SM Energy Hits Record Output; Driven by Uinta

Record Output Driven by Uinta Execution

SM Energy’s total production reached an all-time high of 209,000 barrels of oil equivalent per day, exceeding the midpoint of guidance by 5%. This outperformance was largely driven by the Uinta Basin, where strong well results, improved takeaway logistics, and marketing agility enabled the company to exceed expectations.

Oil production specifically was a standout, reaching 115,700 Bbls/day, or 55% of total volumes, and supported a mix shift toward higher-margin barrels.

Notably, the Uinta Basin is now fully integrated following last year’s acquisition. The company has shifted into an optimization phase, targeting margin enhancement across the value chain, including well design upgrades and logistics improvements.

Rig Count Down, Efficiency Up

While output surged, activity levels moderated—highlighting a deliberate capital discipline:

-

Rig count dropped from 9 in Q1 to 6 in Q2

-

Frac activity in the Uinta shifted from double-barrel to single-barrel operations

Despite this pullback, SM advanced several efficiency-enhancing initiatives, including the redeployment of a centralized remote e-fleet capable of completing 30+ wells through 2026 using 100% recycled water—a clear nod to both sustainability and cost control.

They also launched the “Sand Slinger 3000”, an automated sand conveyor system that lowers cost, eliminates truck traffic, and improves on-site safety—small-scale innovation with real operational upside.

Technology as a Competitive Edge

Technology is emerging as a central theme in SM’s operational strategy. The technical team has developed proprietary machine learning models to optimize well design. Early results are impressive: wells in Howard County are outperforming peer-operated offsets by 30%, confirming the value of data-informed drilling and completion decisions.

Beth McDonald, EVP & COO, emphasized the company’s commitment to innovation, pointing to an upcoming internal geosciences and technical summit titled Next Horizons, where teams will align on new tools, workflows, and bold technical ideas.

Cost Structure & Margins

SM delivered strong cost control:

-

LOE down 7% sequentially due to delayed workovers and production leverage.

-

Transportation costs up 5% per BOE, attributable to greater Uinta contribution.

-

Despite lower realized commodity prices, the Uinta Basin delivered the highest cash margin of all three operating areas—further validating the strategic value of this asset.

DD&A guidance was raised slightly to $16/BOE, reflecting the growing oil contribution.

Looking Ahead: Optionality in 2026 and Beyond

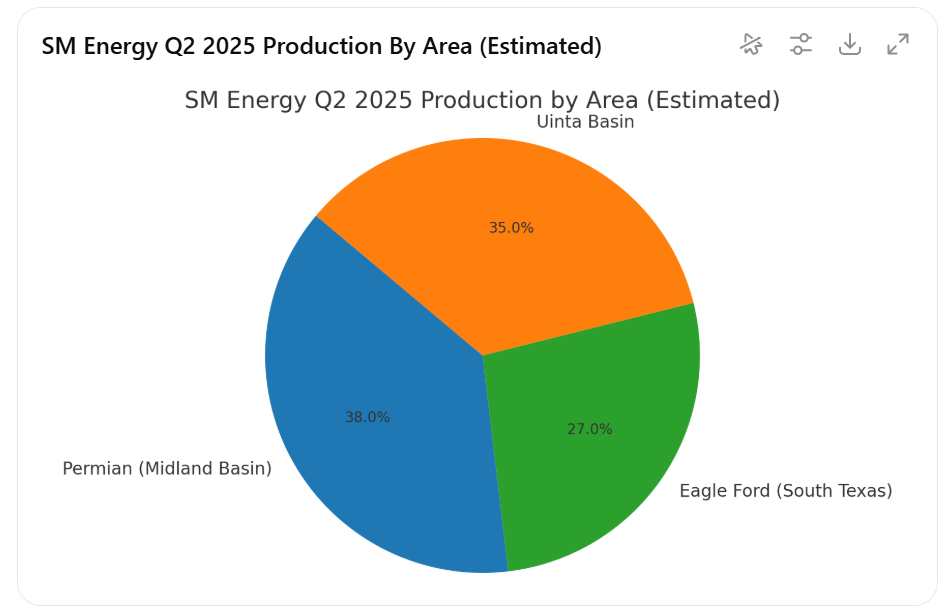

For 2026, SM emphasized flexibility, citing significant optionality across its three core areas (Uinta, Midland, and South Texas). The company will announce a detailed capital plan next year, but clearly views its expanded footprint and deep inventory as levers it can dial up or down depending on the commodity backdrop.

Of note:

-

2025 oil production growth revised up from 30% to ~38%

-

Continued investment in 4-mile laterals and faster drilling cycles (recent Woodford wells in Midland drilled 25% faster than past cycles)

-

Strategic deployment of lease gas for frac operations in South Texas to reduce costs