Diamondback's Drilling Up 41% YOY; Focuses on Cutting Costs Post-Merger

Diamondback Energy, Inc. reported its Q1 2019 results. Here are the highlights from its report and presentation.

Q1 Summary

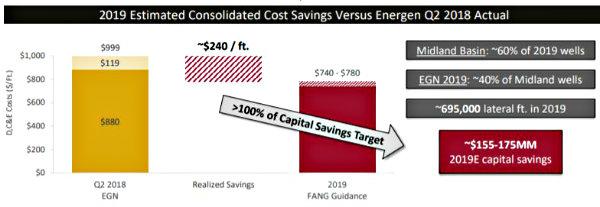

- Q1 D&C Spend: Diamondback spent $533 million during Q1 - this is down -31% from the $769 million that Diamondback and Energen spent on D&C in Q1 2018

- Q1 Production: 262.6 MBOEPD - up +34% YOY from the combined 195.5 MBOEPD produced by Diamondback and Energen in Q1 2018

- Drilling Activity - Majority in Wolfcamp A: Turned 82 wells to production - this is up +41% from the combined 58 wells from Diamondback and Energen in Q1 2018

- The average lateral length for the wells completed during the first quarter was 9,630 feet

- Wells included 39 Wolfcamp A wells, 23 Lower Spraberry wells, 12 Wolfcamp B wells, four Third Bone Springs wells, two Second Bone Springs wells and two Middle Spraberry wells.

- Rigs: Currently running 30 drilling rigs - down -25% from 40 (combined) in Q1 2018 - to be expected given the merger

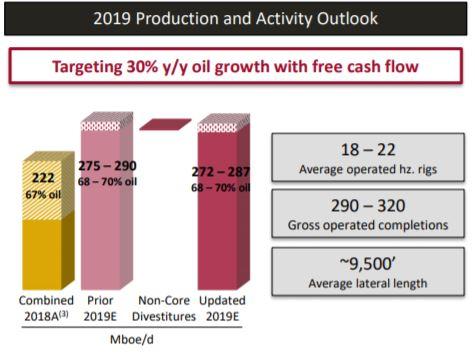

- Updated 2019 Production Guidance: Updated to 272.0 - 287.0 Mboe/d (68% - 70% oil) after giving effect to the divested production from the non-core asset sales closing by July 1, 2019

Focuses on Cost Savings

Recent Well Results

In the Southern Delaware Basin, as part of its joint venture with Carlyle, Diamondback recently began operated development on its San Pedro Ranch acreage in the Southeast portion of its Pecos County acreage position. The Company recently completed two Wolfcamp A wells with an average lateral length of 7,611 feet. These wells commenced production with an average IP30 of 197 boe/d per 1,000 feet (79% oil).

Also in Pecos County, Diamondback continues to have strong performance from operated completions targeting the Second Bone Spring. Most recently, the Company completed the Page Royalty State 31-32 B 2SB well with a 10,207 foot lateral, and a peak IP30 of 182 boe/d per 1,000 feet (91% oil).

In the Northern Delaware Basin, Diamondback recently completed a two-well pad targeting the Wolfcamp A and the Wolfcamp B with an average lateral length of 9,752 feet. The Wolfcamp A well, the Deguello 54-7-2 A 601H, had a peak IP30 of 298 boe/d per 1,000 feet (69% oil) with the Wolfcamp B well producing 149 boe/d per 1,000 feet (67% oil) over the same period.