Ovintiv Inc → Newfield Exploration Co.- One-Page Deal Sheet

Calculated Metrics( EV/Category)

Transaction Details:

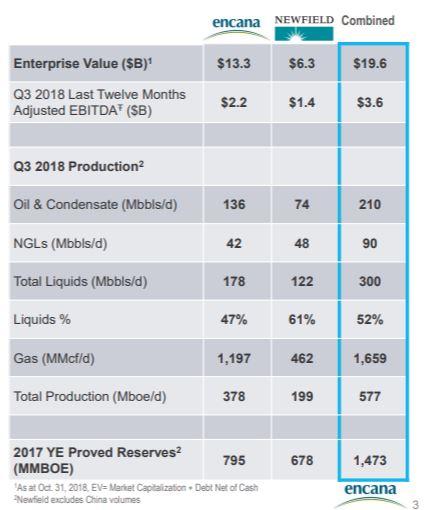

Encana Corp. has inked a deal to acquire Newfield Exploration in an all-stock transaction valued at approximately $5.5 billion. In addition, Encana will assume $2.2 billion of Newfield net debt.

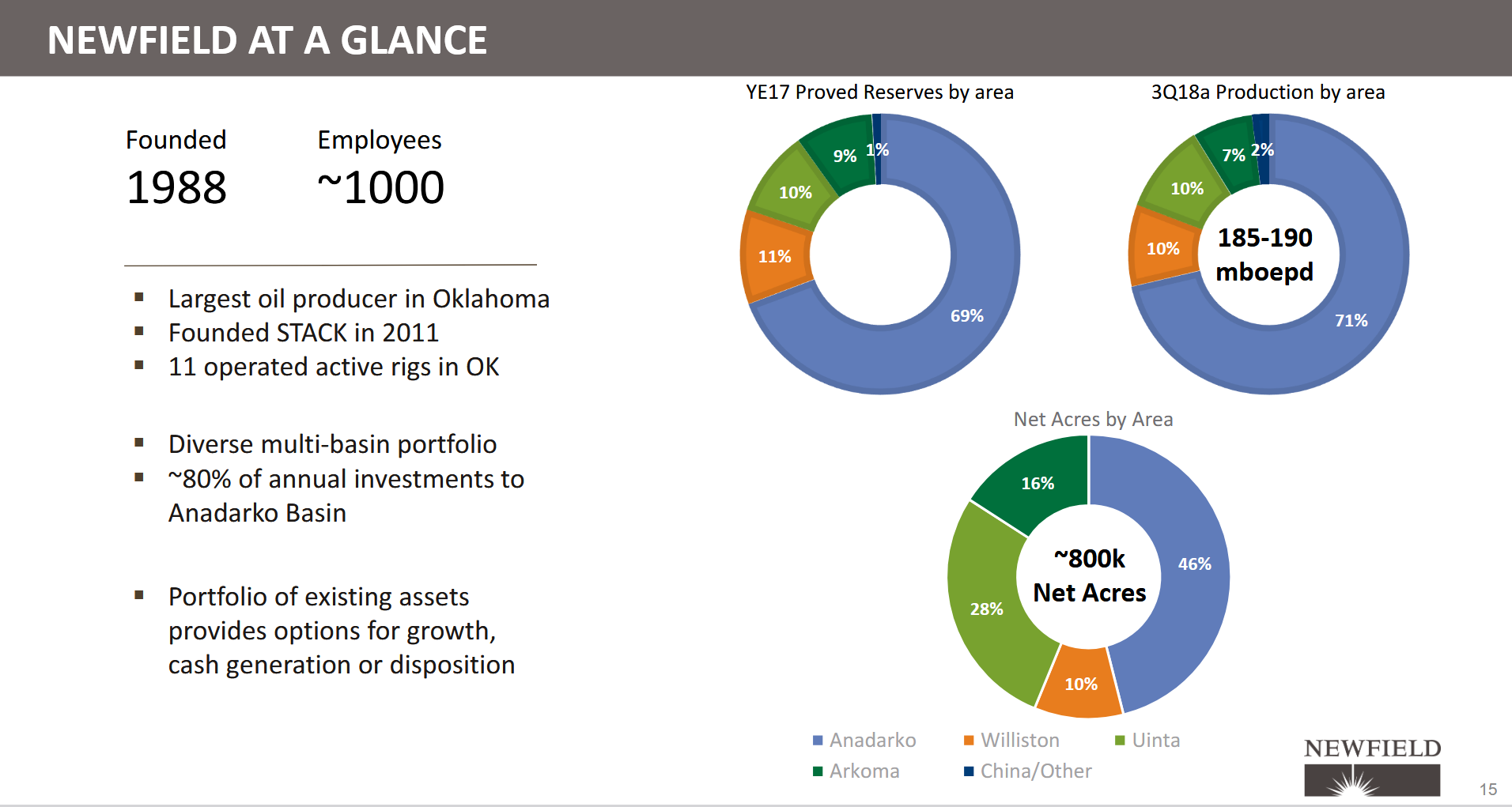

Newfield asset snapshot used in the deal

Production (NFX standalone, Q3-2018):

-

Oil & condensate: 74 Mbbl/d

-

NGLs: 48 Mbbl/d

-

Gas: 462 MMcf/d

-

Total: 199 Mboe/d. GlobeNewswire

Reserves (1P, YE2017):

-

Total proved: 680 MMBOE

-

Oil & condensate: 250 MMBbl (248 domestic + 2 China)

-

NGLs: 146 MMBbl

-

Natural gas: 1,704 Bcf. CloudFront+1

-

Acreage (YE2017):

-

Company-wide: ~2,215k gross / 1,105k net acres (developed 1,718k gross / 880k net; undeveloped 497k gross / 225k net). CloudFront

-

Anadarko Basin (STACK/SCOOP): ~680k gross / 369k net (developed + undeveloped). CloudFront

-

Deal highlight (STACK/SCOOP “core-of-core”): ~360k net acres. GlobeNewswire

Inventory / locations: “6,000+ gross risked well locations” in STACK/SCOOP and “~3 Bboe net unrisked resource”. GlobeNewswire

Profitability metrics (NFX, TTM to Sep 30, 2018):

-

EBITDA: $1,171 M

-

EBITDAX: $1,445 M (adds back exploration and other permitted adjustments; reconciliation disclosed in SEC filing). SEC

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Jul-08-2024 | Devon To Acquired PE-Backed Grayson Mill For $5 Billion | -  |

-  |

| Feb-21-2024 | Chord Energy and Enerplus to Combine in $11 Billion Transaction Creating Premier Williston-Focused E&P Company | -  |

-  |

| Apr-03-2023 | Grayson Mill Adds More Bakken, Acquires Ovintiv's Assets For $825 Million | -  |

-  |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Aug-03-2016 |

-  |

-  |

Click here | Texas | E&P |

| May-05-2016 |

-  |

-  |

Click here | Oklahoma | E&P |

| Jul-30-2014 |

-  |

-  |

Click here | Oklahoma | E&P |

| Oct-22-2013 |

-  |

-  |

Click here | Texas | E&P |

| Sep-18-2012 |

-  |

-  |

Click here | E&P |

Other Ovintiv Inc Deals

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Nov-14-2024 |

-  |

-  |

Click here | Utah | E&P |

| Nov-06-2024 |

-  |

-  |

Click here | Alberta | E&P |

| Apr-03-2023 |

-  |

-  |

Click here | Texas | E&P |

| Apr-03-2023 |

-  |

-  |

Click here | North Dakota | E&P |

| Jul-06-2022 |

-  |

-  |

Click here | Montana | E&P |