Halliburton Warns of Deepening U.S. Frac Slowdown

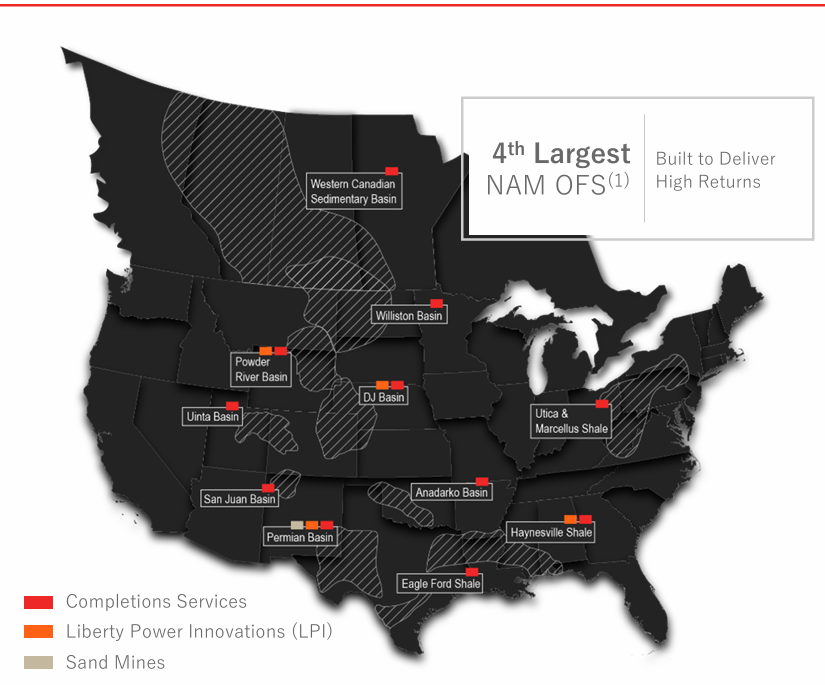

Halliburton's Q2 earnings call confirmed what we said in our recent Intel-Bits report: the back half of 2025 is shaping up to be significantly weaker than expected, particularly in North America. CEO Jeff Miller pulled no punches in describing a market that looks “very different today than it did only 90 days ago,” citing unexpected schedule gaps from even large operators, worsening pricing conditions, and growing uneconomic pressure in both frac and drilling operations.

Below is a breakdown of the key themes from the call, including market commentary, operational trends, tough analyst questions, and what Halliburton’s guidance implies for the remainder of the year.

North America: White Space Widens in Frac Calendars

Halliburton’s North America revenue was flat sequentially at $2.3B, but underlying signals were concerning. Seasonal strength in Q2 masked deeper issues in U.S. land:

-

Frac activity is expected to decline materially in H2, with Halliburton forecasting more "white space" on its frac calendars.

-

Service pricing erosion continues, especially in pressure pumping. Margins in the Completion & Production (C&P) segment were down to 16% from Q1, and further margin compression is forecasted in Q3 (down 150–200 bps).

-

Frac fleet stacking is underway. Miller was explicit: “We will not work equipment where it does not earn economic returns.” Lower-performing fleets are being retired or reallocated.

-

Artificial lift is also under pressure, hit by both lower activity and rising tariffs—especially impacting U.S. land operations.

Drilling Activity: Holding Up Better, but Not Immune

While frac is decelerating, Halliburton’s Drilling & Evaluation (D&E) segment offered a mixed picture:

-

Q2 D&E revenue rose 2% sequentially to $2.3B, but margins declined 11% due to startup and mobilization costs.

-

Automation tools like iCruise and LOGIX drove strong performance in technically demanding environments, including Norway and the Middle East.

-

U.S. rotary steerable drilling saw double-digit growth, even as rig counts dropped.

Yet even here, the forecast is cautious:

-

Halliburton expects Q3 D&E revenue to decline 1%–3%, but margins should recover due to the fading of Q2 mobilization costs and stronger software sales.

-

Q4 is likely to see flattish revenue at best, with C&P margins still soft and D&E buoyed only by software seasonality.

International: A Tale of Two Halves

International revenue climbed 2% sequentially to $3.3B, led by strength in Latin America (up 9%) and Europe/Africa (up 6%). However:

-

Middle East/Asia revenue fell 4%, due to activity reductions in Saudi Arabia and Kuwait.

-

Halliburton now expects full-year international revenue to decline mid-single digits YoY, citing slower spending by major NOCs.

Still, international growth engines are intact:

-

Unconventionals in Argentina, UAE, Australia, and North Africa are seeing robust adoption of long laterals and pad drilling.

-

Halliburton highlighted record fiber-optic fracture monitoring in Argentina, a 67-stage stimulation in Australia, and expansion of coiled tubing in Norway.

-

Artificial lift is booming internationally, with Halliburton securing its largest-ever ESP contract in the Middle East and forecasting 20% lift revenue growth globally in 2025.

Guidance & Forecast: Resetting Expectations

Halliburton is aligning itself with the new market reality:

-

North America revenue forecast: low double-digit decline YoY.

-

International revenue: mid-single-digit decline YoY, largely from Saudi and Mexico.

-

CapEx expected at 6% of revenue, though ZEUS fleet expansion will slow as demand softens.

-

Free cash flow guidance trimmed to $1.8B–$2.0B (down from earlier targets), though $1.6B in shareholder returns is still intact.

-

Completion & Production (C&P) revenue will decline in Q3 and Q4; margins may hover just above 10% by year-end.

-

Drilling & Evaluation (D&E) will likely be the stronger segment in Q4, boosted by software and automation.

Tough Analyst Questions: Key Themes

Q: Is this the bottom? When does recovery begin?

Jeff Miller cautioned that visibility into Q4 and 2026 is limited. He emphasized that U.S. oil activity is below maintenance levels and that production declines will eventually force a rebound—but no timeline was offered.

Q: Will frac pricing drop further?

Analysts from Barclays and Piper Sandler pushed on pricing strategy. Miller insisted Halliburton will not chase uneconomic work: “We are choosing to walk away where needed.”

Q: What about international unconventionals?

Multiple analysts asked about growth in Argentina, UAE, and the Middle East. Halliburton stressed that it’s well positioned with technology and experience, noting rising interest in LSTK and integrated models.

Q: Will cost cuts be enough to protect margins?

Halliburton acknowledged that it’s still early in right-sizing, targeting roughly a 1% structural cost reduction over a few quarters. More cuts may come as H2 unfolds.