Concho Scoops Up Reliance Energy for $1.6 B

Multiples

Transaction Details:

Closing Announcement - October 5, 2016

Initial Announcement - August 15, 2016

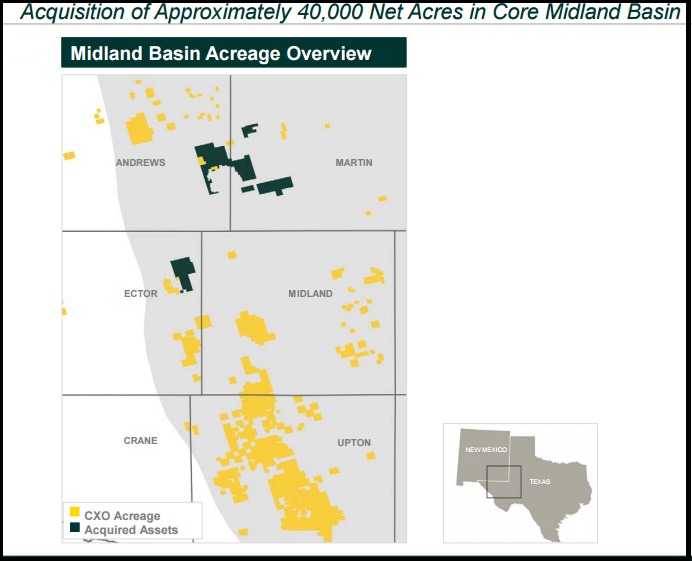

Concho Resources Inc. plans to acquire approximately 40,000 net acres in the core of the Midland Basin from Reliance Energy, a privately held, Midland-based energy company, for $1.625 billion.

Map:

Acquisition Highlights

- Adds ~ 40,000 net acres with an average 99% working interest to Concho’s core Midland Basin position

- Includes ~ 10 MBoepd (67% oil) of current production

- 530 long-lateral drilling locations targeting the Middle Spraberry, Lower Spraberry and Wolfcamp B

- Provides expansive development upside across multiple zones

- The acquisition includes 10 MBoepd from 326 vertical wells and 44 horizontal wells, only one of which was completed in 2016. The present value of this stable production base at current NYMEX strip pricing is approximately $0.5 billion, with the remaining $1.1 billion of the purchase price attributable to 40,000 undeveloped acres.

Estimated proved reserves attributable to the acquisition total approximately 43 million Boe. Proved developed reserves represent approximately 69% of the total proved reserves. The estimate of proved reserves is based on the Company’s internal estimates as of June 30, 2016, and utilizes the Securities and Exchange Commission’s reserve recognition standards and pricing assumptions based on the trailing 12-month average first-day-of-the-month prices of $39.63 per Bbl of oil and $2.24 per MMBtu of natural gas.

The acquired acreage is located in Andrews, Martin and Ector counties in Texas with minimal leasehold obligations.

The acquisition adds more than 530 long-lateral drilling locations to the Company’s inventory. Due to the contiguous nature of the acquired assets, two-thirds of these locations are two-mile laterals, and the remaining locations are 1.5-mile laterals.

The engineered locations are based on eight locations per zone in the Middle Spraberry, Lower Spraberry or Wolfcamp B, with two to three of these zones targeted per drilling spacing unit. The Company believes there is substantial development upside from applying optimal drilling and completion methods, testing closer well spacing and delineating other zones.

Consideration in the transaction includes approximately $1.1 billion of cash and 3.96 million shares of Concho’s common stock valued at approximately $0.5 billion and issuable pursuant to a stock payment option that the Company intends to exercise. The Company intends to fund the cash portion of the acquisition through proceeds from a potential equity market transaction, subject to market conditions and other factors. The acquisition is expected to close in October 2016, and is subject to customary closing conditions.

Vinson & Elkins LLP acted as legal advisor and Evercore acted as financial advisor to Concho on the acquisition. Sidley Austin LLP acted as legal advisor to Reliance Energy.

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Jan-04-2024 |

-  |

-  |

Click here | Texas | E&P |

| Oct-11-2023 |

-  |

-  |

Click here | Texas | E&P |

| Aug-21-2023 |

-  |

-  |

Click here | New Mexico | E&P |

| Nov-16-2022 |

-  |

-  |

Click here | Texas | E&P |

| Sep-30-2022 |

-  |

-  |

Click here | Texas | E&P |

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Feb-12-2024 | Diamondback To Acquire Endeavor Energy In $26 Billion Transaction | -  |

-  |

| Jan-04-2024 | APA Corp to Acquire Permian Pure Player- Callon In All Stock Deal | -  |

-  |

| Dec-15-2023 | Fury Resources Takes Battalion Private In Transaction Worth $450 Million : Map | -  |

-  |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Oct-19-2020 |

-  |

-  |

Click here | Texas | E&P |

| Sep-03-2019 |

-  |

-  |

Click here | New Mexico | E&P |

| Mar-28-2018 |

-  |

-  |

Click here | New Mexico | E&P |

| Feb-20-2018 |

-  |

-  |

Click here | Texas | E&P |

| Aug-03-2017 |

-  |

-  |

Click here | Texas | E&P |