Helmerich & Payne Fiscal Q4: Predicts Big Rig Jump at Start of 2021

Helmerich & Payne, Inc. reported its fiscal Q4 2020 results.

Predicts 30% Rig Increase in Early 2021

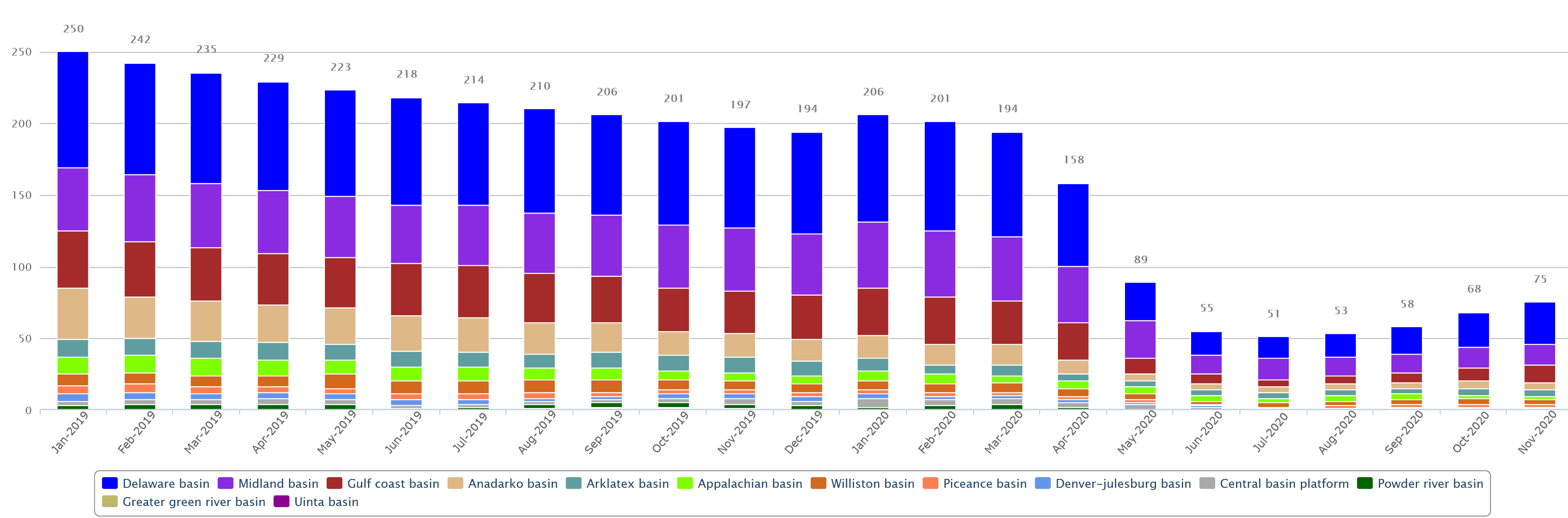

President and CEO John Lindsay commented, “We expect our contracted rigs to increase by one-third during the first fiscal quarter of 2021, exiting at approximately 90 rigs, almost doubling the number of rigs turning to the right compared to our fourth fiscal quarter trough rig count. This is almost double the number of rigs turning to the right compared to the lowest level reached in August. The Permian has led the industry rig count recovery and H&P has earned approximately two-thirds of the incremental work in that basin."

H&P Lower 48 Rig Count by Basin

Outlook:

North America Solutions:

- We expect North America Solutions operating gross margins(2) to be between $40-$50 million, inclusive of approximately $1 million of contract early termination compensation

- We expect to exit the quarter at between 88-93 contracted rigs, inclusive of approximately 0-2 contracted rigs generating revenue that could remain idle

International Solutions:

- We expect International Solutions operating gross margins(2) to be between $(5)-$(7) million, exclusive of any foreign exchange gains or loses

Offshore Gulf of Mexico:

- We expect Offshore Gulf of Mexico rig operating gross margins(2) to be between $5-$7 million

- Management contracts are also expected to generate approximately $1-2 million in operating income

Other Estimates for Fiscal Year 2021

- Gross capital expenditures are expected to be approximately $85 to $105 million; roughly one-third expected for maintenance, roughly one-third expected for skidding to walking conversions and roughly one-third for corporate and information technology. Asset sales include reimbursements for lost and damaged tubulars and sales of other used drilling equipment that offset a portion of the gross capital expenditures and are expected to total approximately $20 million in fiscal year 2021.

- Depreciation is expected to be approximately $430 million

- Research and development expenses for fiscal year 2021 are expected to be roughly $30 million

- General and administrative expenses for fiscal year 2021 are expected to be approximately $160 million

Fiscal Q4 Highlights:

- The Company ended the quarter with $577 million in cash and short-term investments and no amounts drawn on its $750 million revolving credit facility culminating in over $1.3 billion in liquidity

- H&P expects its first quarter of fiscal 2021 North America Solutions rig count to exit at approximately 90 rigs up over 30% during the quarter

- Reported a fiscal fourth quarter net loss of $(0.55) per diluted share; including select items(1) of $0.19 per diluted share

- Quarterly North America Solutions operating gross margins(2) decreased $63 million to $39 million sequentially, as revenues decreased by $105 million to $149 million and expenses decreased by $43 million to $110 million

- H&P's leadership position in automated directional drilling technology continues as AutoSlide® commercial deployments accelerated despite a significantly declining rig market with some notable operators implementing this technology on 100% of their wells in multiple basins

- On September 9, 2020, Directors of the Company declared a quarterly cash dividend of $0.25 per share payable on December 1, 2020 to stockholders of record at the close of business on November 13, 2020

Financial Results

HP reported a net loss of $59 million, or $(0.55) per diluted share, from operating revenues of $208 million for the quarter ended September 30, 2020, compared to a net loss of $46 million, or $(0.43) per diluted share, on revenues of $317 million for the quarter ended June 30, 2020. The net losses per diluted share for the fourth and third quarters of fiscal year 2020 include $0.19 and $(0.09) of after-tax gains and losses, respectively, comprised of select items(1). For the fourth quarter of fiscal year 2020, select items(1) were comprised of:

- $0.20 of after-tax gains pertaining to the sale of industrial real estate property

- $(0.01) of after-tax losses pertaining to a non-cash fair market adjustment to our equity investment and restructuring charges

Net cash provided by operating activities was $93 million for the fourth quarter of fiscal year 2020 compared to $214 million for the third quarter of fiscal year 2020.

For fiscal year 2020, the Company reported a net loss of $494 million, or $(4.60) per diluted share, from operating revenues of $1.8 billion. The net loss per diluted share includes $(3.74) of after-tax losses comprised of select items(1), the most significant of which are non-cash losses of $563 million related to impairments of goodwill, less capable rigs, predominantly consisting of U.S. non-super-spec rigs, and excess related drilling equipment, and inventory and $16 million related to restructuring charges. Net cash provided by operating activities was $539 million in fiscal year 2020 compared to $856 million in fiscal year 2019.

President and CEO John Lindsay commented, “In terms of activity, this past fourth fiscal quarter was one of the most challenging in the Company's history. Our strong financial position together with our long-term vision for the future of the business enabled us to focus on introducing new commercial models and expanding our drilling and digital technology solutions to customers. These efforts are making good progress in this difficult environment and will serve as the foundation from which the Company will build as the market begins to recover.

"Our embedded customer centric approach is one that focuses on providing customized solutions, employing a combination of people, rigs and automation technology to provide more value and lower risk. This approach is distinctive in the industry, resonating well across our customer base, and is a driver for the recent increased activity levels with further improvements on the horizon. We expect our contracted rigs to increase by one-third during the first fiscal quarter of 2021, exiting at approximately 90 rigs, almost doubling the number of rigs turning to the right compared to our fourth fiscal quarter trough rig count.

"Concurrent with the expected increase in near-term activity, we are also experiencing increased customer utilization of our performance-based contracts and rig automation software, AutoSlide, and we expect adoption to increase and become more prevalent in the industry. H&P's 'touch of a button' autonomous drilling approach optimizes every major facet of the operation, from real-time automated geosteering, to rotary and sliding execution, to wellbore quality and placement. The uniqueness of our automated solutions is backed by a patented economic-driven approach where the software not only makes optimal cost/benefit decisions, but also directs the rig to execute those decisions without the need of an on-site directional driller, which improves reliability, enhances value and reduces risk for our customers.

"While we are encouraged by these developments, we are also cognizant that there remains a substantial amount of uncertainty in the market and that it may take several quarters to realize what the 'new normal' activity environment will look like given the uncertain timeline and lasting impacts of the COVID-19 pandemic."

Senior Vice President and CFO Mark Smith also commented, "The Company's financial strength continues to be a bright spot in this very challenging environment. Our strong capital stewardship continues looking out into fiscal 2021 as well with our anticipated capex spend to range between $85 and $105 million.

"Additionally during the fourth fiscal quarter, we completed the sale of the Company's industrial real estate assets. The decision to divest these legacy, non-core assets was considered as we entered 2020, but the close of the sale was delayed by several months due to the COVID-19 pandemic. The proceeds from the sale serve to further bolster our cash position, which together with short-term investments was $577 million at our fiscal year-end, resulting in cash in excess of debt of $90 million."

John Lindsay concluded, “Looking back at an unprecedented and demanding 2020 fiscal year, we remain steadfast in our commitment to reshape our business and the industry during this challenging time. Our teams are doing great work to accelerate long-term strategic priorities, including driving efficiency across the company and evolving our digital technology and data platforms to deliver value-added solutions and services to our customers and partners."

Operating Segment Results

North America Solutions:

This segment had an operating loss of $78 million compared to an operating loss of $25 million during the previous quarter. The increase in the operating loss was driven by the continued decline in rig activity due to significantly lower crude oil prices resulting from a global supply and demand imbalance caused by the pandemic.

Operating gross margins(2) declined by $62.5 million to $39.3 million as both revenues and expenses declined sequentially. Revenues during the current quarter benefited from $11.7 million in early contract termination revenue compared to $50.2 million in the prior quarter. Expenses during the quarter were adversely impacted by higher than expected self-insurance expenses. Our technology solutions were in-line with expectations and had a positive, albeit small, contribution to the total North America Solutions operating gross margins(2).

International Solutions:

This segment had an operating loss of $3.5 million compared to an operating loss of $9.5 million during the previous quarter. Despite a decline in revenue days, operating gross margins(2) improved $4.0 million to a negative $1.2 million due to certain revenue reimbursements received during the quarter. This segment continues to carry a higher level of expenses relative to activity levels resulting from compliance with local jurisdictional requirements surrounding COVID-19. The Company continues to explore opportunities to mitigate these expenses, while maintaining strict adherence to local regulations. Current quarter results included a $2.6 million foreign currency loss related to our South American operations compared to an approximate $3.2 million foreign currency loss in the third quarter of fiscal year 2020.

Offshore Gulf of Mexico:

This segment had operating income of $1.5 million compared to operating income of $3.0 million during the previous quarter. Operating gross margins(2) declined by $3.9 million to $4.6 million due to unfavorable adjustments to self-insurance expenses related to a prior period claim. Segment operating income from management contracts on customer-owned platform rigs contributed approximately $1.1 million of the total, compared to approximately $1.7 million during the prior quarter.

COVID-19 Update

The COVID-19 pandemic continues to have a significant impact around the world and on our Company. After falling dramatically, crude oil prices and industry activity appear to have stabilized, albeit at much lower levels. The environment in which we operate is still uncertain; however, upon the onset of COVID-19's rapid spread across the United States in early March 2020, we responded quickly and took several actions to maintain the health and safety of H&P employees, customers and stakeholders and to preserve our financial strength. We discussed these actions in our press releases dated April 30, 2020 and July 28, 2020 and in our quarterly reports on Form 10-Q for the quarters ended March 31, 2020 and June 30, 2020 and will provide updates in our annual report on Form 10-K for the fiscal year ended September 30, 2020 when filed.

Select Items Included in Net Income per Diluted Share

Fourth quarter of fiscal year 2020 net loss of $(0.55) per diluted share included $0.19 in after-tax gains comprised of the following:

- $0.20 of after-tax gains pertaining to the sale of industrial real estate property

- $(0.00) of after-tax losses related to restructuring charges

- $(0.01) of non-cash after-tax losses related to fair market value adjustments to equity investments

Third quarter of fiscal year 2020 net loss of $(0.43) per diluted share included $(0.09) in after-tax losses comprised of the following:

- $0.02 of non-cash after-tax gains related to fair market value adjustments to equity investments

- $(0.11) of after-tax losses related to restructuring charges

Fiscal year 2020 net loss of $(4.60) per diluted share included $(3.74) in after-tax losses comprised of the following:

- $0.03 of after-tax gains related to the change in fair value of a contingent liability

- $0.10 of after-tax gains related to the sale of a subsidiary

- $0.13 of after-tax benefits from the reversal of accrued compensation

- $0.20 of after-tax gains pertaining to the sale of industrial real estate property

- $(0.06) of non-cash after-tax losses related to fair market value adjustments to equity investments

- $(0.11) of after-tax losses related to restructuring charges

- $(4.03) of non-cash after-tax losses related to the impairment of goodwill, less capable rigs, predominantly consisting of U.S. non-super-spec rigs, and excess related equipment and inventory