Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown

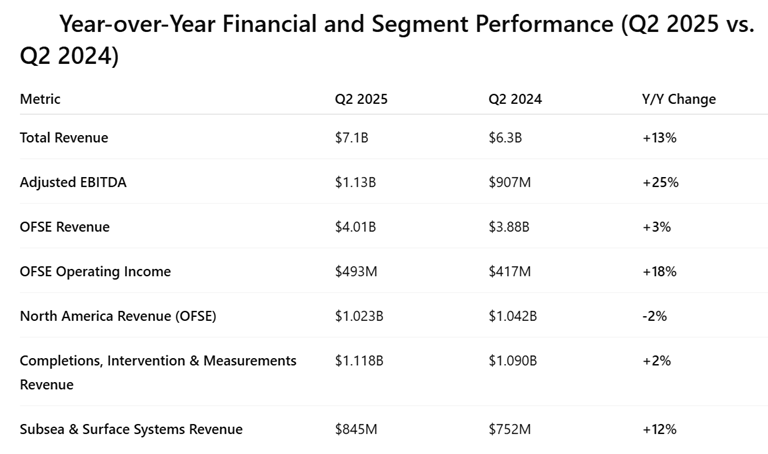

Baker Hughes reported a strong second quarter for 2025, with total company revenue rising to $7.1 billion, a 13% increase over the $6.3 billion reported in Q2 2024. Adjusted EBITDA climbed to $1.13 billion, up 25% year-over-year, reflecting broad-based momentum across several international and offshore businesses.

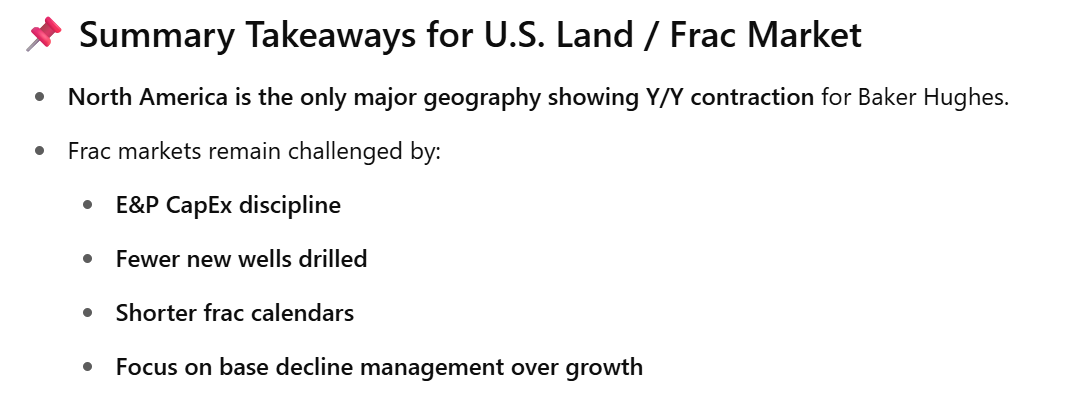

However, the U.S. land and frac market painted a more subdued picture.

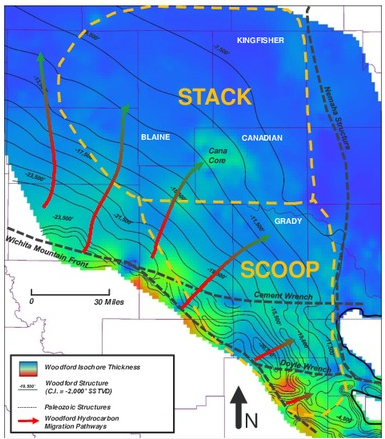

U.S. Land and Frac Market Commentary

-

North America OFSE revenue declined 2% Y/Y, a stark contrast to growth in international regions (Europe/CIS/SSA +23%, ME/Asia +2%).

-

Completions and Intervention business grew just 2% Y/Y, indicating flat or weakening demand for frac-related services.

-

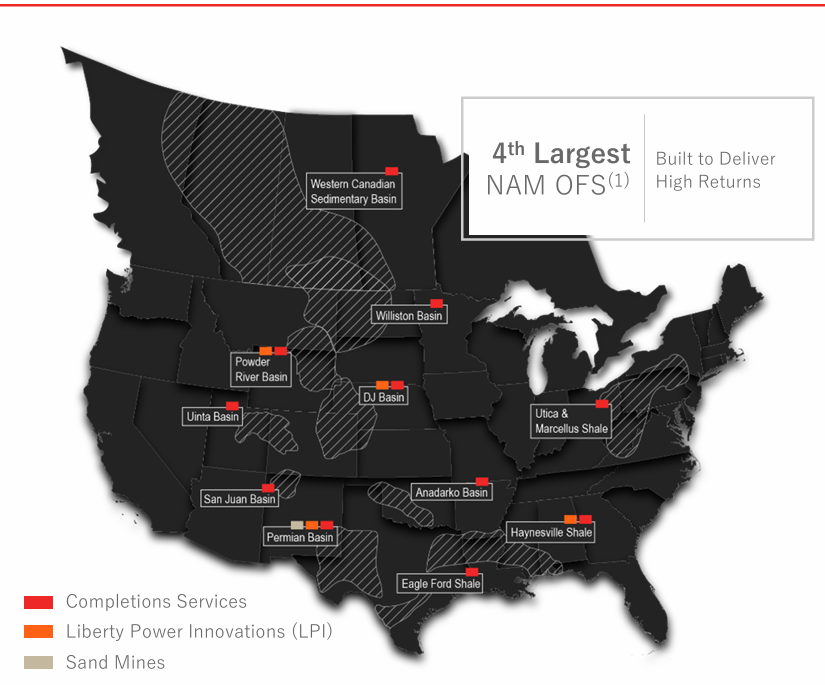

Operators are scaling back frac intensity and rig counts in U.S. land, contributing to growing white space in service calendars, as echoed by both Halliburton and Schlumberger.

-

Pricing discipline remains under pressure in U.S. land as E&Ps prioritize capital returns over volume growth.

While the Oilfield Services & Equipment (OFSE) segment saw 3% revenue growth year-over-year—reaching $4.01 billion in Q2 2025 versus $3.88 billion in Q2 2024—this growth was concentrated outside North America. Specifically, North America OFSE revenue declined by 2%, slipping from $1.042 billion to $1.023 billion over the same period.

Drilling deeper, the Completions, Intervention & Measurements business, which includes fracturing and related well services, grew modestly—up just 2% year-over-year—from $1.09 billion to $1.118 billion. This limited growth contrasts sharply with the 12% year-over-year increase in the Subsea & Surface Systems segment and the 23% growth in revenue across Europe/CIS/SSA.

The results suggest that the North American frac and completions market remains mired in softness, even as global demand for drilling and production technology accelerates. While specific rig counts or lateral length trends were not disclosed in the documents, the flat-to-negative revenue performance in U.S. land signals reduced activity levels and pricing pressure.

The contrast is underscored by strong international demand, where the Middle East/Asia and offshore markets contributed significantly to Baker Hughes' Q2 growth. Additionally, the company noted record backlog levels in its Industrial & Energy Technology segment, a signal of long-cycle project momentum outside North America.

With international markets absorbing more investment and providing higher-margin opportunities, Baker Hughes appears increasingly aligned with operators prioritizing production efficiency and long-term offshore developments. Meanwhile, the U.S. frac market, once the engine of growth, is now a modest and flattening contributor amid cautious capital deployment by domestic E&Ps.