Diamondback Acquires Delaware Basin Focused Brigham Resources

Multiples

Transaction Details:

Closing Announcement - March 1, 2017

Diamondback Energy announced the closing of its previously announced acquisition of leasehold interests and related assets from Brigham Resources Operating, LLC and Brigham Resources Midstream, LLC for an aggregate purchase price of $2.55 billion.

Initial Announcement - December 15, 2016

Diamondback Energy, is acquiring 76,319 net acres and 9,482 boe/d (77% oil) of production in Pecos and Reeves county from Brigham Resources Operating LLC a portfolio company Pinebrook and Warbug Pincos for $2.43 billion in cash and stock ($1.62 billion in cash and 7.69 million shares of Diamondback common stock) .

Proforma, Diamondback will have 182,000 net acres in the permian basin. Current working interest for the property averages 83% and the company expects the closing date to be at the end of february 2017.

ACQUISITION HIGHLIGHTS:

- 76,319 net leasehold acres in the Delaware Basin, which has been de-risked by 48 producing horizontal wells on the acreage

- Mineral interests comprised of 1,149 net royalty acres under leasehold acres

- November 2016 average net production of 9,482 boe/d (77% oil)

- 1,213 net identified potential horizontal drilling locations across four proven zones with additional upside potential in multiple other zones and via downspacing

- Significant operating control with approximately 83% of acreage operated and over 81% working interest

- Existing infrastructure valued at approximately $50 million; future upside from midstream development

- Company will issue approximately 7.69 million shares of Diamondback common stock to the Sellers valued at $809.6 million based on the December 13, 2016 closing price of $105.28

"Diamondback's pending acquisition of Brigham Resources in the Delaware Basin represents an important milestone for our company and creates a standard for growth within cash flow in the independent North American E&P space. Diamondback feels we are creating exceptional shareholder value by doubling our Tier One inventory at an attractive entry price. This acquisition is expected to be immediately accretive on operational and financial metrics, and the existing production allows Diamondback to grow volumes on a pro forma basis without compromising balance sheet integrity. We feel that the single well economics of over 100% internal rates of return at today's commodity prices on this acreage compete for capital in the top quartile of our existing inventory and are comparable to the acreage we acquired in July 2016 in the Southern Delaware Basin."

"With Diamondback's proven ability to execute, we now believe we have the resource and acreage base to efficiently support 15 to 20 operated rigs. In addition to our soon to be added sixth rig that will begin developing our previously acquired acreage in the Delaware Basin, we plan to add two additional rigs to develop this pending acquisition in 2017," stated Travis Stice, Chief Executive Officer of Diamondback.

Mr. Stice continued, "We believe our near-term acceleration across our asset base, along with the production from this acquisition, will put us in a position to achieve over 60% production growth in 2017 at the midpoint of our current guidance range. We also believe our balanced acreage position between the Midland and Delaware Basins provides a runway for unprecedented growth for years to come while we remain focused on shareholder returns and balance sheet integrity. We look forward to working with the Brigham team immediately to prepare for a smooth transition post close."

Gene Shepherd, Chief Executive Officer of Brigham Resources stated, "This transaction represents a unique opportunity to place our Southern Delaware Basin assets in the hands of one of the premier value creators and operators in the Permian Basin. I am proud of what the Brigham team accomplished over a few short years in identifying, capturing and developing a large and highly economic inventory of drilling locations across the multiple Wolfcamp and Bone Spring objectives. Along with our sponsors, Warburg Pincus, Yorktown and Pine Brook, we are excited to partner with Travis Stice and the Diamondback team for the asset's next phase of accelerated development."

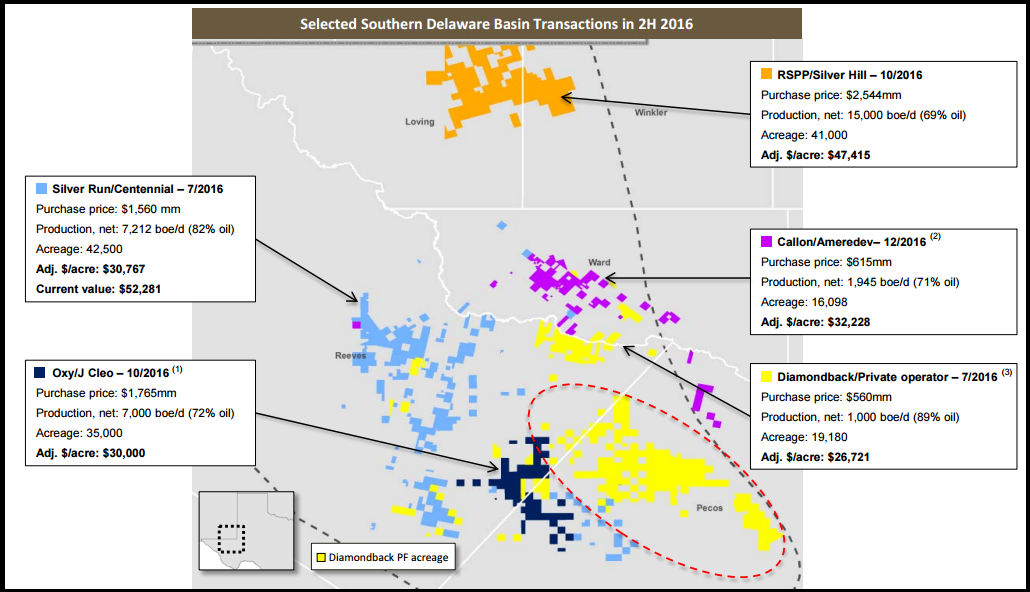

Acquisition Map

Permian - Delaware Basin Deal Activity In Last 12 Months

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Dec-15-2023 |

-  |

-  |

Click here | Texas | E&P |

| Sep-13-2023 |

-  |

-  |

Click here | Texas | E&P |

| Jun-20-2023 |

-  |

-  |

Click here | New Mexico | E&P |

| May-03-2023 |

-  |

-  |

Click here | Texas | E&P |

| Jan-24-2023 |

-  |

-  |

Click here | New Mexico | E&P |

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Jan-04-2024 | APA Corp to Acquire Permian Pure Player- Callon In All Stock Deal | -  |

-  |

| Nov-21-2023 | Northern Oil Acquires Additional Permian Working Interest; Enters Utica | -  |

-  |

| Aug-21-2023 | Permian Resources Acquires Earthstone Energy | -  |

-  |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Feb-12-2024 |

-  |

-  |

Click here | Texas | E&P |

| Nov-16-2022 |

-  |

-  |

Click here | Texas | E&P |

| Oct-11-2022 |

-  |

-  |

Click here | Texas | E&P |

| May-04-2021 |

-  |

-  |

Click here | Texas | E&P |

| May-03-2021 |

-  |

-  |

Click here | North Dakota | E&P |