-13 pad are scheduled for March 2021 with on-stream timing during Q2 2021.

Subsequently, Pipestone has begun drilling 6 wells on the 15-25 pad with scheduled on-stream timing forecast for Q3 2021.

ESG Update

Pipestone Energy believes that the responsible development of its Montney asset and the surrounding environment will be critical to its long-term success and the ability to generate sustainable returns for shareholders. The Liability Management Rating (“LMR”) is a measure designed by the Alberta Energy Regulator to help assess a company’s ability to address their abandonment and reclamation obligations. The LMR ratio is calculated by dividing a company’s deemed assets (i.e. production) by its deemed liabilities (i.e. abandonment and reclamation costs). Pipestone Energy has differentiated itself as an industry leader with an exceptionally strong LMR of 41.1 at December 31, 2020 as illustrated below:

Pipestone Energy continues to advance its ESG initiatives on all fronts, including the reduction of greenhouse gas emissions, and plans on releasing its inaugural ESG report in the second quarter of 2021.

1.jpg)