Silver Run Acquisition Corp II → Alta Mesa Resources, Inc,Kingfisher Midstream LLC- One-Page Deal Sheet

Calculated Metrics( EV/Category)

Transaction Details:

Silver Run Acquisition Corp II has agreed to merge with Alta Mesa and Kingfisher Midstream, creating a company worth $3.8 billion.

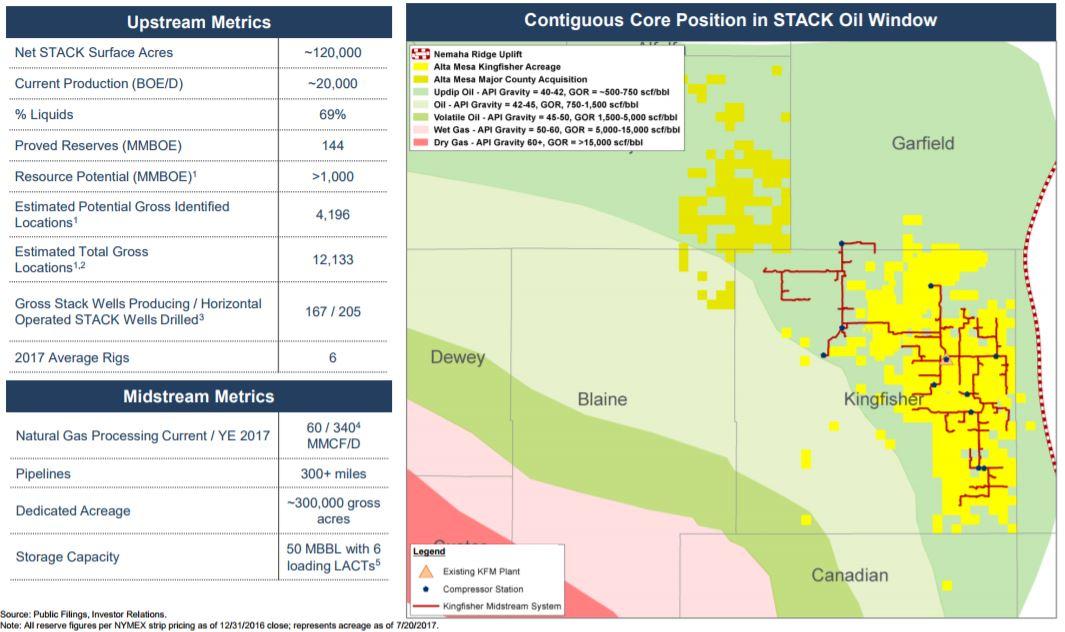

Bayou City-backed Alta Mesa, who filed an S-1 to go public in July 2017, is an E&P focused on the STACK play. It currently has approximately 120,000 contiguous net acres and about 4,200 gross identified drilling locations. Previously, Alta Mesa signed a drilling joint venture with Bayou City, where the company annouced it would fund 100% of Alta Mesa well cost up to $3.5 million for a total of 40 wells.

Current production is 20,000 boe/d (69% liquids) and proved reserves is 144 MMboe.

Silver Run II is a blank check company that was formed by Riverstone.

Silver Run II is expected to be renamed Alta Mesa Resources, Inc. and trade on the NASDAQ stock exchange under the ticker symbol "AMR".

Kingfisher Midstream is a private midstream company with a leading position in the STACK play, with Alta Mesa serving as its anchor producer. Kingfisher's assets include over 300 miles of pipeline, 50 thousand barrels of crude storage capacity, and 60 MMcf/d of gas processing capacity with an additional 200 MMcf/d cryogenic plant expansion expected to commence operations in the fourth quarter of 2017. With approximately 300,000 gross dedicated acres from Alta Mesa and five other third party customers, Kingfisher is uniquely positioned to capitalize on the increasing development activity in the STACK.

Mid-Continent - Anadarko Basin Deal Activity In Last 12 Months

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Mar-24-2025 |

-  |

-  |

Click here | Oklahoma | E&P |

| Sep-06-2022 |

-  |

-  |

Click here | E&P | |

| Jul-28-2022 |

-  |

-  |

Click here | Texas | E&P |

| Jun-29-2022 |

-  |

-  |

Click here | Oklahoma | E&P |

| Mar-02-2022 |

-  |

-  |

Click here | Oklahoma | E&P |

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Jul-28-2022 | Diversified Picks Up MidCon Assets from Conoco for $240 Million | -  |

-  |

| Mar-02-2022 | BCE-Mach Picks Up Midcontinent Assets for $66.5MM; STACK, MissLime | -  |

-  |

| Nov-18-2020 | Tapstone Picks Up Chesapeake's MidCon Assets with $131MM Bid | -  |

-  |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Apr-08-2020 |

-  |

-  |

Click here | Oklahoma | E&P |

| Jan-19-2016 |

-  |

-  |

Click here | Oklahoma | E&P |

| Sep-22-2015 |

-  |

-  |

Click here | Oklahoma | E&P |

| Sep-22-2015 |

-  |

-  |

Click here | Texas | E&P |

| Oct-14-2014 |

-  |

-  |

Click here | Texas | E&P |