Mach Natural Resources LP → Paloma Partners IV, LLC- One-Page Deal Sheet

Calculated Metrics( EV/Category)

Transaction Details:

Mach Natural Resources said it will acquire anadarko basin assets from Paloma Partners IV, LLC, a privately-held Delaware limited liability company backed by EnCap Investments for $815 million in cash.

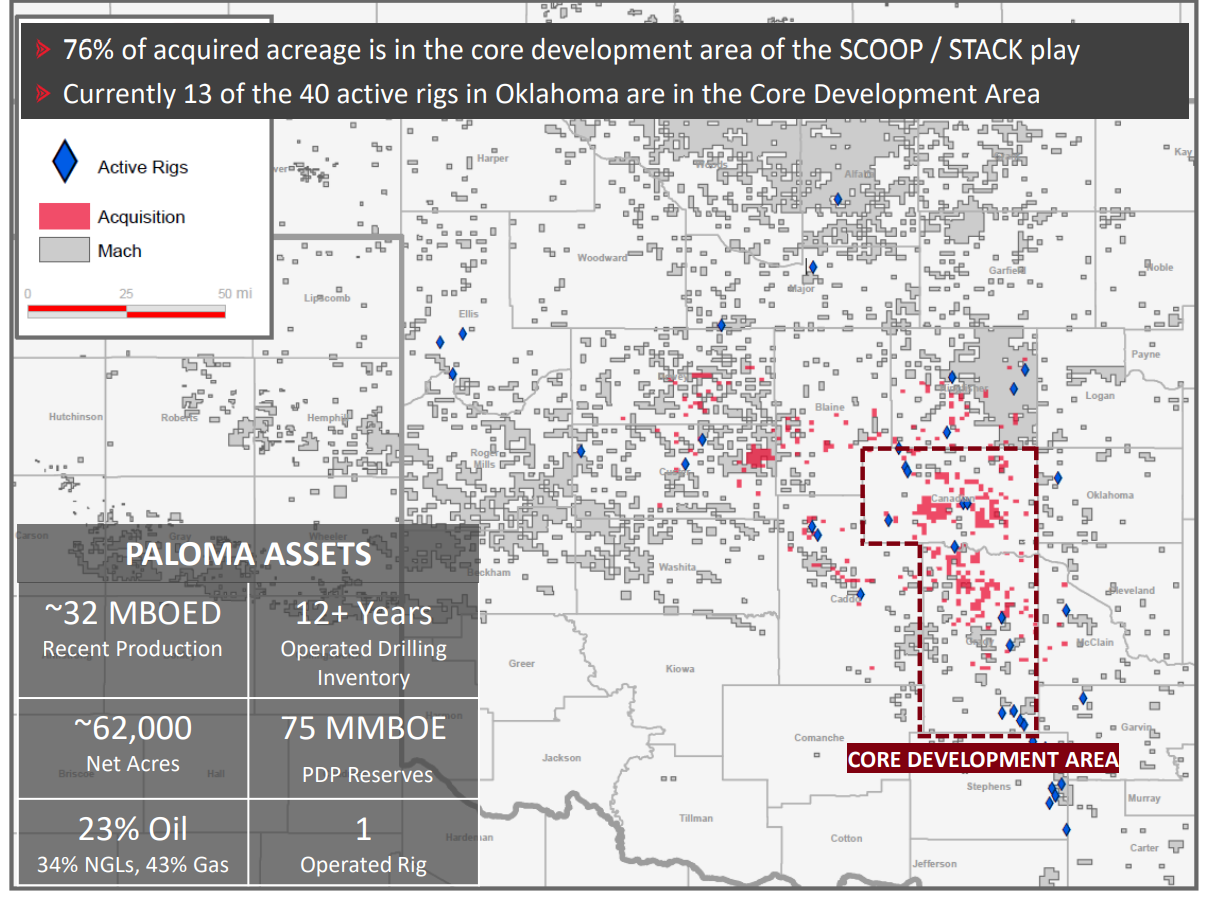

The assets are located in Oklahoma.

The deal is expected to close on December 29, 2023.

Asset Highlights

- Production : 32,000 Boepd (23% oil, 57% liquids)

- PDP reserves of approximately 75 MMBOE

- Approximately 62,000 net acres in the Anadarko Basin in Canadian, Grady, McClain, Caddo, Custer, Dewey, Blaine and Kingfisher Counties, Oklahoma, approximately 76% located in the core development area in Canadian and Grady Counties

- High-return drilling locations with over 12 years of operated inventory on a 1 rig program

Financing

Mach plans to fund the purchase price with new debt financing. Mach has received fully committed financing from a group led by Chambers Energy Management and EOC Partners, and including Mercuria Investments US, Inc., funds managed by Farallon Capital Management LLC, Macquarie Group, among other financial institutions as participants. The $825mm Senior Secured Term Loan will close in conjunction with the closing of the Acquisition.

Advisors

Kirkland & Ellis is serving as legal advisor for Mach.

Vinson & Elkins is serving as legal advisor and RBC Richardson Barr is serving as financial advisor for Sellers.

Latham & Watkins is serving as legal advisor for the term loan participants.

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Jul-31-2018 | Penn Virginia Sells Off Oklahoma Assets to Undisclosed Buyer | -  |

-  |

| Oct-08-2016 | Fairway Resources Partners Scores 223,000 Net Acres In The Anadarko Basin | -  |

-  |

| Jun-06-2016 | Devon to Divest Granite Wash Properties for $310 Million | -  |

-  |