Blackstone Partnership Inks $1.2B Deal for Shell's Haynesville Assets

Multiples

Transaction Details:

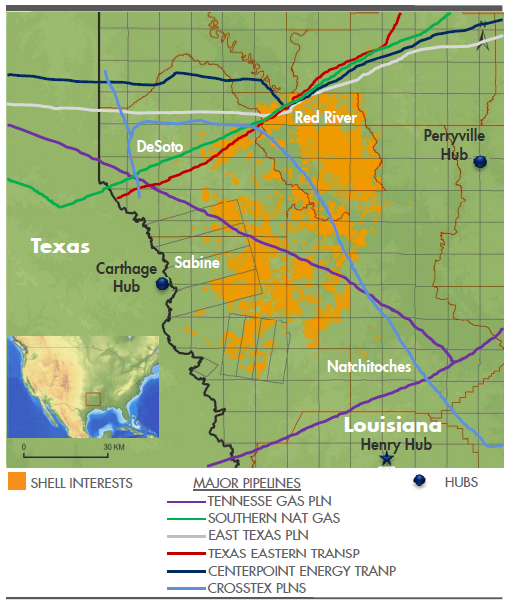

Vine Oil & Gas LP, and Blackstone Energy Partners, agree to acquire the Haynesville assets from Royal Dutch Shell plc, for $1.2 billion. (See asset map below)

The assets comprise over 107,000 net acres in North Louisiana in the core of the Haynesville Shale natural gas shale basin. The transaction is subject to customary closing conditions and regulatory approvals, and is expected to close in the fourth quarter of 2014.

Source : Shale Experts Presentation Database, Shell Investor Presentation

Vine Oil & Gas is a partnership formed by Blackstone Energy Partners and funds affiliated with Blackstone, a leading global, alternative investment manager. Vine was formed earlier this year by Blackstone with the intent of becoming a significant, independent shale development company. Vine’s objective is to be the partner of choice, capitalizing on the team’s unique operational excellence, track record, and capital resources, for companies seeking to accelerate drilling activity and drive production growth, while lowering costs and maintaining a strong HSE track record.

Vine is led by Eric Marsh, previously a senior executive with Encana Corporation, and a team of veteran oil and gas executives with significant operational experience across a range of natural gas basins in North America and a long track record of best-in-class operations, optimizing well costs, recovery factors and production growth in an environmentally responsible manner.

Eric Marsh, President and Chief Executive Officer of Vine, said, "We are pleased to acquire and develop a significant, strategic, and top-tier position in the core of the Haynesville Shale, a premier North American unconventional dry gas play located next to multiple growing sources of demand and an area where we have operated extensively before. We are very excited about our partnership with Blackstone Energy Partners, our continued growth, and the future partnerships and joint ventures that we might be able to form. Blackstone’s successful track record of investing in energy and the oil and gas sector specifically, and extensive industry relationships, in combination with the Vine team’s operational capabilities and experience, will allow us to continue to optimally develop these properties and be a partner of choice in the region over the long-term."

Angelo Acconcia, a Managing Director of Blackstone Energy Partners who oversees their oil and gas investments, said, "We are very excited to accelerate the growth of our partnership with Vine via this acquisition and to continue to grow through future partnerships, joint ventures or acquisitions. Our partnership capitalizes on our deep oil and gas investing experience in North America combined with a best-in-class management team at Vine who have significant operating and shale development experience and an impressive track record. Eric is an incredibly talented operator and he and his team are uniquely situated to contribute significant operational expertise to these assets as well as future opportunities, having successfully led multiple unconventional oil and gas development programs in the U.S. and Canada over the course of their careers."

Blackstone Senior Managing Director and CEO of Blackstone Energy Partners David Foley said, “Our partnership with Vine is consistent with our strategy of backing best-in-class managers to build world class companies across the energy spectrum.”

Evercore and Kirkland & Ellis LLP advised Blackstone and Vine on the transaction.

Ark-La-Tex Deal Activity In Last 12 Months

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Jan-11-2024 |

-  |

-  |

Click here | West Virginia | E&P |

| Dec-15-2023 |

-  |

-  |

Click here | Texas | E&P |

| Jul-13-2022 |

-  |

-  |

Click here | Louisiana | E&P |

| Jul-11-2022 |

-  |

-  |

Click here | Texas | E&P |

| Jun-21-2022 |

-  |

-  |

Click here | E&P |

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Dec-15-2023 | TG Natural Resources To Acquire backed-Rockcliff Energy II For $2.7 Billion | -  |

-  |

| Jul-13-2022 | Tellurian to Acquire Haynesville Assets from EnSight for $125 Million | -  |

-  |

| May-18-2022 | Grey Rock, ENPC Ink $1.3B Business Combination; Form Granite Ridge Resources | -  |

-  |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Sep-20-2021 |

-  |

-  |

Click here | Texas | E&P |

| Feb-17-2021 |

-  |

-  |

Click here | Alberta | E&P |

| Sep-09-2020 |

-  |

-  |

Click here | E&P | |

| May-04-2020 |

-  |

-  |

Click here | Pennsylvania | E&P |

| Jan-31-2020 |

-  |

-  |

Click here | E&P |