Tengasco, Riley Exploration Permian to Merge in All-Stock Deal

Transaction Details:

Tengasco Inc. has inked a deal to acquire Riley Exploration - Permian, LLC in an all-stock transaction.

Under the terms of the merger agreement, Tengasco will issue approximately 203 million shares of Tengasco common stock to Riley members at the closing of the transaction. Following the closing of the transaction, the current members of Riley will own 95% of Tengasco and the current Tengasco stockholders will own the remaining 5%. In addition, Riley will become a wholly owned subsidiary of Tengasco.

Riley Assets

- Acreage: 44,880 net acres

- Production: Nine months ended June 30, 2020 average daily production of 7,073 Net Boe/d (81% oil, 10% Natural Gas and 9% NGLs)

- Proved Reserves: 54,803 MBOE

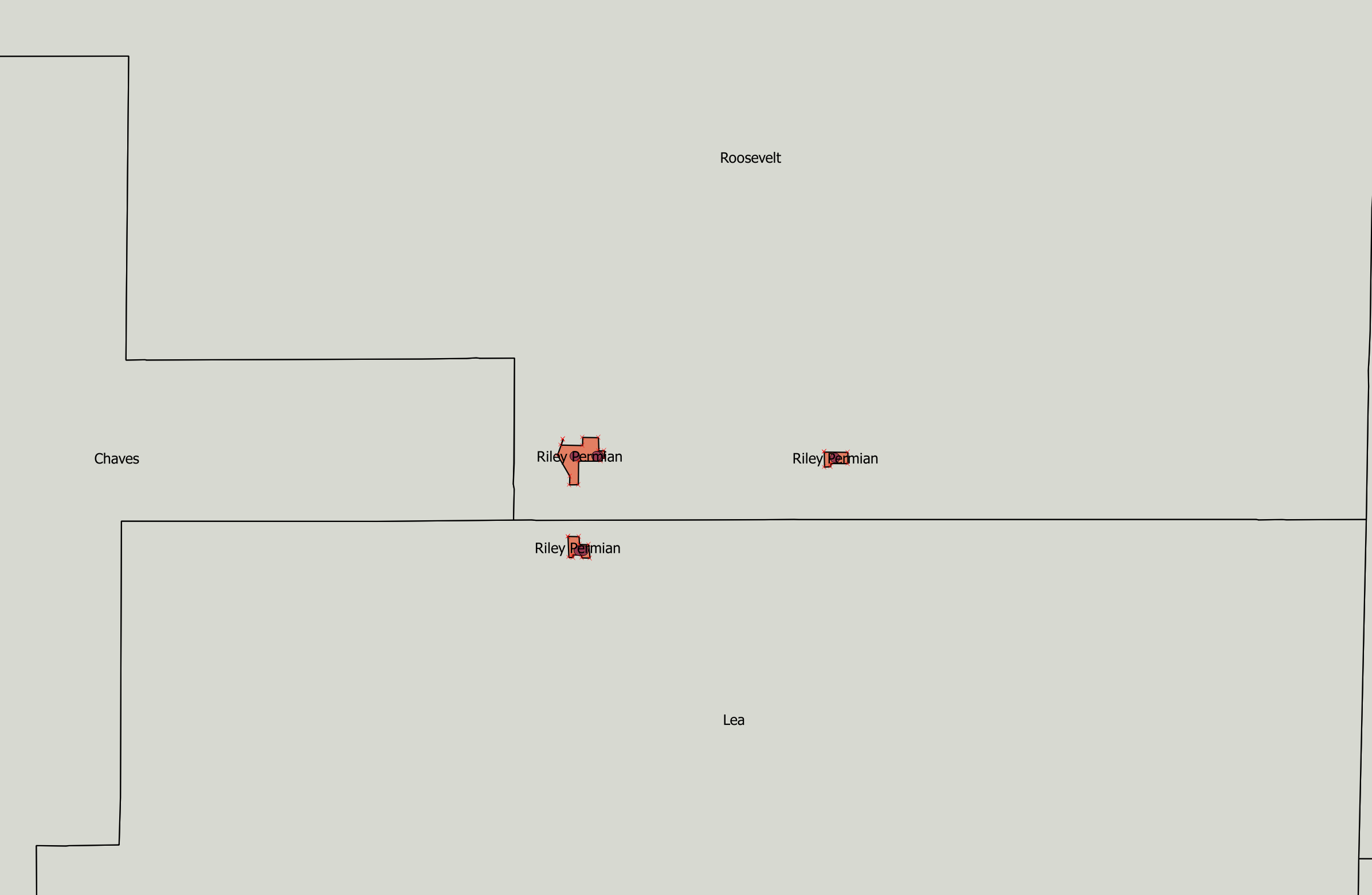

Riley is a private equity backed company focused on developing conventional oil and natural gas properties in the Northwest Shelf of the Permian Basin. Riley's acreage is primarily located on large contiguous blocks in Yoakum County, Texas and Lea, Roosevelt and Chaves Counties in New Mexico; and the offset legacy assets are located in the Permian Basin San Andres fields, which include the Wasson and Brahaney Fields.

Riley's assets have a shallower decline profile than most unconventional reservoirs.

Post Close Actions

- Tengasco will change its name to Riley Exploration Permian, Inc.

- Tengasco's common stock will continue to trade on the NYSE American, but under a new symbol, expected to be "REPX."

- Current management of Riley will become the management of Tengasco with Bobby Riley serving as CEO and Kevin Riley as President. Michael Rugen, the interim CEO and the CFO of Tengasco will continue as CFO of Tengasco.

- The corporate office will be relocated to Riley's current office in Oklahoma City, OK.

- We anticipate reverse stock split in a range from 8-to-1 to 12-to-1 will be completed following closing.

- The Board of Directors of Tengasco will consist of:

- Bobby Riley - Chairman of the Board and Chief Executive Officer

- Bryan Lawrence - Non-Employee Director

- Philip Riley - Non-Employee Director

- Michael Rugen - Director

- Unnamed Independent Director

Mr. Rugen stated, "We started a process at the beginning of the year to explore strategic alternatives that we hoped could maximize the value of Tengasco for our stockholders. We sought a candidate that would provide a solid asset base, proven management, a healthy balance sheet and growth that could be accelerated based upon market conditions. Riley not only meets these objectives but exceeds them in that they have a history of paying a cash dividend to common unitholders that is expected to continue, resulting in our stockholders participating in that dividend going forward. We are confident in the future of Riley and look forward to closing this merger as quickly as possible."

Bobby Riley further stated, "Riley is positioned to be one of a new breed of E&P companies that offers a mix of assets that provides for strong capital efficiency and optionality for our stakeholders. We believe we will not only maintain our conservative balance sheet, but will improve it over the next year, while maintaining or possibly even increasing our cash dividend over the same period. With our strong hedge position, we are confident heading into the future, and anticipate continued growth, that can be accelerated based upon prevailing market conditions. We believe that providing our stockholders with stockholder friendly policies, along with conservative fiscal management and growth options constitutes the new breed of energy company that the market has been waiting for."

The transaction is expected to close during the first quarter of 2021.

Advisors

ROTH Capital Partners acted as exclusive financial advisor to Tengasco, Inc. and Davis Graham & Stubbs LLP is serving as legal advisor to Tengasco.

Truist Securities acted as exclusive financial advisor to Riley Exploration - Permian, and DiSanto Law and Thompson & Knight LLP are serving as legal advisors to Riley.

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Sep-13-2023 | Vital Energy Spends $1.1 Billion to Acquires Assets from Three Permian Cos. | -  |

-  |

| Aug-21-2023 | Permian Resources Acquires Earthstone Energy | -  |

-  |

| Jun-20-2023 | Civitas Resources Acquires PE-Backed Tap Rock for $2.5 Billion | -  |

-  |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| May-15-2018 |

-  |

-  |

Click here | New Mexico | E&P |

| May-26-2015 |

-  |

-  |

Click here | Texas | E&P |

Other Tengasco Inc. Deals

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Feb-06-2008 |

-  |

-  |

Click here | Kansas | E&P |