Permian Resources Corp. → APA Corp.- One-Page Deal Sheet

Announced Date

May 07,2025

Close Date

June 16,2025

Transaction Type

Asset

Enterprise Value (EV)($MM)

608

Asset/Basin:

["Permian (Delaware)"]

TargetZones:

[]

Net Acres

13,320 ( 99% HBP, 65% Operated )

% Oil:

45 % oil

Source Documents:

Location

Calculated Metrics( EV/Category)

Region

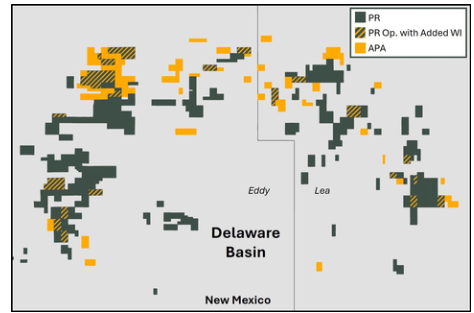

Permian - Delaware Basin,Permian - Northern Delaware

Country

United States

State

New Mexico

County

Eddy ,Lea

Play

Production Production

12,000 Boe/d

Production Mix

45 % Oil

Calculated Metrics( EV/Category)

$/ Flowing

50,667

$/ Acre

45,646

$/Location

6,080,000

Transaction Details:

Permian Resources announced a $608 million cash acquisition from APA Corporation, securing ~13,320 net acres and ~8,700 net royalty acres adjacent to its core New Mexico assets.

The bolt-on provides ~12,000 Boe/d of production and over 100 high-NRI operated two-mile locations, with breakevens around $30/bbl WTI. The acquisition enhances near-term development visibility, increases capital efficiency, and provides opportunities to consolidate working interest and optimize operated units via acreage trades.

Bolt-On Transaction Highlights

- Acquired 13,320 net acres and 8,700 net royalty acres directly offset Permian Resources’ core New Mexico operating areas for $608 million

- ~12 MBoe/d (~45% oil) of low decline production expected during second half of 2025

- High NRI (average 83% 8/8ths) enhances returns and bolsters PR’s existing royalty position

- Adds >100 new gross operated, two-mile locations with advantaged NRIs, which immediately compete for capital

- Inventory scheduled for development in the near-term achieves an average breakeven of ~$30 per barrel WTI

- Significant industrial logic with clear path to outsized value creation

- Majority of inventory located within PR’s existing Parkway asset in Eddy County, one of the Company’s most capital efficient assets

- High-quality non-operated position provides PR the opportunity to add incremental value via its ground game

- Purchased at an attractive valuation, reflecting current market conditions

- $12,500 per net acre, $6,000 per net royalty acre and $2 million per net location

- Accretive to all key per share metrics

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Sep-02-2025 | Crescent Energy Acquires Vital | -  |

-  |

| Jul-10-2025 | Mach Enters Permian Basin, Buys PE_backed Sabinal Assets for $500 Million | -  |

-  |

| May-03-2025 | Riley Permian Acquires PE-Backed Silverback II For $142million | -  |

-  |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Jan-04-2024 |

-  |

-  |

Click here | Texas | E&P |

| Aug-04-2022 |

-  |

-  |

Click here | Texas | E&P |

Other Permian Resources Corp. Deals

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Jul-30-2024 |

-  |

-  |

Click here | Texas | E&P |

| Aug-21-2023 |

-  |

-  |

Click here | New Mexico | E&P |

| Jan-17-2023 |

-  |

-  |

Click here | New Mexico | E&P |

| May-19-2022 |

-  |

-  |

Click here | Texas | E&P |

| Nov-03-2021 |

-  |

-  |

Click here | Texas | E&P |