GEP Haynesville LLC → Ovintiv Inc- One-Page Deal Sheet

Calculated Metrics( EV/Category)

Transaction Details:

Encana Oil & Gas has reached an agreement to sell its Haynesville natural gas assets, located in northern Louisiana, to GEP Haynesville, LLC, a joint venture formed by GeoSouthern Haynesville, LP and funds managed by GSO Capital Partners LP.

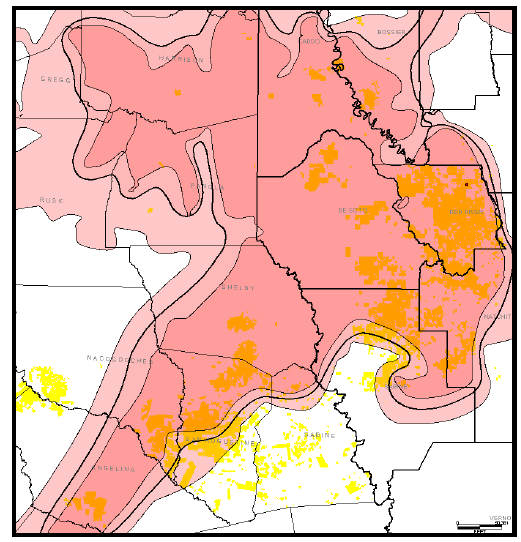

Encana Acreage Map

Source : Shale Experts Presentation Manager

Total cash consideration to Encana under the transaction is US$850 million. In addition, through the transfer of current and future obligations, Encana will reduce its gathering and midstream commitments, which will be substantially complete through 2020, by approximately US$480 million on an undiscounted basis. Further, Encana will transport and market GeoSouthern's Haynesville production on a fee for service basis for the next five years.

Encana's Haynesville natural gas assets include approximately 112,000 net acres of leasehold, plus additional fee mineral lands. Collectively, they represent Encana's total position in northern Louisiana. Encana operates approximately 300 wells in the area.

Estimated year-end 2014 proved reserves were 720 billion cubic feet equivalent (Bcfe) of natural gas. The properties, which are located primarily in DeSoto and Red River Parishes, Louisiana, contain 300 operated wells in the most prolific area of the Haynesville Shale.

The sale of Encana's Haynesville assets is subject to satisfaction of normal closing conditions, as well as regulatory approvals and post-closing adjustments, and is expected to close in the fourth quarter of 2015 with an effective date of January 1, 2015.

Jefferies LLC, Credit Suisse and Gordon Arata McCollam Duplantis & Eagan, LLC advised Encana on the transaction. GeoSouthern was advised by Kirkland & Ellis and Thompson & Knight.

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Jan-11-2024 |

-  |

-  |

Click here | West Virginia | E&P |

| Dec-15-2023 |

-  |

-  |

Click here | Texas | E&P |

| Jul-13-2022 |

-  |

-  |

Click here | Louisiana | E&P |

| Jul-11-2022 |

-  |

-  |

Click here | Texas | E&P |

| Jun-21-2022 |

-  |

-  |

Click here | E&P |

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Apr-01-2025 | TG Natural Resources Acquires Interest in Chevron’s Haynesville Asset | -  |

-  |

| Dec-15-2023 | TG Natural Resources To Acquire backed-Rockcliff Energy II For $2.7 Billion | -  |

-  |

| Jul-13-2022 | Tellurian to Acquire Haynesville Assets from EnSight for $125 Million | -  |

-  |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Nov-14-2024 |

-  |

-  |

Click here | Utah | E&P |

| Nov-06-2024 |

-  |

-  |

Click here | Alberta | E&P |

| Apr-03-2023 |

-  |

-  |

Click here | Texas | E&P |

| Apr-03-2023 |

-  |

-  |

Click here | North Dakota | E&P |

| Jul-06-2022 |

-  |

-  |

Click here | Montana | E&P |

Other GEP Haynesville LLC Deals

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Nov-04-2021 |

-  |

-  |

Click here | Louisiana | E&P |

| Jul-06-2017 |

-  |

-  |

Click here | Louisiana | E&P |