ConocoPhillips Bolts-On Montney Property for $390MM Cash

Multiples

Transaction Details:

ConocoPhillips has signed an agreement to acquire additional Montney acreage in Canada from Kelt Exploration Ltd. for $390 million in cash (up from $375MM originally), plus the assumption of approximately $30 million in financing obligations for associated partially owned infrastructure.

This deal closed on August 21, 2020.

The transaction increases the company's Montney acreage position to 295,000 net acres with 100% working interest.

Asset Details:

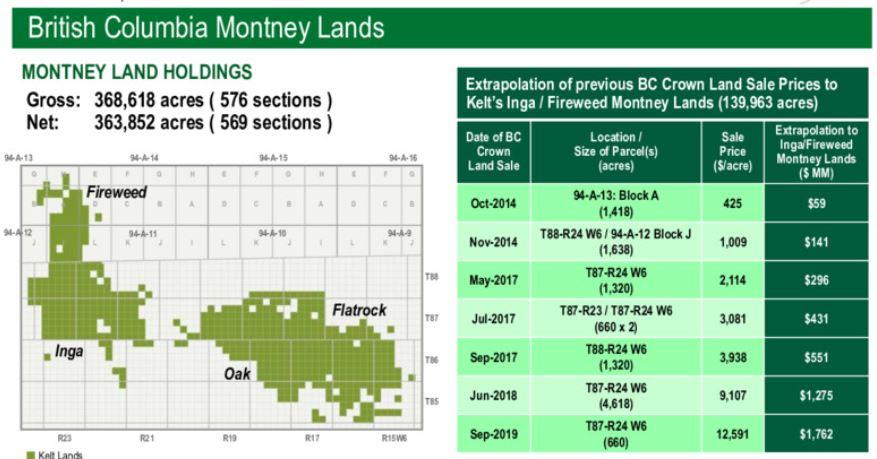

- Acreage: 140,000 net acres

- Acreage is located in the liquids-rich Inga-Fireweed asset Montney zone, which is directly adjacent to the company's existing Montney position

- Well Locations: Adds 1,000 well locations

- Production: Approximately 15 MBOED

- Resource Potential: Adds over 1 billion barrels of oil equivalent (BBOE) of high-value resource with an all-in cost of supply of mid-$30s (WTI basis).

COO Matt Fox said: "We have tracked and analyzed this adjacent acreage position for a long time. It represents a high-value extension of our existing Montney position, and we're pleased to capture this opportunity at an attractive cost of supply that meets our criteria for resource additions. The transaction provides operating scale and flexibility to create significant value for shareholders by applying our drilling and completion techniques on this asset and optimizing our future overall Montney development plans.

"Our current Montney development is performing according to our projections and plans. We're still in the process of bringing our initial wells online, and early results are encouraging: we have confirmed the liquids-rich nature of the play and also confirmed that transferring the drilling and completion techniques we're employing in the U.S. Big 3 can add significant rate and recovery potential to the play. We view the Montney as a very attractive long-term asset and today's announcement gives us significant running room at a very attractive all-in cost."

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Aug-22-2022 |

-  |

-  |

Click here | British Columbia | E&P |

| Aug-01-2022 |

-  |

-  |

Click here | Alberta | E&P |

| Jun-29-2022 |

-  |

-  |

Click here | Alberta | E&P |

| Dec-15-2021 |

-  |

-  |

Click here | E&P | |

| Nov-29-2021 |

-  |

-  |

Click here | Alberta | E&P |

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Jun-29-2022 | Exxon Sells Off Montney, Duvernay Portfolio in $1.47 Billion Cash Deal | -  |

-  |

| Nov-29-2021 | CNRL to Acquire Montney-Focused Storm Resources in $960MM Deal | -  |

-  |

| Jun-11-2021 | Tourmaline Acquires Montney-Focused Black Swan Energy | -  |

-  |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Jan-04-2017 |

-  |

-  |

Click here | Alberta | E&P |

| Feb-23-2015 |

-  |

-  |

Click here | Alberta | E&P |

| Jun-17-2014 |

-  |

-  |

Click here | Alberta | E&P |

| Nov-06-2013 |

-  |

-  |

Click here | Alberta | E&P |

| Aug-01-2013 |

-  |

-  |

Click here | British Columbia | E&P |

Other ConocoPhillips Deals

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| May-29-2024 |

-  |

-  |

Click here | Texas | E&P |

| Jul-28-2022 |

-  |

-  |

Click here | Texas | E&P |

| Dec-08-2021 |

-  |

-  |

Click here | E&P | |

| Dec-08-2021 |

-  |

-  |

Click here | E&P | |

| Sep-20-2021 |

-  |

-  |

Click here | Texas | E&P |