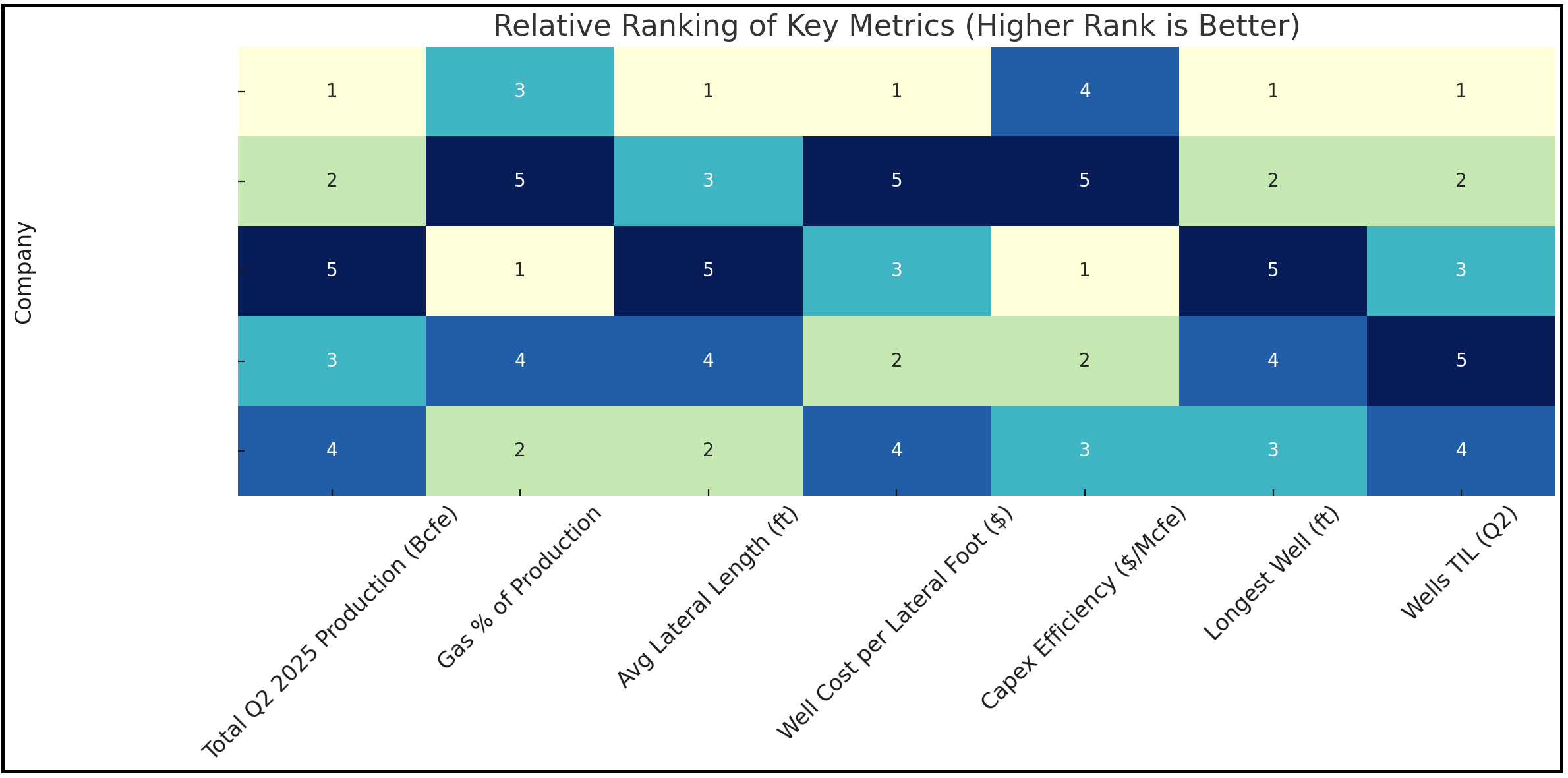

Comstock Rides Higher Gas Prices, Operational Momentum in Q2 2025

Comstock Resources delivered a resilient second quarter, capitalizing on higher natural gas prices and solid well results across the Haynesville and Bossier plays. The company reported strong production metrics, disciplined cost control, and strategic midstream initiatives that position it for long-term growth.

Financial Highlights: Margin Expansion Despite Production Decline

Comstock generated $344 million in total natural gas and oil sales for the quarter, bolstered by realized gas prices of $3.06/Mcf (with hedging). Though production declined year-over-year, the company delivered:

Source : (Comstock, Shale Experts Company Database)

Operations Update: Western Haynesville Leads

Comstock drilled 12 operated horizontal wells in the Haynesville/Bossier during Q2, with average lateral lengths of 10,388 feet. The company turned 13 operated wells to sales, including several high-rate wells in the Western Haynesville:

-

Bell Meyer #1: 41 MMcf/d IP, 9,100’ lateral

-

Menn PB #1: 38 MMcf/d IP, 10,926’ lateral

-

Jennings Loehr #1: 34 MMcf/d IP, 12,106’ lateral

-

Jennings FSRA #1: 28 MMcf/d IP, 12,045’ lateral

Across all 21 new Legacy Haynesville wells brought online in 2025 so far, the average IP rate stands at 25 MMcf/d with laterals averaging 11,803 feet — reinforcing Comstock’s reputation for scale and cost efficiency.

Midstream Moves: Powering Data Centers with NextEra

In a forward-looking strategic development, Comstock is collaborating with NextEra Energy Resources to explore power generation projects near its Western Haynesville acreage. These initiatives aim to serve rising energy demand from data centers and digital infrastructure.

The company emphasized its competitive advantage in supplying low-cost, abundant gas to emerging energy hubs, hinting at a potential long-term shift from upstream-only to integrated energy delivery.