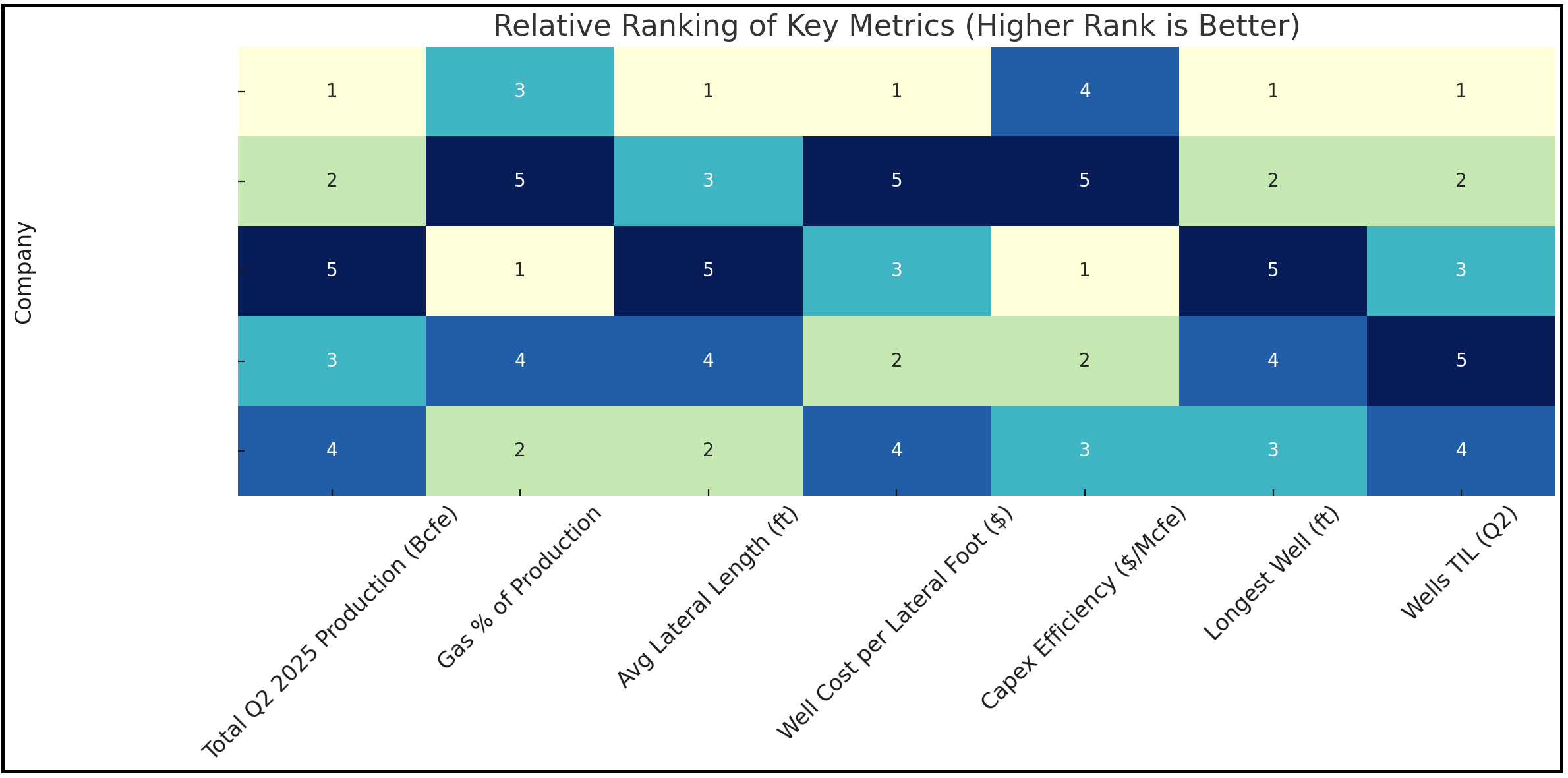

Comstock Resources To Increase Haynesville Drilling Activity in 2025

As part of it's Q4 results. Comstock provided us with it's 2025 forecast.

2025 Outlook

-

Increased Rig Activity:

-

Raising rig count from 5 to 7, focusing on Western Haynesville

-

-

Planned Capex:

-

$1.0B–$1.1B for development/exploration

-

$130M–$150M on midstream investments (funded via partnership)

-

-

Target: 46 operated wells drilled & turned to sales

Full-Year 2024 Financials

-

Production: 527.8 Bcfe (flat YoY)

-

Total Sales (incl. hedging): $1.26B

-

Operating Cash Flow: $675.2M

-

Net Loss: ($218.8M) or ($0.76/share)

-

Adjusted Net Loss (non-GAAP): ($69M) or ($0.24/share)

Production & Operations

-

Cost Efficiency:

-

Production costs down to $0.72/Mcfe in Q4 (vs. $0.81 in Q4 2023)

-

Unhedged Operating Margin: 69% in Q4, 61% for the year

-

-

Well Performance:

-

48 operated wells turned to sales in 2024

-

Western Haynesville wells had IP rates of ~40 MMcf/day

-