Baytex Acquires Viking/Duvernay Player-Raging River For $2.1 Billion

Multiples

Transaction Details:

Baytex has annouced it is acquring Raging River Exploration for stock in a deal worth C$2.8 billion ($US$ 2.1 billion). The assets being aquired includes Raging River's Viking and East Duvernay Light oil properties.

The Transaction will result in holders of common shares of Raging River receiving, directly or indirectly, 1.36 common shares of Baytex for each Raging River Share owned. The exchange ratio was determined based on the market trading levels of the Baytex Shares and Raging River Shares at the time the companies entered into exclusive negotiations.

This deal closed on August 22, 2018.

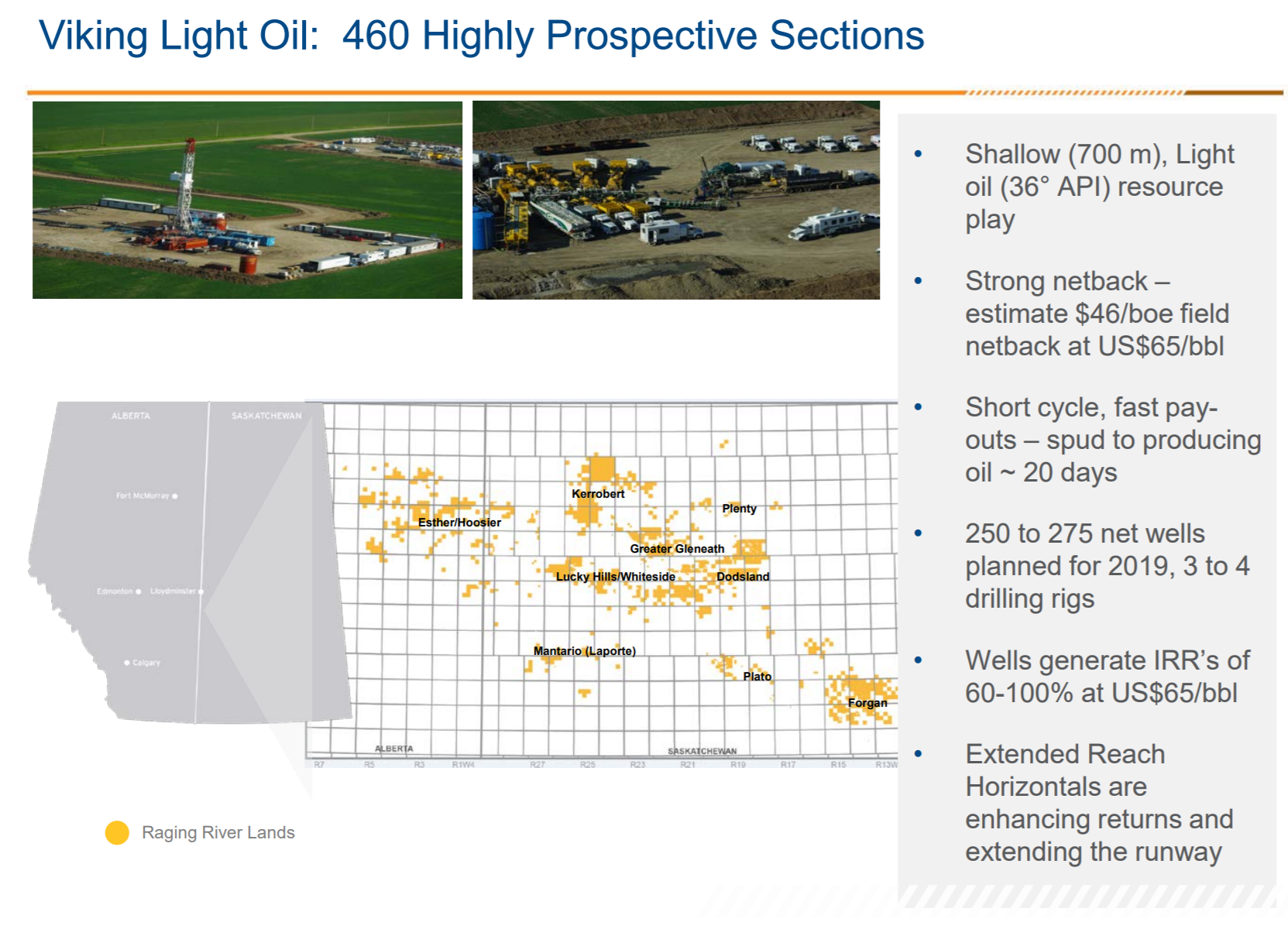

Raging River Assets

- Production : 24,118 BOEPD in Q1 2018 production (88% oil)

- Reserves PDP : 34.7 MMBOE (as of 12/31/2017) (93% oil)

- Land : 460 sections (higly prospective) Viking light Oil or (294,400 net acres)

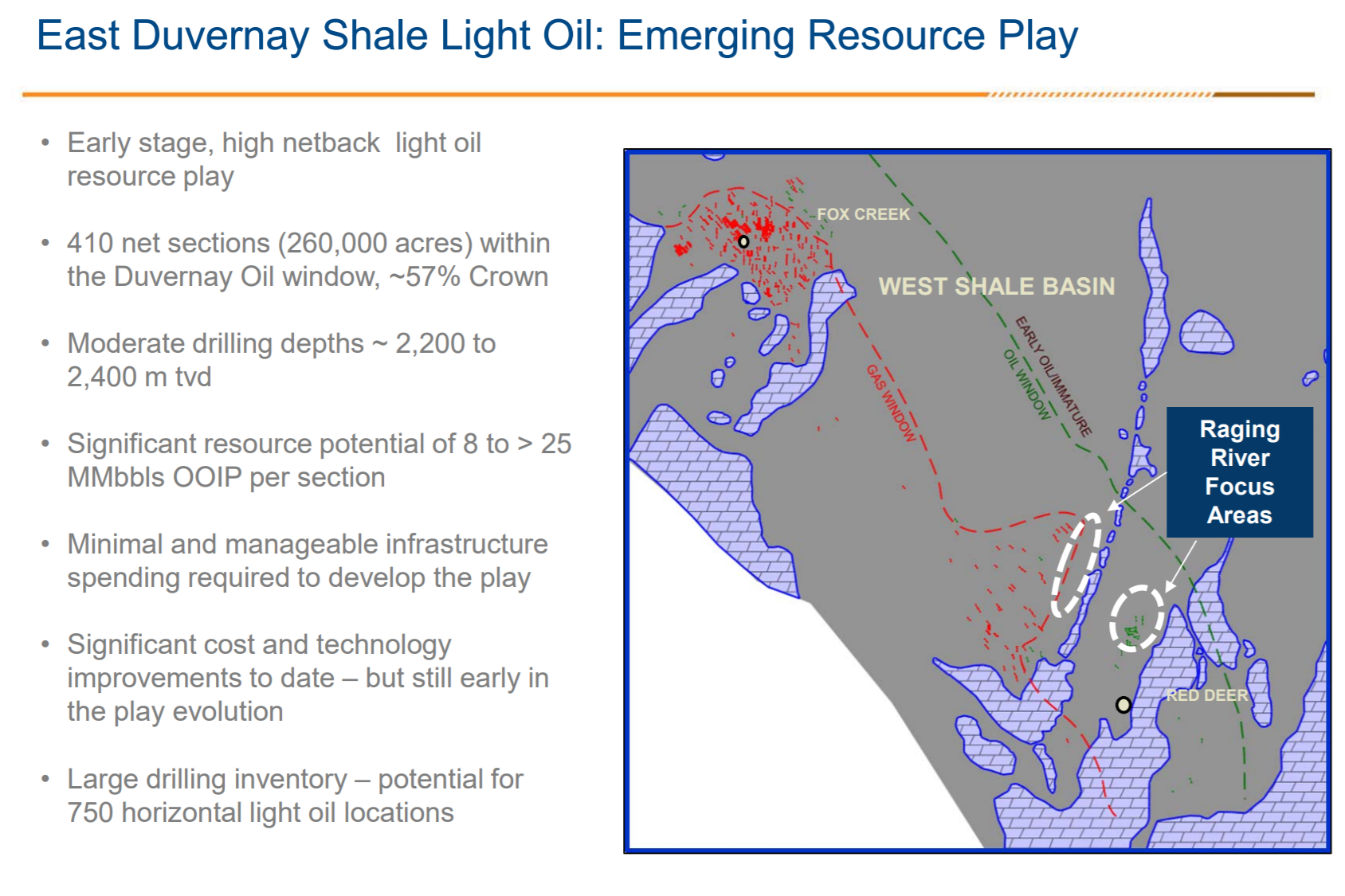

- Land : 410 net sections East Duvernay light oil or (262,400 net acres)

East Duvernay & Viking Light Oil

Combined Company Highlights:

The combined company is expected to have production of approximately 94,000 boe/d from a diverse portfolio of high quality oil assets that includes the Viking, Peace River, Lloydminster and East Duvernay Shale in Canada and the Eagle Ford in Texas.

- Production will be comprised of approximately 83% liquids (45% light oil and condensate, 28% heavy oil and 10% NGLs) and 17% natural gas. By geography, production will be weighted approximately 62% from Canada and 38% from the United States.

- Proved and proved plus probable reserves total 338 mmboe and 539 mmboe, respectively (as at December 31, 2017). The reserves life index is approximately 10 years on a proved basis and 16 years on a proved plus probable basis.

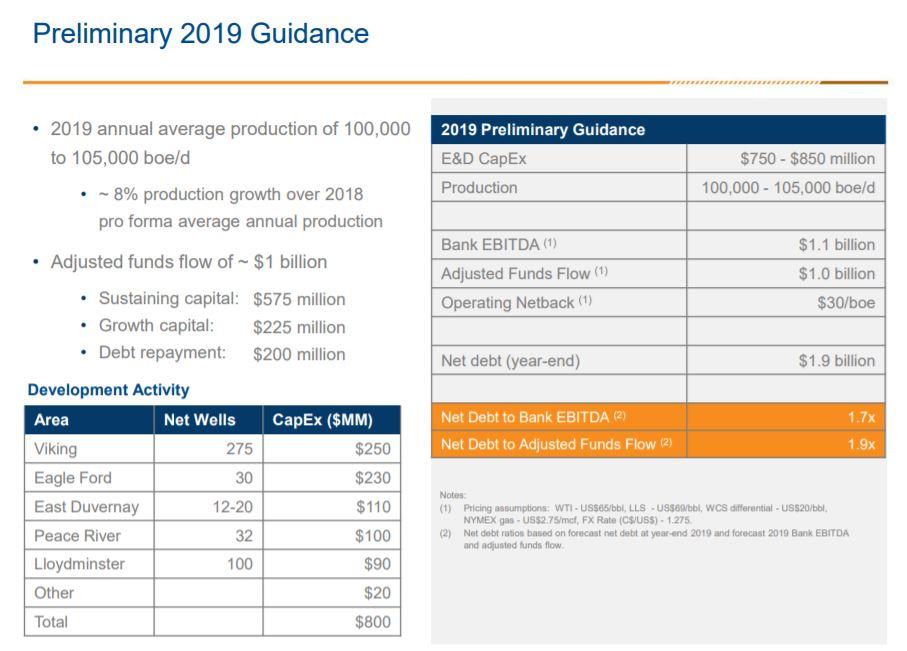

- Average annual production of 100,000 to 105,000 boe/d (85% oil and NGLs) with an exploration and development capital program of $750 to $850 million, representing 5% to 10% production growth

- Debt adjusted production per share growth of approximately 13%

- Adjusted funds flow of approximately $1.0 billion

- Sustaining capital of $575 million equating to a free cash flow yield of 15%

- Net debt to adjusted funds flow of 1.9x

- Strong operating netback of approximately $30/boe across portfolio

- Combined management team and board with a track record of value creation

- Greater than 260,000 acres in the East Duvernay Shale oil play with recent exploration success validating the prospectivity of the lands

The combined organization will be led by Mr. Edward LaFehr, President and Chief Executive Officer of Baytex, Mr. Richard Ramsay, Chief Operating Officer of Baytex, and Mr. Rodney Gray, Chief Financial Officer of Baytex. Mr. Bruce Beynon, the current President of Raging River, will join Baytex as Executive Vice President with responsibility for Exploration, Land and Corporate Development. Mr. Jason Jaskela, the current Chief Operating Officer of Raging River, will join Baytex as Vice President of the East Duvernay Shale oil play, reporting directly to the CEO. In addition, a majority of the Raging River management team and staff will have key roles in the combined company.

The Board of Directors of the combined company will consist of six members of the Baytex Board and four members of the Raging River Board.

Preliminary 2019 Guidance

Executive Commentary

Mr. Neil Roszell, Executive Chairman and Chief Executive Officer of Raging River, will serve as Chairman and Mr. Edward LaFehr, President and Chief Executive Officer of Baytex, will serve as President and Chief Executive Officer of the combined company. The balance of the senior management of the combined company will incorporate senior individuals from both Baytex and Raging River. The board of directors of the combined company will consist of members of both the Baytex Board and the Raging River Board with Mr. Raymond Chan serving as Lead Independent Director.

"We are uniting two strong oil companies with exceptional people and assets. This combination creates a diversified, well-capitalized oil producer that has an impressive suite of high quality producing assets and the ability to materially advance our East Duvernay Shale light oil opportunity, while continuing to develop our Eagle Ford, Viking, Peace River and Lloydminster core assets. The combination provides a substantial value proposition for all shareholders of Raging River and Baytex incremental to what each company could deliver on its own. The combination with Baytex is an excellent outcome to the comprehensive strategic process undertaken by the Raging River Board," said Mr. Roszell.

"We believe the combined company will deliver a powerful combination of industry-leading returns, attractive production growth and strong free cash flow generation. The merger creates a company with world class assets and a strong balance sheet while retaining substantial torque to higher crude oil prices. We will be well-positioned to optimize our capital investment program across our high rate of return asset base. The combined company has a dominant 260,000 net acre position in the emerging East Duvernay Shale oil play which has the potential to compete for capital with the best plays in North America," said Mr. LaFehr.

Advisors

CIBC and Scotiabank acted as co-financial advisors to Baytex with respect to the Transaction. Stikeman Elliott LLP is acting as Baytex's legal advisor.

GMP FirstEnergy is acting as exclusive financial advisor to Raging River and National Bank is acting as advisor to the Special Committee with respect to the Transaction. Burnet, Duckworth & Palmer LLP is acting as Raging River's legal advisor.

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Aug-22-2022 |

-  |

-  |

Click here | British Columbia | E&P |

| Aug-01-2022 |

-  |

-  |

Click here | Alberta | E&P |

| Jun-29-2022 |

-  |

-  |

Click here | Alberta | E&P |

| Dec-15-2021 |

-  |

-  |

Click here | E&P | |

| Nov-29-2021 |

-  |

-  |

Click here | Alberta | E&P |

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Jun-29-2022 | Exxon Sells Off Montney, Duvernay Portfolio in $1.47 Billion Cash Deal | -  |

-  |

| Mar-17-2021 | Petro Viking Picks Up Duvernay, Viking Mineral Rights | -  |

-  |

| Feb-17-2021 | Crescent Point Inks $900MM Deal for Shell's Duvernay Assets | -  |

-  |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Nov-29-2016 |

-  |

-  |

Click here | Saskatchewan | E&P |

| Jun-01-2016 |

-  |

-  |

Click here | Saskatchewan | E&P |

| Dec-11-2015 |

-  |

-  |

Click here | Alberta | E&P |

| Mar-18-2014 |

-  |

-  |

Click here | Saskatchewan | E&P |

| Oct-23-2013 |

-  |

-  |

Click here | Saskatchewan | E&P |

Other Baytex Energy Corp. Deals

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Feb-28-2023 |

-  |

-  |

Click here | Texas | E&P |

| Nov-22-2016 |

-  |

-  |

Click here | Alberta | E&P |

| Jul-28-2016 |

-  |

-  |

Click here | Texas | E&P |

| Jul-30-2014 |

-  |

-  |

Click here | North Dakota | E&P |

| Feb-06-2014 |

-  |

-  |

Click here | Texas | E&P |