General News | Deals - Acquisition, Mergers, Divestitures

Phillips 66 Makes Offer to Buy DCP Midstream for $34.75/Share

Phillips 66 has submitted a non-binding proposal to the board of directors of the general partner of DCP Midstream offering to acquire all publicly held common units of DCP Midstream in an all cash deal.

The company is offering $34.75/share for all outsanding units of DCP. Under the agreement, DCP Midstream would become an indirect subsidiary of Phillips 66.

This move is concurrent with Phillips 66’s announcement of the realignment of economic and governance interests in DCP.

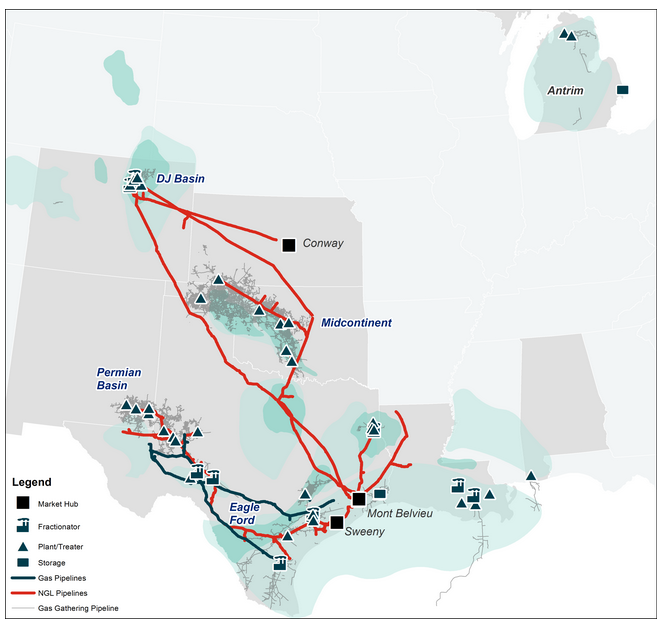

DCP has assets in the following plays:

- Permian Basin

- DJ Basin

- Eagle Ford

- Anadarko Basin

- Gulf Coast

Search Data From DCP Midstream LP Latest Presentations

November 18, 2020