Energy Transfer LP → Semgroup Corporation- One-Page Deal Sheet

Transaction Details:

Energy Transfer will acquire SemGroup in a cash and stock transaction valued at $17 per share, or a total consideration including the assumption of debt of approximately $5 billion, based on the closing price of ET common units on September 13, 2019.

The merger consideration consists of $6.80 in cash and 0.7275 of an ET common unit for each outstanding share of Class A Common Stock of SemGroup, or 40% cash and 60% equity. This represents a 65% premium to the closing price of SemGroup shares as of September 13, 2019.

Complementary Assets

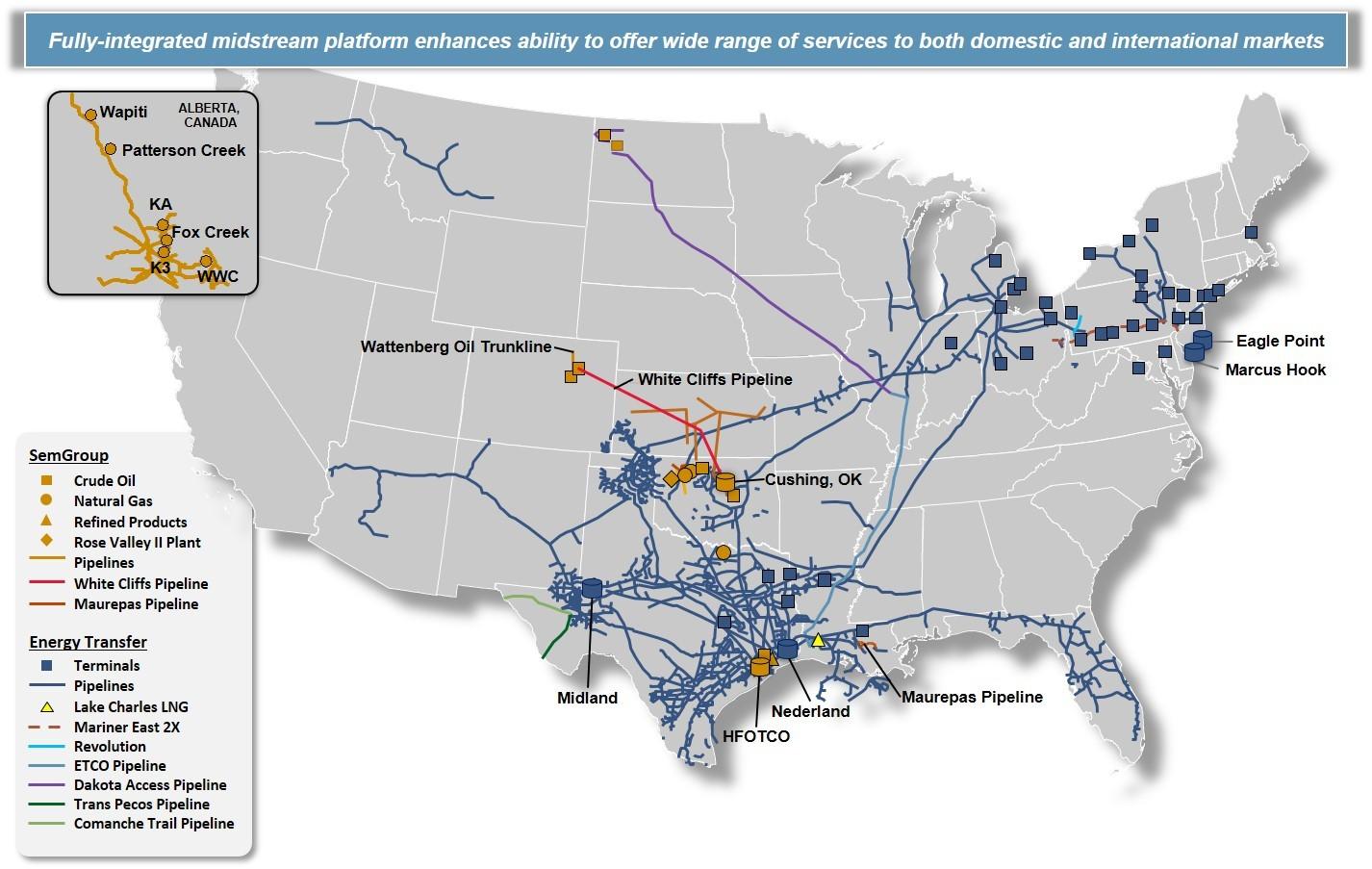

Energy Transfer’s acquisition of SemGroup will increase Energy Transfer’s scale across multiple regions and provide increased connectivity for Energy Transfer’s crude oil and NGL transportation businesses.

Energy Transfer will significantly strengthen its crude oil transportation, terminalling and export capabilities with the addition of the Houston Fuel Oil Terminal (“HFOTCO”), a world class crude oil terminal on the Houston Ship Channel with 18.2 million barrels of crude oil storage capacity, five deep-water ship docks and seven barge docks. HFOTCO is supported by stable take-or-pay cash flows from diverse, primarily investment grade customers. To enhance this optionality, Energy Transfer is also announcing its plans to construct a new crude oil pipeline, the Ted Collins Pipeline, to connect HFOTCO to Energy Transfer’s Nederland Terminal.

This acquisition also expands Energy Transfer’s crude oil and NGL infrastructure by adding crude oil gathering assets in the DJ Basin in Colorado and the Anadarko Basin in Oklahoma and Kansas, as well as crude oil and natural gas liquids pipelines connecting the DJ Basin and Anadarko Basin with crude oil terminals in Cushing, Oklahoma. These assets will greatly increase Energy Transfer’s crude oil and NGL transportation business in the Rockies and Mid-Continent and will complement Energy Transfer’s existing crude oil and NGL transportation business in the Permian Basin. Energy Transfer’s crude oil assets on the Gulf Coast will also benefit from the Maurepas Pipeline and its connections to the St. James refining complex. The acquisition will also provide a significant crude oil gathering and transportation presence in the Alberta Basin in western Canada.

United States Deal Activity In Last 12 Months

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Sep-02-2025 |

-  |

-  |

Click here | Texas | E&P |

| Jul-10-2025 |

-  |

-  |

Click here | Colorado | E&P |

| Jul-10-2025 |

-  |

-  |

Click here | Texas | E&P |

| Jun-05-2025 |

-  |

-  |

Click here | Wyoming | E&P |

| May-30-2025 |

-  |

-  |

Click here | Ohio | E&P |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Sep-02-2025 |

-  |

-  |

Click here | Texas | E&P |

| Jul-10-2025 |

-  |

-  |

Click here | Colorado | E&P |

| Jul-10-2025 |

-  |

-  |

Click here | Texas | E&P |

| Jun-05-2025 |

-  |

-  |

Click here | Wyoming | E&P |

| May-30-2025 |

-  |

-  |

Click here | Ohio | E&P |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Feb-10-2015 |

-  |

-  |

Click here | Colorado | Midstream |

| May-02-2013 |

-  |

-  |

Click here | Kansas | Midstream |

| Jan-09-2013 |

-  |

-  |

Click here | Colorado | Midstream |