Schlumberger 4Q, Full Year 2021 Results; North America to Continue Driving Growth

Schlumberger Limited reported results for the fourth-quarter and full-year 2021.

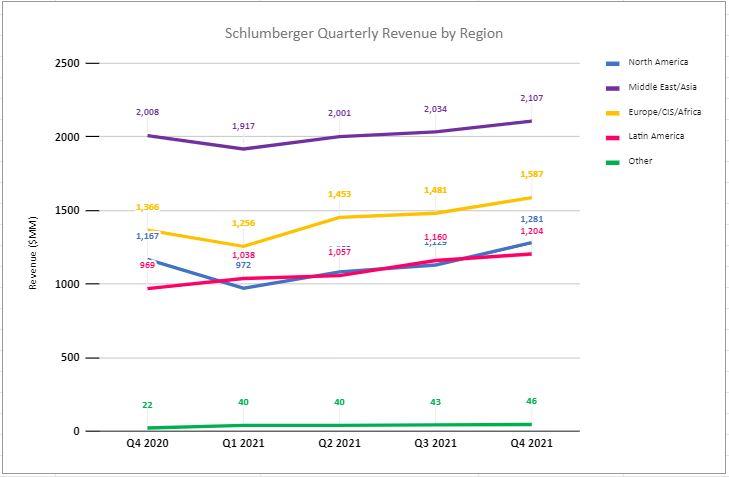

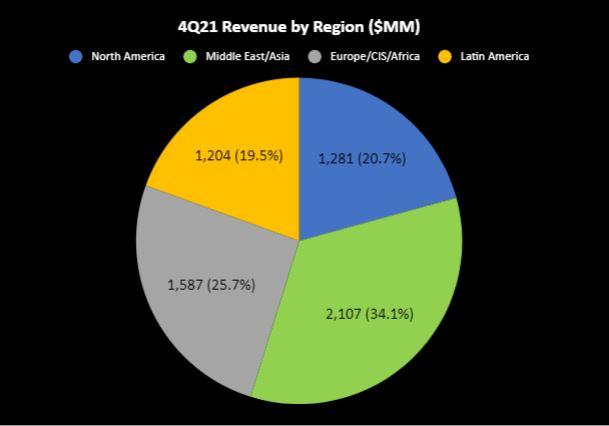

Revenue by region as well as highlights from the conference call regarding North American operations can be found below.

Revenue by Region

Conference Call Highlights - North America Driving Growth

- North America leading the uptick in growth - growing 13% sequentially (while international growth is only at 6%).

- In its conference call, Schlumberger executives said: "Today we are seeing and we are already recording some of pricing improvements in a broad market condition, both in North America and also internationally. North America is leading the uptick of growth. Activity growth in the first half; international further accelerating in the second half. While we did end on the H2 ‑‑ over H2 of 12%. We expect this to be the base in the first half and accelerate further in the second half internationally, so that we are even accelerating into 2023 for international activity. Geographically, sequential growth in North America exceeded rig activity, growing in excess of 20% offshore, and international revenue growth accelerated, closing the second half of 2021, up 12% versus the prior year."

- North America to continue to lead growth into 2022

- "Turning to 2022, more specifically, we expect an increase in capital spending of at least 20% in North America, impacting both the onshore and offshore markets, while internationally, capital spending is projected to increase in the low-to-mid teens, building momentum from a very strong exit in the second half of 2021. All areas and operating environments ‑‑ short- and long-cycle, including deepwater ‑‑ are expected to post strong growth, with upside potential as Omicron disruptions dissipate as the year advances. In this scenario, increased activity and pricing will drive simultaneous double-digit growth ‑‑ both internationally and in North America ‑‑ that will lead our overall 2022 revenue growth to reach mid-teens."

- Q: "Regarding your North American outlook for the 20% increase in spending this year. Can you maybe just sort of break that out in terms of what you might expect for drilling versus completion versus price inflation in general?"

- "Yes. Good question. I think, first, I think the North America outlook we are providing is inclusive of offshore and onshore, and onshore inclusive of U.S. and Canada. So I think it's a mix that is a bit not difficult, but it's a lot of variables at play to decipher here. But to your specific question, we foresee indeed that the U.S. land, which is a big portion of this activity outlook, will be having a bias towards Well Construction as the market is rotating from depleting the DUCs to replenishing the DUCs. Hence, Well Construction rig-based activity will be the lead in a 20% plus. And I think we are set to respond to this with a Well Construction portfolio in that environment, and this will be very favorable to us. And the offshore environment is broad. And I think offshore environment will be execution of Well Construction and also Reservoir Performance. And so, when you put all these and you put a more modest and more moderate Canada environment, you have a mix that is favorable to our Well Construction and production system in U.S. lands and favorable to our Reservoir Performance and Well Construction in offshore environments, all of which combine to give us this ambition about 20%."

Highlights:

- Fourth-quarter revenue of $6.22 billion increased 6% sequentially and 13% year-on-year

- Fourth-quarter GAAP EPS of $0.42 increased 8% sequentially and 56% year-on-year

- Fourth-quarter EPS, excluding charges and credits, of $0.41 increased 14% sequentially and 86% year-on-year

- Fourth-quarter cash flow from operations was $1.93 billion and free cash flow was $1.30 billion

- Board approved quarterly cash dividend of $0.125 per share

- Full-year revenue was $22.9 billion

- Full-year GAAP EPS was $1.32

- Full-year EPS, excluding charges and credits, was $1.28

- Full-year cash flow from operations was $4.65 billion and free cash flow was $3.00 billion

Schlumberger CEO Olivier Le Peuch commented, “Strengthening activity, accelerating digital sales, and outstanding free cash flow performance combined to deliver another quarter of remarkable financial results to close the year with great momentum.

"In retrospect, we started 2021 with a constructive outlook and an ambition to visibly expand margins and deliver robust free cash flow, while remaining focused on capital discipline.

“In fact, we concluded the year with 88% growth in EPS, excluding charges and credits; adjusted EBITDA margin of 21.5%; and $3.0 billion in free cash flow. The adjusted EBITDA margin—which represents a year-on-year expansion of 320 basis points (bps)—is the highest level since 2018. We restored our North America pretax operating margin to double-digits and expanded our international margin, both exceeding prepandemic 2019 levels.

“This was also a momentous year for us in terms of our commitment to sustainability. We announced our comprehensive 2050 net-zero commitment, inclusive of Scope 3 emissions, and launched our Transition Technologies* portfolio.

“I am extremely proud of the full-year results, as we operationalized our returns-focused strategy and surpassed our financial ambitions with resounding success.

“Turning to the fourth-quarter results, sequential revenue growth was broad based across all geographies and Divisions, led by Digital & Integration.

“International revenue of $4.90 billion grew 5% sequentially, driven primarily by strengthening activity, increased digital sales, and early benefits of pricing improvements. The sequential revenue increase was led by growth in Europe/CIS/Africa due to strong offshore activity in Africa and new projects in Europe. This growth was complemented by project startups and activity gains in the Middle East & Asia and sustained activity growth in Latin America. The fourth-quarter international revenue performance represents a 13% year-on-year increase, enabling us to accomplish our double-digit revenue growth ambition for the second half of 2021 when compared to the same period in 2020.

“In North America, revenue of $1.28 billion grew 13% sequentially, outperforming the rig count growth. The sequential growth was driven by strong offshore and land drilling activity and increased exploration data licensing in the US Gulf of Mexico and the Permian.

“Among the Divisions, Digital & Integration revenue increased 10% sequentially, driven by very strong digital sales, as the adoption of our digital offering continues to accelerate, and from increased exploration data licensing sales. Reservoir Performance revenue increased 8% sequentially from higher intervention activity in Latin America, new stimulation projects and activity gains in the Middle East & Asia, and increased offshore evaluation activity in North America. Well Construction revenue increased 5% due to higher land and offshore drilling activity both in North America and internationally. Similarly, Production Systems revenue grew 5% sequentially from new offshore projects and year-end sales.

“Overall, our fourth-quarter pretax segment operating income increased 9% sequentially, attaining the highest quarterly operating margin level since 2015. Contributing to this remarkable performance are the accretive effect of accelerating digital sales and early signs of pricing improvements, particularly when driven by new technology adoption and performance differentiation.

“Looking ahead into 2022, the industry macro fundamentals are very favorable, due to the combination of projected steady demand recovery, an increasingly tight supply market, and supportive oil prices. We believe this will result in a material step up in industry capital spending with simultaneous double-digit growth in international and North American markets. Absent any further COVID-related disruption, oil demand is expected to exceed prepandemic levels before the end of the year and to further strengthen in 2023. These favorable market conditions are strikingly similar to those experienced during the last industry supercycle, suggesting that resurgent global demand-led capital spending will result in an exceptional multiyear growth cycle.

“Schlumberger is well prepared to fully seize this growth ahead of us. We have entered this cycle in a position of strength, having reset our operating leverage, expanded peer-leading margins across multiple quarters, and aligned our technology and business portfolio with the new industry imperatives. Throughout 2021, we continued to strengthen our core portfolio, enhanced our sustainability leadership, successfully advanced our digital journey, and expanded our new energy portfolio.

“The combination of our performance and returns-focused strategy is resulting in enduring customer success and higher earnings. As such, we have increased confidence in reaching our midcycle adjusted EBITDA margin ambition earlier than anticipated and sustaining our financial outperformance. I am truly excited about this year and the outlook for Schlumberger—rooted in capital discipline and superior returns while also continuing to lead technology, digital, and clean energy innovation—to enable performance and sustainability for the global energy industry.”

Other Events

On November 30, 2021, Schlumberger deposited sufficient funds with the trustee for its $1.0 billion of 2.40% Senior Notes due May 2022 to satisfy and discharge all of its legal obligations relating to such notes.

On January 20, 2022, Schlumberger’s Board of Directors approved a quarterly cash dividend of $0.125 per share of outstanding common stock, payable on April 7, 2022 to stockholders of record on February 9, 2022.

Fourth-Quarter Revenue by Geographical Area

|

|

||||||||||

| (Stated in millions) | ||||||||||

| Three Months Ended | Change | |||||||||

| Dec. 31, 2021 | Sept. 30, 2021 | Dec. 31, 2020 | Sequential | Year-on-year | ||||||

| North America* |

$1,281 |

$1,129 |

$1,167 |

13% |

10% |

|||||

| Latin America |

1,204 |

1,160 |

969 |

4% |

24% |

|||||

| Europe/CIS/Africa |

1,587 |

1,482 |

1,366 |

7% |

16% |

|||||

| Middle East & Asia |

2,107 |

2,033 |

2,008 |

4% |

5% |

|||||

| Other |

46 |

43 |

22 |

n/m |

n/m |

|||||

|

$6,225 |

$5,847 |

$5,532 |

6% |

13% |

||||||

|

|

|

|||||||||

| International |

$4,898 |

$4,675 |

$4,343 |

5% |

13% |

|||||

| North America* |

$1,281 |

$1,129 |

$1,167 |

13% |

10% |

|||||

| *Schlumberger divested certain businesses in North America during the fourth quarter of 2020. These businesses generated revenue of $284 million during the fourth quarter of 2020. Excluding the impact of these divestitures, global fourth-quarter 2021 revenue increased 19% year-on-year. North America fourth-quarter 2021 revenue, excluding the impact of these divestitures, increased 45% year-on-year. | ||||||||||

| n/m = not meaningful | ||||||||||

North America

North America revenue of $1.28 billion increased 13% sequentially, driven by strong offshore and land drilling activity and increased exploration data licensing in the US Gulf of Mexico and the Permian.

International

Revenue in Latin America of $1.20 billion increased 4% sequentially due to double-digit revenue growth in Argentina, Brazil, and Mexico, mainly from robust Well Construction activity. Reservoir Performance and Production Systems revenue also increased but was partially offset by a temporary production interruption in our Asset Performance Solutions (APS) projects in Ecuador due to pipeline disruption.

Europe/CIS/Africa revenue of $1.59 billion increased 7% sequentially, due to higher revenue in Europe and Africa driven by strong offshore activity, increased digital sales, and new projects—mainly in Turkey—that benefited Production Systems. These increases, however, were partially offset by reduced Reservoir Performance and Well Construction activity in Russia and Scandinavia due to the onset of seasonal effects.

Revenue in the Middle East & Asia of $2.11 billion increased 4% sequentially due to new projects and activity gains that benefited Reservoir Performance in Saudi Arabia, Oman, Australia, Qatar, Indonesia, and Iraq. Similarly, Well Construction revenue grew from new projects in Iraq and the United Arab Emirates, and from increased drilling activity in Qatar, Kuwait, and Indonesia. Growth was also driven by higher digital sales in China and Malaysia. These increases, however, were partially offset by lower sales of production systems due to delivery delays as a result of logistics constraints.

Fourth-Quarter Results by Division

Digital & Integration

| (Stated in millions) | ||||||||||

| Three Months Ended | Change | |||||||||

| Dec. 31, 2021 | Sept. 30, 2021 | Dec. 31, 2020 | Sequential | Year-on-year | ||||||

| Revenue | ||||||||||

| International |

$624 |

$615 |

$688 |

1% |

-9% |

|||||

| North America |

263 |

196 |

142 |

34% |

85% |

|||||

| Other |

2 |

1 |

2 |

n/m |

n/m |

|||||

|

$889 |

$812 |

$832 |

10% |

7% |

||||||

|

|

|

|||||||||

| Pretax operating income |

$335 |

$284 |

$269 |

18% |

25% |

|||||

| Pretax operating margin |

37.7% |

35.0% |

32.4% |

268 bps |

537 bps |

|||||

| n/m = not meaningful | ||||||||||

Digital & Integration revenue of $889 million increased 10% sequentially, propelled by accelerated digital sales internationally, particularly in Europe/CIS/Africa and Middle East & Asia, and increased exploration data licensing sales in North America offshore and the Permian. These increases, however, were partially offset by the effects of a temporary production interruption in our APS projects in Ecuador due to pipeline disruption.

Digital & Integration pretax operating margin of 38% expanded 268 bps sequentially, due to improved profitability in digital and exploration data licensing.

Reservoir Performance

| (Stated in millions) | ||||||||||

| Three Months Ended | Change | |||||||||

| Dec. 31, 2021 | Sept. 30, 2021 | Dec. 31, 2020 | Sequential | Year-on-year | ||||||

| Revenue* | ||||||||||

| International |

$1,194 |

$1,112 |

$906 |

7% |

32% |

|||||

| North America* |

92 |

79 |

339 |

16% |

-73% |

|||||

| Other |

1 |

1 |

2 |

n/m |

n/m |

|||||

|

$1,287 |

$1,192 |

$1,247 |

8% |

3% |

||||||

|

|

|

|||||||||

| Pretax operating income |

$200 |

$190 |

$95 |

5% |

111% |

|||||

| Pretax operating margin |

15.5% |

16.0% |

7.6% |

-43 bps |

792 bps |

|||||

| *Schlumberger divested its OneStim pressure pumping business in North America during the fourth quarter of 2020. This business generated revenue of $274 million during the fourth quarter of 2020. Excluding the impact of this divestiture, global fourth-quarter 2021 revenue increased 32% year-on-year. North America fourth-quarter 2021 revenue, excluding the impact of this divestiture, increased 42% year-on-year. | ||||||||||

| n/m = not meaningful | ||||||||||

Reservoir Performance revenue of $1.29 billion increased 8% sequentially due to higher intervention activity across the international offshore markets, mainly in the UK and Latin America, and from new stimulation projects and activity gains in the Middle East & Asia, particularly in Saudi Arabia. These increases, however, were partially offset by the onset of seasonal effects in Russia and Scandinavia. North America revenue grew from higher offshore evaluation activity.

Reservoir Performance pretax operating margin of 16% was essentially flat sequentially. Profitability improved from higher offshore and exploration activity but was offset by technology mix and seasonality effects in the Northern Hemisphere.

Well Construction

|

|

(Stated in millions) | |||||||||

| Three Months Ended | Change | |||||||||

| Dec. 31, 2021 | Sept. 30, 2021 | Dec. 31, 2020 | Sequential | Year-on-year | ||||||

| Revenue | ||||||||||

| International |

$1,901 |

$1,839 |

$1,569 |

3% |

21% |

|||||

| North America |

441 |

382 |

252 |

15% |

75% |

|||||

| Other |

46 |

52 |

47 |

n/m |

n/m |

|||||

|

$2,388 |

$2,273 |

$1,868 |

5% |

28% |

||||||

|

|

|

|||||||||

| Pretax operating income |

$368 |

$345 |

$183 |

6% |

101% |

|||||

| Pretax operating margin |

15.4% |

15.2% |

9.8% |

20 bps |

559 bps |

|||||

| n/m = not meaningful | ||||||||||

Well Construction revenue of $2.39 billion increased 5% sequentially, driven by higher measurements and drilling fluids activity and increased drilling equipment sales. North America revenue increased due to higher rig count on land and increased well construction activity in the US Gulf of Mexico. International revenue growth was driven by the double-digit growth in Latin America, mainly in Mexico and Argentina, in Sub-Sahara Africa, and in the Middle East in Kuwait, Qatar, Iraq, and UAE. These increases were partially offset by seasonal effects in Russia and Scandinavia.

Well Construction pretax operating margin of 15% was essentially flat sequentially as the favorable mix of increased activity and new technology was offset by seasonal effects in the Northern Hemisphere.

Production Systems

| (Stated in millions) | ||||||||||

| Three Months Ended | Change | |||||||||

| Dec. 31, 2021 | Sept. 30, 2021 | Dec. 31, 2020 | Sequential | Year-on-year | ||||||

| Revenue* | ||||||||||

| International |

$1,278 |

$1,205 |

$1,215 |

6% |

5% |

|||||

| North America* |

484 |

469 |

433 |

3% |

12% |

|||||

| Other |

3 |

0 |

1 |

n/m |

n/m |

|||||

|

$1,765 |

$1,674 |

$1,649 |

5% |

7% |

||||||

|

|

|

|||||||||

| Pretax operating income |

$159 |

$166 |

$155 |

-4% |

3% |

|||||

| Pretax operating margin |

9.0% |

9.9% |

9.4% |

-85 bps |

-38 bps |

|||||

| *Schlumberger divested its low-flow artificial lift business in North America during the fourth quarter of 2020. This business generated revenue of $11 million during the fourth quarter of 2020. Excluding the impact of this divestiture, global fourth-quarter 2021 revenue increased 8% year-on-year. North America fourth-quarter revenue, excluding the impact of this divestiture, increased 15% year-on-year. | ||||||||||

| n/m = not meaningful | ||||||||||

Production Systems revenue of $1.76 billion increased 5% sequentially. Revenue increases in subsea, well production, and midstream production systems were offset by a revenue decline in surface production systems. International activity was driven by double-digit growth in Europe/CIS/Africa—mainly from strong project progress in Angola, Gabon, and Mozambique, new projects in Turkey, and increased activity in Scandinavia and Russia & Central Asia—and by growth in Latin America, mainly in Brazil and Ecuador. This revenue growth was partially offset by delivery delays in the Middle East & Asia as a result of global supply and logistics constraints.

Production Systems pretax operating margin of 9% declined 85 bps sequentially due to an unfavorable mix and the impact of delayed deliveries due to global supply and logistics constraints.

Quarterly Highlights

As activity growth accelerates, Schlumberger’s performance differentiation, technology, and integration capabilities continue to earn customer recognition and contract awards for all types of oil and gas projects, from short- and long-cycle development to exploration—including offshore and deepwater. Awards from the quarter include:

- Chevron U.S.A. Inc. awarded Schlumberger contracts for integrated well construction and wireline services for deepwater projects in the Gulf of Mexico. Schlumberger was awarded the contracts for integrated services and technology for deepwater wells, in addition to subsea services previously awarded for another high-pressure, high-temperature (HPHT) deepwater Gulf of Mexico project. The integrated contract includes well construction, for which Schlumberger will bring specific technologies suited for HPHT environments as well as digital capabilities that will enhance overall project execution, efficiency, and safety, including the Performance Live* remote operation service.

- TotalEnergies has awarded Schlumberger a three-year contract for the provision of a significant well intervention scope to improve well production and downhole testing services on new wells located offshore the United Kingdom and Denmark. Under the contract, which has options for two single-year extensions, the project team will apply a comprehensive portfolio of downhole testing services, coiled tubing, slickline, and wireline—including the latest technologies. Work is expected to commence in Q1 2022.

- In Saudi Arabia, Schlumberger was awarded a five-year contract for coiled tubing drilling services to be deployed in major gas fields across the Kingdom. The contract, which has a two-year option to extend, includes a full suite of unique underbalanced coiled tubing drilling technologies and other fit-for-basin technology.

- Equinor has made a direct award to Schlumberger for four RapidXtreme* TAML 3 large-bore multilateral junctions to retrofit existing wells to multilaterals in the Statfjord Field. This award is the result of an integrated contract and the unique architecture of the Rapid* multilateral systems—part of the Transition Technologies portfolio. Conversion of existing wellbores to multilaterals will unlock additional reserves and extend the productive life in the Statfjord Field while reducing the carbon impact of production. Installation of these multilateral completion systems is expected to commence in Q2 2022.

- Woodside, as operator for and on behalf of the Scarborough Joint Venture, for the Scarborough project offshore Western Australia, awarded a contract to OneSubsea®—the subsea technologies, production, and processing systems division of Schlumberger—as part of the Subsea Integration Alliance. The contract includes a subsea production systems scope, which OneSubsea will deliver, including wellheads, single-phase flowmeters, subsea distribution units, flying leads, a connection system, subsea production control system for topsides and subsea, and postdelivery services. This project will help the Scarborough Joint Venture maximize the potential of this significant gas resource, which will be developed through new offshore facilities connected to a second liquified natural gas (LNG) train at the existing Pluto LNG onshore facility.

- In Indonesia, Premier Oil—a subsidiary of Harbour Energy—has awarded Schlumberger a three-year contract for services and technology for its deepwater offshore exploration project in the Andaman Sea. The contract scope covers a broad range of services, including drilling, drilling fluids, wireline logging, and well testing. A Schlumberger team drawn from three Divisions will deliver a broad set of services and technologies, including Muzic* wireless telemetry, Quanta Geo* photorealistic reservoir geology service, and the Sonic Scanner* acoustic scanning platform—driving performance and efficiency of exploration operations. Work is expected to commence in the second quarter of 2022.

Schlumberger technologies—which won an array of innovation awards in 2021, including an Offshore Technology Conference Spotlight on New Technology, six World Oil Awards, and two Hart Energy's E&P Meritorious Awards for Engineering Innovation—and peer-leading execution capabilities are making significant performance impacts for customers, who are increasingly adopting technologies that help them create differentiated value.

Examples of performance impact during the quarter in North America include:

- In the Appalachian Basin, CNX implemented NeoSteer* at-bit steerable system paired with Smith Bits, a Schlumberger company, cutting structures and dual-telemetry MWD xBolt G2* accelerated drilling service to drill curves and laterals consistently in single runs in their Marcellus Shale assets. Over the last three months, Schlumberger has drilled the top three longest single curve and laterals in CNX's history, with footages ranging between 21,836 ft and 22,565 ft, and with exceptional safety and service quality performance. These are also the top three longest single curve and lateral operations in Schlumberger US Land history to date. NeoSteer system provided enhanced steerability, overall superior performance, and reduced footprint when compared with conventional technologies, resulting in a reduction in drilling time, and savings in drilling operational costs for these three record wells.

- In the Permian Basin, an ExxonMobil and Schlumberger partnership enabled the reduction of drilling rig days by 34% across five wells, performance that will enable ExxonMobil to drill more wells per year with the same number of rigs. An integrated fit-for-basin technology package, including the PowerDrive Orbit G2* rotary steerable system and XBolt G2 accelerated drilling service—controlled from the ExxonMobil Remote Operations Center in Houston—enabled ExxonMobil to drill its first Delaware Basin well in less than nine days and achieve similar performance with five total record-setting wells. Compared to prior target performance benchmarks, a total reduction of more than 26 drilling days was realized for these five wells.

Examples of performance impact during the quarter internationally include:

- In the fourth quarter of 2021, Schlumberger commenced integrated stimulation operations at Jafurah, the largest unconventional nonassociated gas field in the Kingdom of Saudi Arabia. The combination of cutting-edge technology, fully integrated supply chain, and close project management collaboration between Aramco and Schlumberger resulted in more than 35% improvement in stages per month. This new performance benchmark matches that of top-quartile stimulation fleets in United States unconventional assets during 2021—a key ambition set between Schlumberger and Aramco on the path to deliver the full potential of the Jafurah project.

- In Kuwait, Schlumberger has begun to deploy technology with Kuwait Oil Company (KOC) to increase productivity of its Jurassic gas fields with rigless perforation, made possible by the newest generation of StreamLINE iX* extreme-performance polymer-locked wireline cable. A combination of technologies enabled by StreamLINE iX cable has reduced per-run operating time by half. The increased strength of this generation cable made it possible to run a 70-ft perforation gun in a single run—a first in the history of KOC rigless operations on wireline. The capabilities of the new StreamLINE iX cable have enabled use of technology that has reduced operating time per run and CO2 impact while saving deferred production.

- Offshore Australia in the North West Shelf, Santos Ltd. recently achieved a record production rate from the first Van Gogh Phase 2 infill well, which exceeded expectations and produced at a peak rate of 23,200 bbl/d. The extended-reach, dual-lateral well was drilled with a total horizontal section of 5,430 m—490 m more than originally planned. The PowerDrive Archer* high build rate rotary steerable system and GeoSphere HD* high-definition reservoir mapping-while-drilling service enabled Santos to overcome numerous geological challenges and unlock the full production potential of this asset by executing an optimized well completion design.

- In Argentina, Schlumberger deployed technology that reduced drilling time by 10 days and avoided 120 metric tons of CO2 emissions for a joint venture between YPF S.A. and Chevron in the unconventional Vaca Muerta Formation. Drilling the pilot extended-reach well on the project, Schlumberger used the NeoSteer* at-bit steerable system and new features of the autonomous downhole control system to minimize tortuosity and unplanned deviation, constructing a wellbore optimized to increase production. A PowerDrive vorteX* powered rotary steerable system equipped with DynaPower XP* extreme-power motor elastomer managed the high-temperature conditions, improved the rate of penetration (ROP), and enabled delivering 4,155 m of lateral section breaking the 1,000 m drilled-per-day barrier and it became the longest well lateral drilled in the field.

The adoption of Schlumberger’s comprehensive digital platform continues to accelerate as customers advance their digital transformation and apply digital solutions to improve productivity and efficiency. Furthermore, the use cases for Schlumberger digital solutions also continue to expand into adjacent sectors, increasing the total addressable market and enabling decarbonization in and beyond the oil and gas industry.

Digital awards and implementations from the quarter include:

- Schlumberger will deploy the DELFI* cognitive E&P environment on the Norwegian CO2 project by the Northern Lights Joint Venture (NL), to streamline subsurface workflows and longer-term modeling and surveillance of CO2 sequestration. NL was established to develop the world’s first open-source CO2 transport and storage infrastructure, providing accelerated decarbonization opportunities for European industries, with an ambition to store up to 5 million metric tons of CO2 per year based on market demand. Northern Lights is part of Longship—Norway’s largest climate initiative—which comprises a full-scale carbon capture and storage (CCS) project, covering capture, transport, and storage of CO2.

- Angola’s oil and gas regulator—Agência Nacional do Petróleo, Gás e Biocombustíveis (ANPG)—has signed an agreement with Schlumberger to fast-track its digital transformation, with the rollout of DELFI environment. The project follows a detailed consultation and review by a Schlumberger-led consulting team in collaboration with an ANPG team. The team evaluated ANPG’s technology landscape and digital readiness, resulting in a compressed digitalization roadmap. The accelerated deployment of the DELFI environment will enable efficient remote teamwork across ANPG, expanded data analytics capabilities, and increased exploration and field development efficiency—driving sizeable production gains.

- In Ecuador, DrillOps Automate, part of the DrillOps* on-target well delivery solution, and DrillPilot* equipment sequencing software have been deployed on two Schlumberger rigs operating on its APS assets. These digital solutions are orchestrating multiple workflows and driving a step change in operational performance. Since deployment, more than 77,000 ft have been drilled with multiple levels of automation made possible using these advanced digital solutions. Automated rig control has increased on-bottom ROP and reduced connections time, resulting in a 10.6% average efficiency improvement at the end of 2021. Schlumberger continues to expand the use of digital solutions to improve integrated performance, increase safety, and reduce CO2 footprint—resulting in the creation and capture of higher value across these assets.

Decarbonization is a priority, and in 2021, Schlumberger made a bold commitment to achieve net-zero greenhouse gas emissions by 2050, with our net-zero target inclusive of Scope 3 emissions.

Schlumberger is uniquely positioned to help customers decarbonize oil and gas operations through our Transition Technologies portfolio and the novel application of our technologies in low-carbon energy:

- Equinor recently completed the installation of a OneSubsea subsea multiphase boosting system, a solution that will reduce the cost and carbon impact of producing an additional 16 million barrels of oil from the Vigdis Field in the North Sea. In production for more than 20 years, the Vigdis Field is producing into the existing Snorre A facility, a cost advantage over building new infrastructure. Leveraging an all-electric control system, the multiphase boosting system requires less than 50% of the energy to produce the same volume of oil as compared to gas lift, avoiding 200,000 tons of CO2 equivalent over 10 years of operation at Vigdis and paving the way for future subsea electrification around the world.

- In France, Schlumberger was awarded the downhole completions scope for a proof-of-concept green hydrogen storage pilot project called HyPSTER for Storengy, a company of ENGIE—the first project of its kind. HyPSTER aims to support the development of a green hydrogen ecosystem across France—and later Europe. Schlumberger is a key technical partner in this flagship development of renewable hydrogen underground storage using repurposed natural gas storage salt caverns. Schlumberger will provide equipment, engineering, project management, and develop fit-for-purpose economical solutions to enable future development at scale.

In Schlumberger New Energy, we are forging partnerships to apply a portfolio of low-carbon and carbon-neutral energy technologies across industries, contributing to a more sustainable future energy mix.

- Schlumberger New Energy, the French Alternative Energies and Atomic Energy Commission (CEA), and partners have announced the signature of pilot project agreements with leading steel and cement companies on the pathway to net zero in those industries. In the steel industry, Genvia has agreed pilot projects with ArcelorMittal Méditerranée, a subsidiary of ArcelorMittal, a world leader in the steel industry; and Ugitech—part of Swiss Steel Group, a world leader in long stainless-steel products. In the cement industry, Genvia has agreed pilot projects with Vicat, a cement production group; and Hynamics—a low-carbon and renewable-hydrogen solutions subsidiary of EDF Group. Genvia aims to deliver the highest green-hydrogen creation efficiency, resulting in significantly less electricity use per kilogram of hydrogen produced.

- Celsius Energy, a Schlumberger New Energy venture that provides geoenergy technology for zero-carbon heating and cooling of buildings, has expanded its commercial operations in Europe and North America. In France, a leading healthcare company has selected the Celsius Energy solution in two new developments, and feasibility studies for implementation at additional facilities is ongoing. In the US, Celsius Energy completed its first operation during the fourth quarter of 2021 at a prestigious East Coast university campus, opening new market opportunities for the expansion of Celsius Energy solutions. During COP26, more than 1,000 cities committed to the UN-backed “Cities Race to Zero” campaign, while companies and municipalities globally have advanced net-zero targets and commitments to address global greenhouse gas emissions. Celsius Energy is uniquely positioned to support these commitments, contributing to global decarbonization.