Top Story | Deals - Acquisition, Mergers, Divestitures

Cabot & Cimarex To Combine in $17 Billion Enterprise Deal

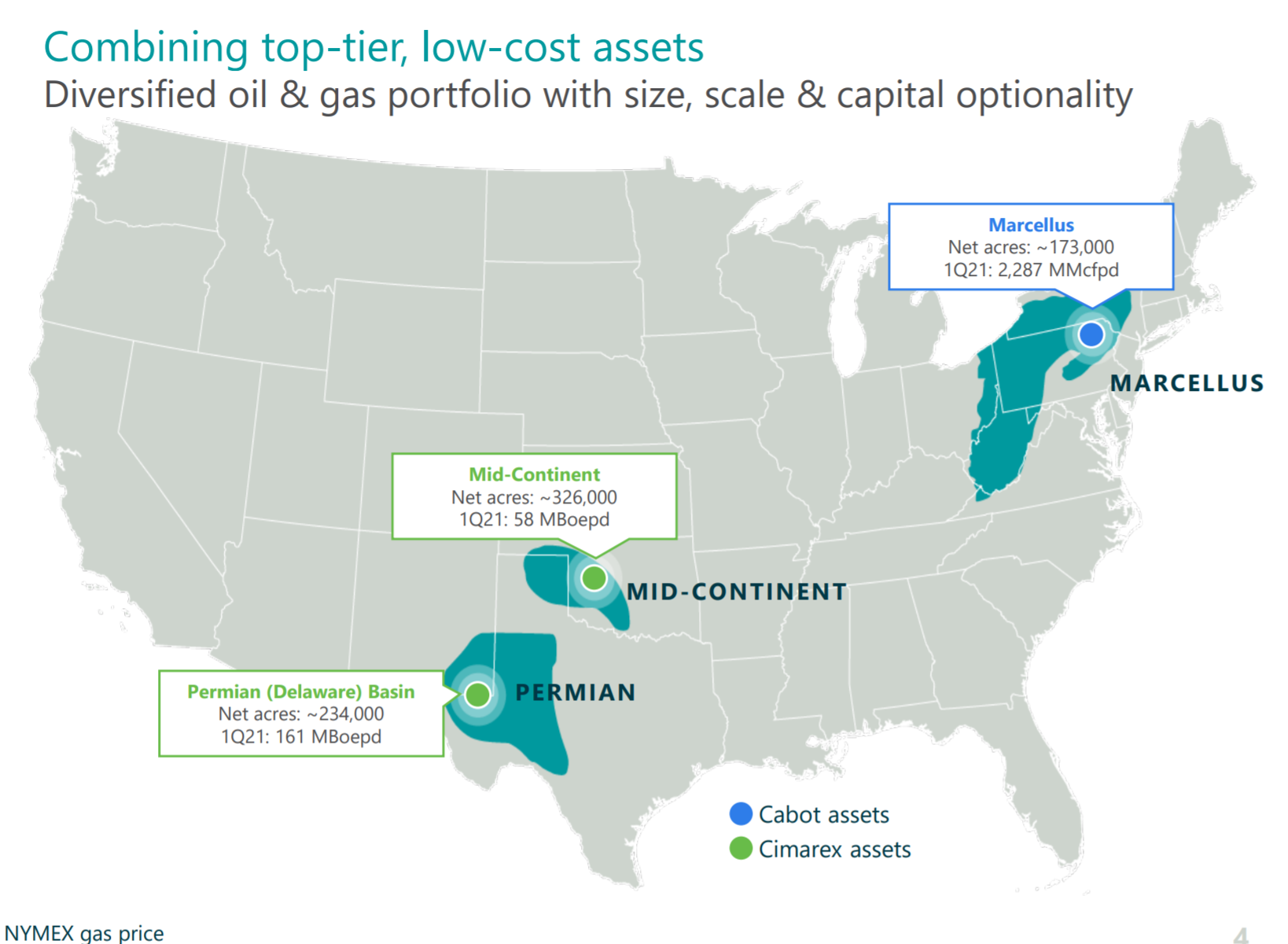

Cabot Oil & Gas with assets in the 173,000 net acres in the Marcellus have agreed to combine with Cimarex. Cimarex has some 560,000 net acres of assets in the MidCon and Permian region.

Cimarex shareholders will receive 4.0146 shares of Cabot common stock for each share of Cimarex common stock owned. The exchange ratio, together with closing prices for Cabot and Cimarex on May 21, 2021, reflects an enterprise value for the combined companies of approximately $17 billion

The company said its low-cost and capital efficient inventory is expected to support its robust, cumulative free cash flow outlook of approximately $4.7 billion of free cash flow from 2022 to 2024 based on $55 per barrel WTI oil prices and $2.75 per MMBtu NYMEX natural gas prices.

The combined business, which will operate under a new name, plans to be headquartered in Houston and maintain its regional offices.

Transaction Details

Combined Company

- Land : 173,000 + 560,000 net acres

- Production : 601,000 Boe/d

- Active Rigs : 9 Rigs

Asset Map

Search Data From Cabot Oil & Gas Corp Latest Presentations

Search Data From Cimarex Energy Co. Latest Presentations

Related Water Management

-

PE-Backed Company Acquires Water System from Permian E&P -

-

NGL Energy Partners Signs Water Management Agreement with XTO/Exxon

-

Water Management Co. Signs Major Disposal Agreement in the Delaware Basin -

-

Permian E&P Warns Its Water Midstream Sale Might Not Close -

-

NGL Signs Delaware Basin Water Transport Agreement