Concho to Acquire RSP In Largest Permian Deal Worth $9.5 Billion

Multiples

Transaction Details:

Concho Resources announced its plan to acquire RSP Permian in an all stock deal worth $9.5 billion inclusive of RSP's debt.

The transaction was unanimously approved by the board of directors of each company.

This deal closed on July 19, 2018.

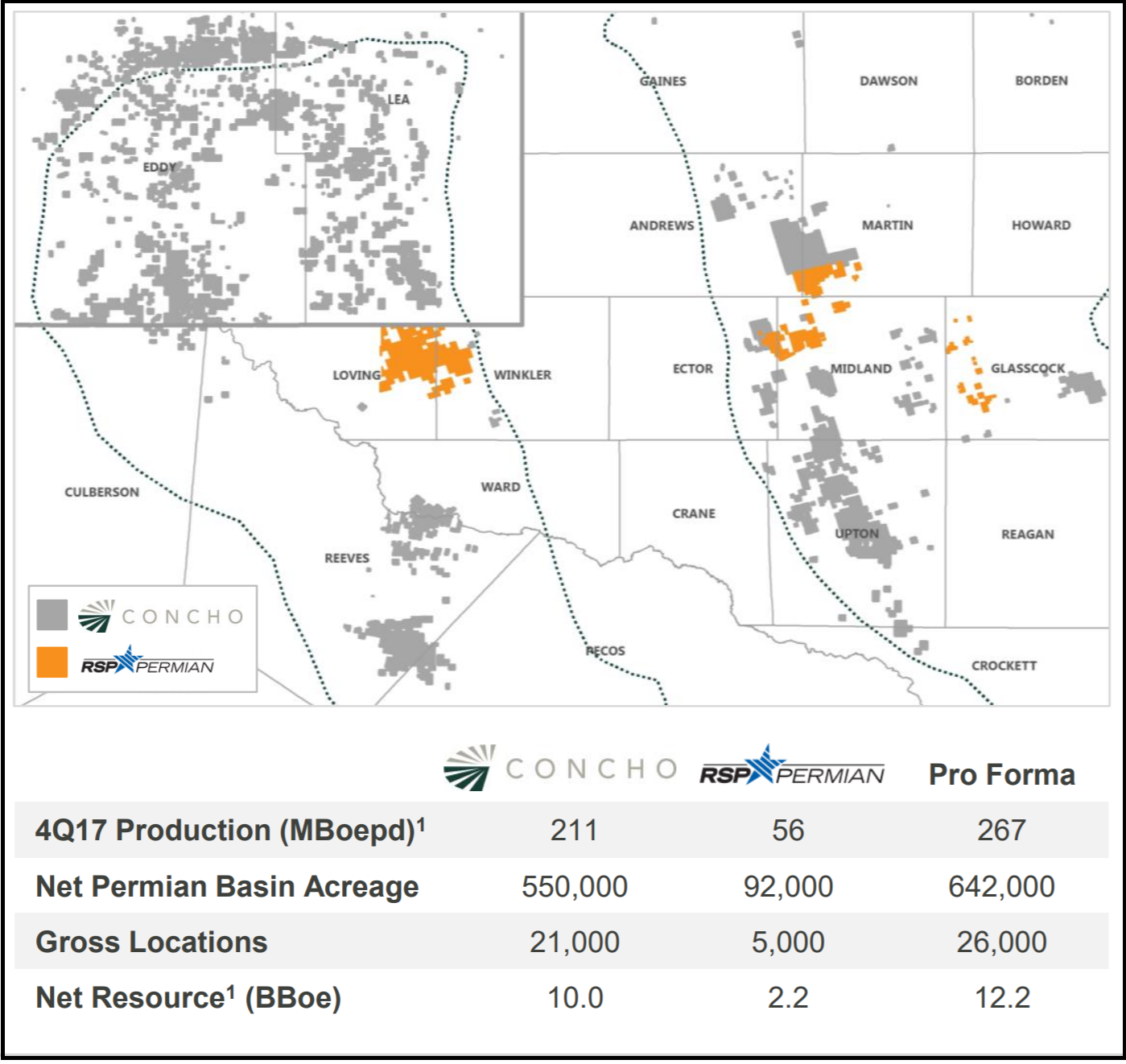

The combined company will run the largest drilling and completion program in the Permian Basin, with 642,000 net acres and 267 MBOEPD in production.

This would be the largest deal done in the basin, beating out the previous $6.5 billion Exxon paid to the Bass family to acquire its Northern Delaware Basin position.

Stock Transaction Details

Under the terms of the definitive merger agreement, shareholders of RSP will receive 0.320 shares of Concho common stock in exchange for each share of RSP common stock, representing consideration to each RSP shareholder of $50.24 per share based on the closing price of Concho common stock on March 27.

The consideration represents a roughly 29% premium to RSP’s closing price of $38.92 on March 27, according to the companies’ joint press release.

Combined Position

Tim Leach, Chairman and Chief Executive Officer of Concho, commented, “This transaction provides a compelling opportunity for both Concho and RSP shareholders to benefit from the strength of our combined company. The RSP team built an exceptional high-margin asset portfolio consistent with our playbook – large, contiguous positions in the core of the Permian Basin. And they did so with a strategy of maximizing well performance and returns, which provides substantial running room for continuous development with large-scale projects. This combination allows us to consolidate premier assets that seamlessly fold into our drilling program, enhance our scale advantage and reinforce our leadership position in the Permian Basin, all while strengthening our platform for delivering predictable growth and returns. We look forward to welcoming RSP’s employees as members of the Concho team.”

Steve Gray, Chief Executive Officer of RSP, commented, “I am extremely proud of the RSP team and the high-quality position we built in the Permian Basin. As RSP has grown and we have seen the resource play develop in the Permian, we have come to recognize that combining with a company with the scale, investment grade balance sheet and operational excellence of Concho will unlock even more value for shareholders. The combined company will have the vision and necessary financial strength to efficiently develop the tremendous resource potential of these assets with large-scale projects.”

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Feb-12-2024 | Diamondback To Acquire Endeavor Energy In $26 Billion Transaction | -  |

-  |

| Jan-04-2024 | APA Corp to Acquire Permian Pure Player- Callon In All Stock Deal | -  |

-  |

| Dec-15-2023 | Fury Resources Takes Battalion Private In Transaction Worth $450 Million : Map | -  |

-  |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Aug-07-2017 |

-  |

-  |

Click here | Texas | E&P |

| Oct-13-2016 |

-  |

-  |

Click here | Texas | E&P |

| Oct-07-2015 |

-  |

-  |

Click here | Texas | E&P |

| Aug-04-2015 |

-  |

-  |

Click here | Texas | E&P |

| Jul-25-2014 |

-  |

-  |

Click here | Texas | E&P |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Oct-19-2020 |

-  |

-  |

Click here | Texas | E&P |

| Sep-03-2019 |

-  |

-  |

Click here | New Mexico | E&P |

| Feb-20-2018 |

-  |

-  |

Click here | Texas | E&P |

| Aug-03-2017 |

-  |

-  |

Click here | Texas | E&P |

| Nov-21-2016 |

-  |

-  |

Click here | New Mexico | E&P |