Strategic Focus

Coterra’s 2025 development program emphasizes:

-

Capital discipline

-

Balanced exposure to oil and gas markets

-

Efficient multi-basin operations

-

High-return well inventory utilization

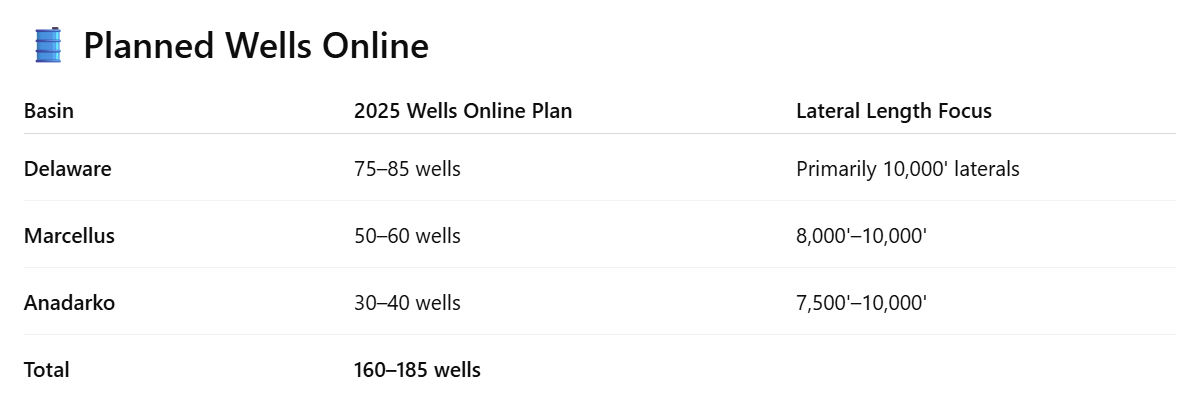

The company plans to maintain capital spending levels flat year-over-year, while continuing to optimize returns across its three core basins: Delaware, Marcellus, and Anadarko.

Capital Expenditure Plan

-

Total capital budget: $1.7–$1.9 billion

-

Flat vs. 2024, reflecting efficiency gains and consistent pricing

-

Majority of capex directed to Delaware Basin (~70%)

-

Continued investment in short-cycle, high-return projects

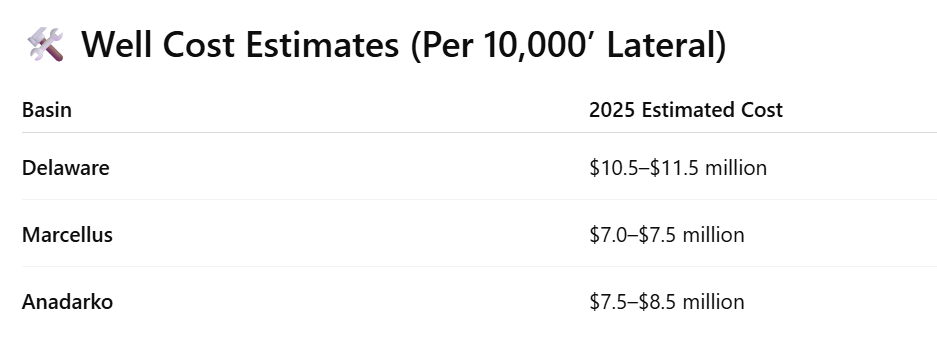

Costs remain flat to slightly lower versus 2024 due to:

-

Improved drilling/completion cycle times

-

Enhanced vendor management

-

Reduced inflationary pressure in service markets

Program Flexibility

Coterra maintains flexibility to adjust activity:

-

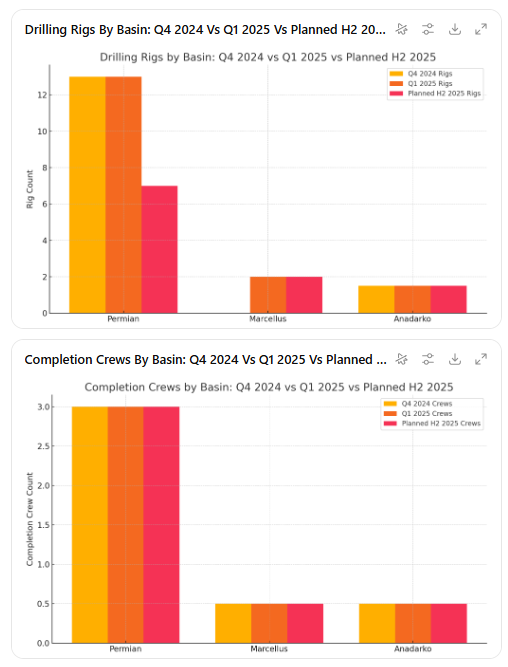

Marcellus and Anadarko programs can ramp up or down based on gas and NGL pricing.

-

Delaware activity is steady, given its oil weighting and capital efficiency.

Additional Highlights

-

FTI (free cash flow yield) expected to remain strong due to disciplined spending.

-

Production guidance reflects a slight increase YoY, particularly in oil-weighted volumes.

-

Operational focus areas: