Not Disclosed → Riviera Resources- One-Page Deal Sheet

Calculated Metrics( EV/Category)

Transaction Details:

Riviera Resources, Inc. has agreed to sell its interest in properties located in the Hugoton Basin to an undisclosed buyer for a contract price of $295 million

This transaction represents a complete basin exit for the Company.

This deal closed on November 22, 2019.

Transaction Details

- Purchase Price : $295 million

- Acreage : 1.1 million net acres

- Production : 104 MMcfe/d (66% Natural Gas, 34% NGL)

- Locations : 1500 (at $3.25/Mcf)

- Natural Gas Processing : Capacity (450 MMcf/d)

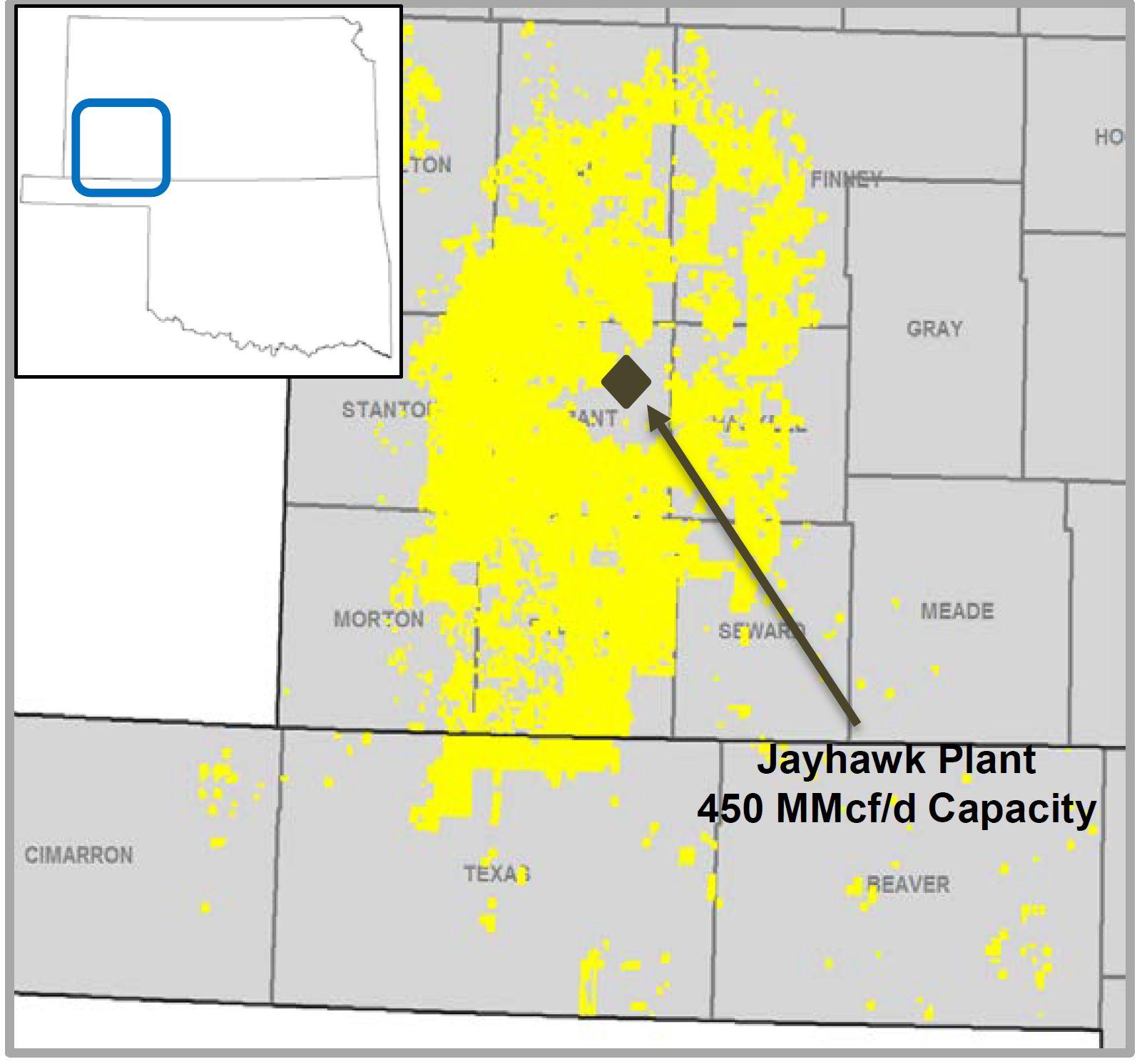

Leasehold Map

The Company's interest in properties to be sold consist of the following:

- Upstream properties of approximately 4,000 wells with second quarter net production of approximately 104 MMcfe/d

- Natural gas processing plants located in Grant County, Kansas, which include the Jayhawk natural gas processing plant with inlet capacity of 450 MMcf/d, current delivered volumes of approximately 260 MMcf/d, and the Satanta natural gas processing plant that is currently inactive.

David Rottino, President and Chief Executive Officer of Riviera commented, "I am pleased to announce this sale will complete our exit from the Hugoton Basin. Over the last 6 months we have strategically monetized our Hugoton Basin properties for over $405 million total through a series of three transactions, which include the monetization of a portion of our helium reserves through a VPP structure for approximately $82 million, and the sale of our interests in certain non-operated assets in the Hugoton Basin for approximately $31 million." Rottino continued, "The Company continues to focus on monetizing assets to unlock the sum of the parts value. Accomplishing a complete regional exit through these transactions not only highlights the value of our assets, but our capability to resourcefully maximize value given the current market environment, generating significant proceeds that we can use to return capital to shareholders."

The transaction is expected to close in the fourth quarter of 2019 with an effective date of July 1, 2019.

CIBC Griffis & Small acted as financial advisors and Kirkland & Ellis LLP as legal counsel during the transaction.

The estimated net proceeds from the sale are expected to be added to cash on the Company's balance sheet. After closing the transaction, the Company will continue to own upstream assets in East Texas, North Louisiana, the Anadarko Basin and the Uinta Basin.

Mid-Continent Deal Activity In Last 12 Months

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Jan-27-2025 |

-  |

-  |

Click here | Texas | E&P |

| Jul-29-2024 |

-  |

-  |

Click here | Oklahoma | E&P |

| Mar-02-2022 |

-  |

-  |

Click here | Oklahoma | E&P |

| Nov-10-2021 |

-  |

-  |

Click here | Texas | E&P |

| May-18-2021 |

-  |

-  |

Click here | Oklahoma | E&P |

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Jul-28-2022 | Diversified Picks Up MidCon Assets from Conoco for $240 Million | -  |

-  |

| Oct-20-2021 | Citizen Energy Picks Up Mid-Continent Asset; 28,000 Net Acres | -  |

-  |

| Oct-07-2021 | Diversified Energy Acquires Mid-Con Assets from Tapstone in PE-backed Deal | -  |

-  |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Aug-06-2020 |

-  |

-  |

Click here | Oklahoma | E&P |

| Jul-29-2020 |

-  |

-  |

Click here | Louisiana | E&P |

| Dec-20-2019 |

-  |

-  |

Click here | Texas | E&P |

| Nov-22-2019 |

-  |

-  |

Click here | Utah | E&P |

| Nov-07-2019 |

-  |

-  |

Click here | Texas | E&P |