Marathon Bolsters STACK Position via $888MM Acquisition of Payrock

Multiples

Transaction Details:

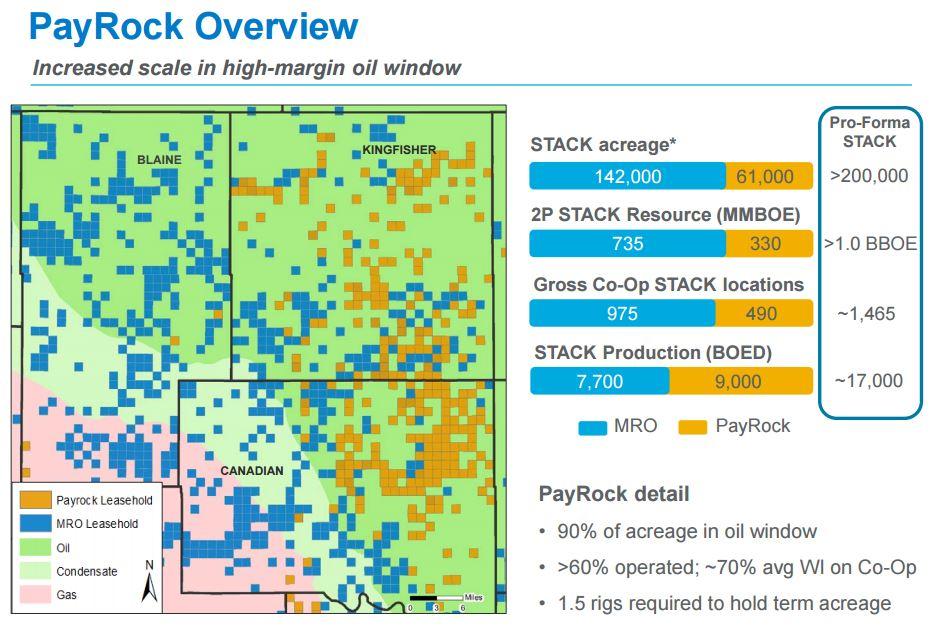

Marathon Oil Corporation announced the signing of a definitive purchase and sale agreement to acquire PayRock Energy Holdings, LLC, a portfolio company of EnCap Investments, for $888 million.

PayRock has approximately 61,000 net surface acres and current production of 9,000 net barrels of oil equivalent per day (boed) in the oil window of the Anadarko Basin STACK play in Oklahoma.

Highlights:

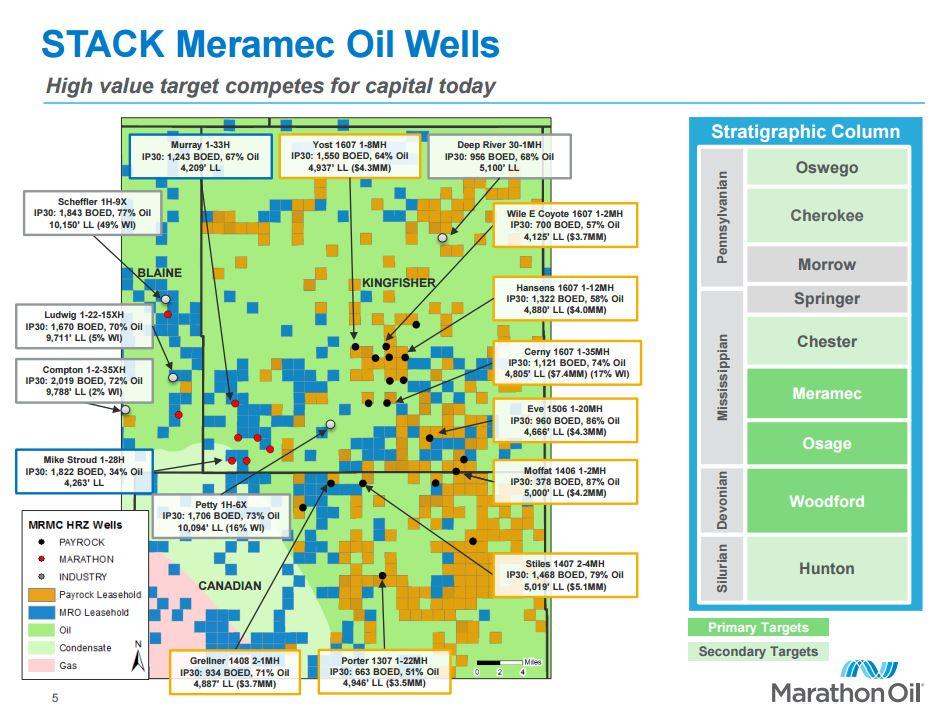

- High quality inventory immediately competes for capital allocation within Marathon Oil's portfolio

- $4.5 - 4.0 million completed well costs offer 60 - 80% before-tax IRRs at $50 WTI

- 330 million BOE 2P resource with 490 gross company operated locations

- 700 million BOE total resource potential from increased well density in Meramec and Woodford, as well as Osage development

- Implied acreage value of $11,800 / acre adjusting for proved developed producing (PDP) reserves

Marathon Oil President and CEO Lee Tillman said: "Acquiring PayRock's STACK position will meaningfully expand the quality and scale of Marathon Oil's existing portfolio in one of the best unconventional oil plays in the U.S. They've built a material position in the high margin oil window of the STACK, and have consistently delivered industry-leading well results. The recent moves we've taken to strengthen the Company's balance sheet, including the successful execution above the top end of our non-core asset divestiture target, have positioned us to be opportunistic to acquire what is an excellent strategic fit.

"We expect the 2016 capital program on the acquired acreage will be covered within our current $1.4 billion budget. As we look into 2017, we would anticipate a minimum four-rig drilling program in our pro forma STACK position, which will achieve leasehold drilling requirements while accelerating delineation work."

The transaction is subject to customary closing conditions and is expected to close in third quarter 2016, funded with cash on hand.

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Sep-06-2022 |

-  |

-  |

Click here | E&P | |

| Jul-28-2022 |

-  |

-  |

Click here | Texas | E&P |

| Jun-29-2022 |

-  |

-  |

Click here | Oklahoma | E&P |

| Mar-02-2022 |

-  |

-  |

Click here | Oklahoma | E&P |

| Nov-01-2021 |

-  |

-  |

Click here | Oklahoma | E&P |

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Jul-28-2022 | Diversified Picks Up MidCon Assets from Conoco for $240 Million | -  |

-  |

| Mar-02-2022 | BCE-Mach Picks Up Midcontinent Assets for $66.5MM; STACK, MissLime | -  |

-  |

| Nov-18-2020 | Tapstone Picks Up Chesapeake's MidCon Assets with $131MM Bid | -  |

-  |

Other Marathon Oil Corp Deals

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Nov-03-2022 |

-  |

-  |

Click here | Texas | E&P |

| Nov-07-2019 |

-  |

-  |

Click here | Texas | E&P |

| Feb-25-2019 |

-  |

-  |

Click here | E&P | |

| Mar-02-2018 |

-  |

-  |

Click here | E&P | |

| Mar-21-2017 |

-  |

-  |

Click here | New Mexico | E&P |