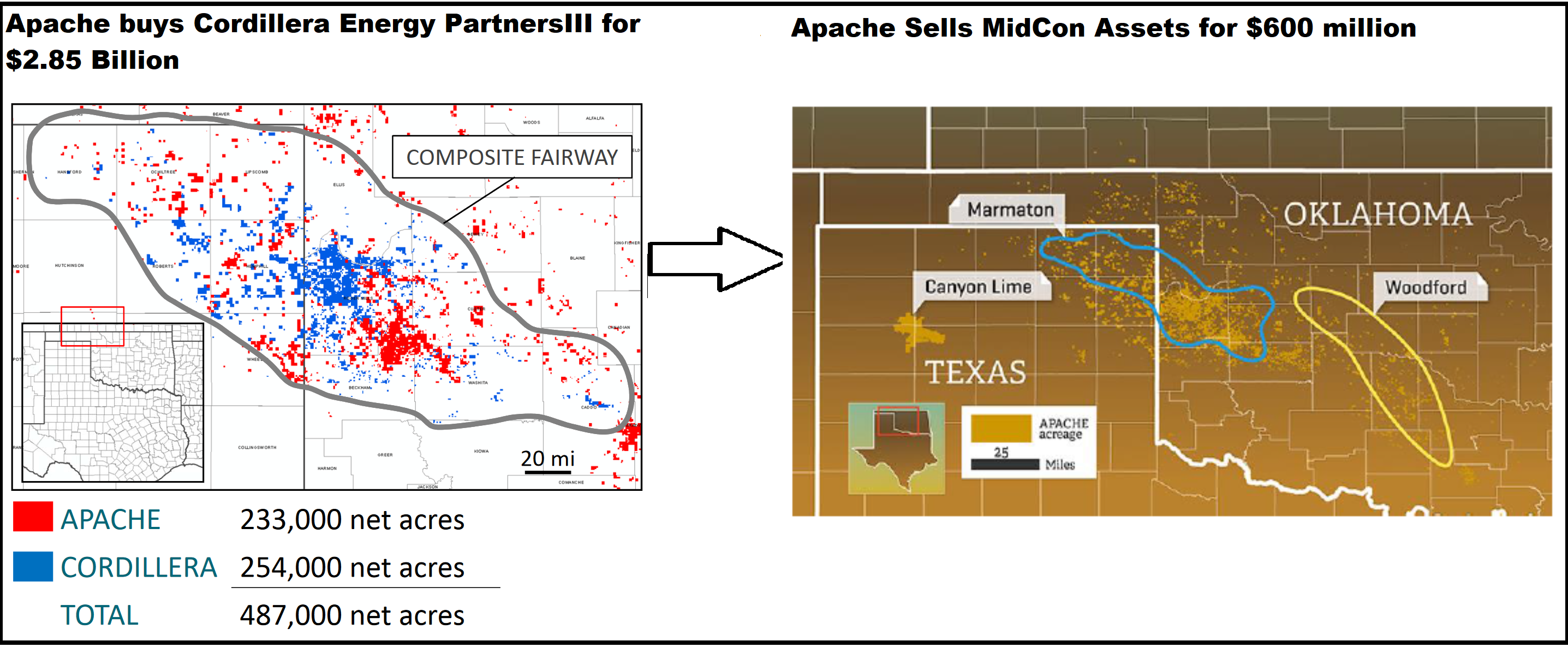

Apache Exits MidCon Region, Sells Western Anadarko/SCOOP

Monday,July 22,2019

Apache Corp. has announced the completion of asset sales in the US midcontinent which will see Apache exiting the region.

In May and July, Apache closed the sale of noncore assets in two separate transactions, comprising US$612 million of net proceeds, subject to customary closing adjustments. A portion of the proceeds from these asset sales was used to retire US$150 million of bonds that matured in early July.

The asset sales reflect the company’s exit from the Western Anadarko Basin and the previously announced exit from the SCOOP/STACK play. Production from the divested assets averaged 33 000 bpd in 1Q19, approximately 90% of which consisted of natural gas and NGLs.

Before we forget, lets remember that Apache acquired the assets for $2.85 billion through Cordillera Energy II. The destruction of capital cannot be underestimated.