Matador Inks $387MM Bolt-On Deal for Delaware Basin Acreage

Multiples

Transaction Details:

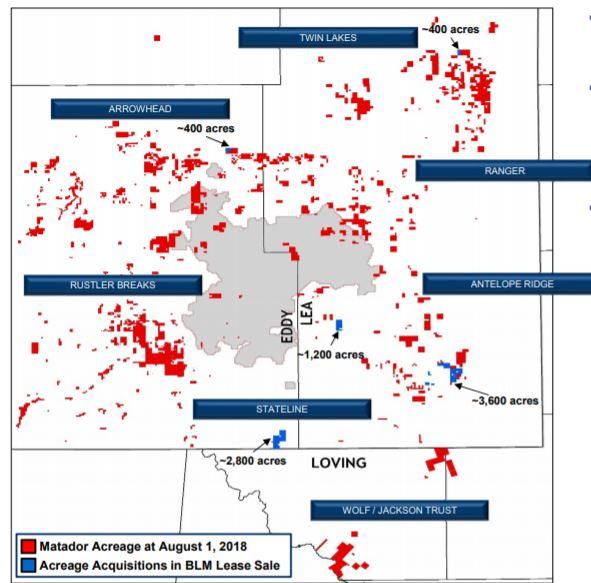

Matador Resources has acquired 8,400 net acres for approximately $387 million, or a weighted average cost of approximately $46,000 per net acre, in Lea and Eddy Counties, New Mexico in the Bureau of Land Management (BLM) New Mexico Oil and Gas Lease Sale.

While this price is noticeably higher compared to Matador's past acqusition deals in the area, it is due to the fact the working interest in this asset is higher than in earlier deals (The acquired leases are federal leases and provide an 87.5% net revenue interest).

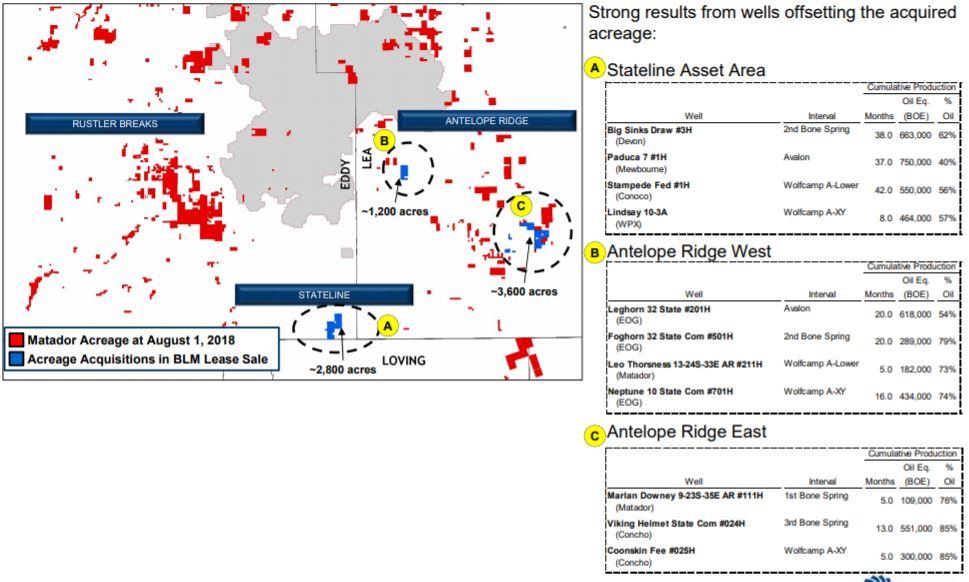

The acquired acreage blends well with Matador’s existing properties, expanding and bolting on acreage in the Antelope Ridge asset area in Lea County, New Mexico and establishing a foothold for the Company in the prolific Stateline area in Eddy County, New Mexico.

- Acreage details: 2,800 gross/net acres in the Stateline area, 4,800 gross/net acres in the Antelope Ridge asset area, 400 gross/net acres in the Arrowhead asset area and 400 gross/net acres in the Twin Lakes asset area, bringing Matador’s total leasehold and mineral position in the Delaware Basin to approximately 217,400 gross (123,800 net) acres

- Matador estimates these properties should immediately add an incremental 16.3 MMBOE, or 10%, in proved undeveloped reserves

- The acquired leases are federal leases and provide an 87.5% net revenue interest

The large majority of the acquired acreage is believed to be conducive to drilling longer laterals of up to two miles or more, utilizing central facilities and multi-well pad development, which should reduce well costs and further improve well returns and economics. The positive effects of this acquisition on Matador’s production and on potential additional midstream opportunities should begin to be realized in late 2019, 2020 and beyond as Matador expects to initiate production from these properties with higher NRIs and lower costs per lateral foot.

Permian - Delaware Basin Deal Activity In Last 12 Months

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Dec-15-2023 |

-  |

-  |

Click here | Texas | E&P |

| Sep-13-2023 |

-  |

-  |

Click here | Texas | E&P |

| Jun-20-2023 |

-  |

-  |

Click here | New Mexico | E&P |

| May-03-2023 |

-  |

-  |

Click here | Texas | E&P |

| Jan-24-2023 |

-  |

-  |

Click here | New Mexico | E&P |

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Jan-04-2024 | APA Corp to Acquire Permian Pure Player- Callon In All Stock Deal | -  |

-  |

| Nov-21-2023 | Northern Oil Acquires Additional Permian Working Interest; Enters Utica | -  |

-  |

| Aug-21-2023 | Permian Resources Acquires Earthstone Energy | -  |

-  |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Jan-24-2023 |

-  |

-  |

Click here | New Mexico | E&P |

| May-21-2018 |

-  |

-  |

Click here | New Mexico | E&P |

| Nov-09-2017 |

-  |

-  |

Click here | E&P | |

| Oct-05-2017 |

-  |

-  |

Click here | New Mexico | E&P |

| Dec-06-2016 |

-  |

-  |

Click here | New Mexico | E&P |