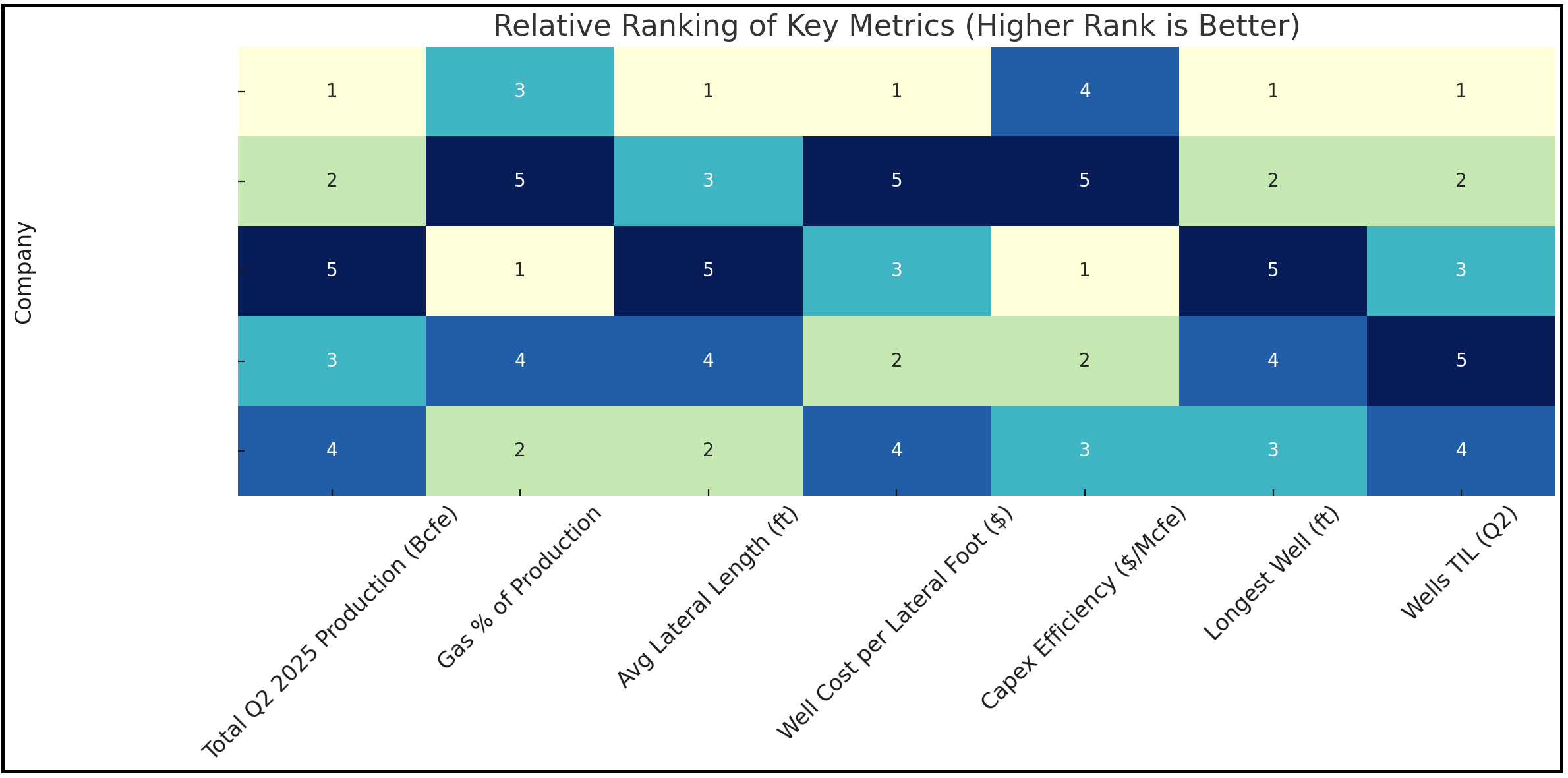

Gulfport Touts Super Long Lateral and Strategic Pivot To Gas Asset

Record-Setting Efficiency and Lateral Lengths Define the Quarter

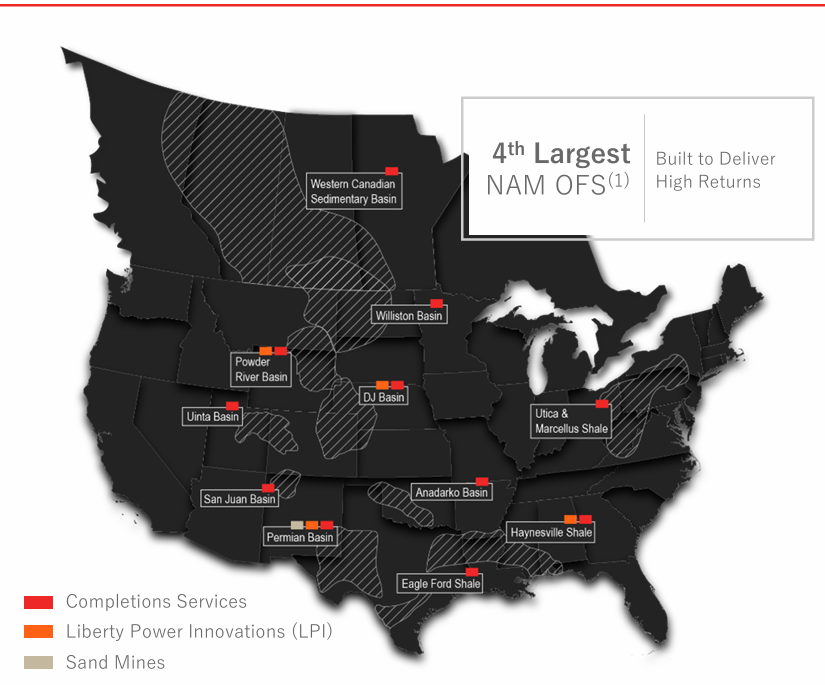

In the core Utica and Marcellus plays, Gulfport pushed the technical frontier:

-

15,000 feet: The average lateral length on wells turned to sales in Q1 — among the longest in Appalachia.

-

105.5 hours: A company record for continuous pumping on a single pad, achieved in April, underscoring its completions team's operational consistency and logistics execution.

-

+28%: Drilling speed increased nearly a third over 2024’s average, allowing faster capital deployment with fewer rig days.

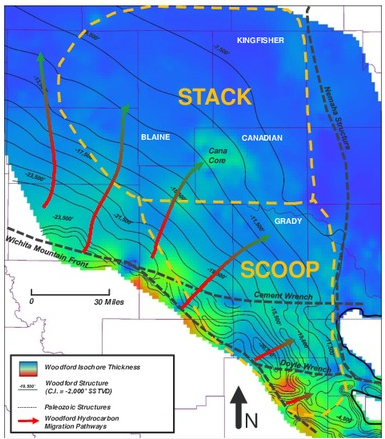

This operational excellence wasn’t confined to one region — it spanned Gulfport's footprint. While SCOOP activity remained measured, it still contributed completions with laterals of 11,500 feet, showing continued technical proficiency.

Financial Discipline Meets Strong Gas Realizations

Despite a front-loaded capital program in Q1, Gulfport delivered $36.6 million in adjusted free cash flow and reaffirmed its full-year 2025 guidance, even while repurchasing $60 million in stock at an average price of $176.13.

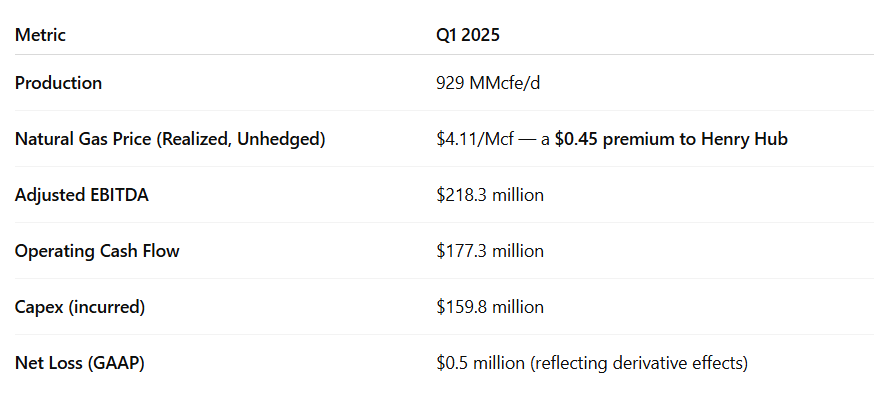

Key financial results

Standout: Gulfport’s realized natural gas price of $4.11/Mcf — achieved through premium basin exposure and takeaway strategy — stands out in a sector still grappling with regional basis pressure. This pricing power translated to robust EBITDA margins.

Strategic Shift: Betting on Dry Gas

A key decision in Q1 was Gulfport’s plan to reallocate capital toward dry gas Utica development in late 2025. The rationale is simple:

-

Improved 2026 economics: High-return locations positioned to benefit from recovering gas prices.

-

Operational optionality: Gulfport can shift activity rapidly based on market signals — a strategic advantage not all peers possess.

-

Portfolio balance: The move reinforces the core Utica asset base while maintaining optional exposure to the SCOOP.

What Stands Out?

-

Gas Premiums: A $0.45/Mcf uplift to Henry Hub in a congested basin is a rare advantage — showcasing Gulfport’s infrastructure access and marketing strength.

-

14% Growth in Liquids Production YoY: Underscoring increasing balance in the production mix and margin enhancement.

-

15,000 ft Laterals: Among the longest in Appalachia, suggesting longer-term productivity improvements and EUR uplift.

-

Operational Records: Continuous pumping hours, drilling speed, and lateral lengths — all reflect a mature well factory model with room for scale.