Continental Resources, Inc. → Pioneer Natural Resources Co.- One-Page Deal Sheet

Calculated Metrics( EV/Category)

Transaction Details:

Continental Resources has entered into the Permian Basin through its acquisition of assets from Pioneer Natural Resources in an all-cash transaction valued at approximately $3.1 billion.

The deal will have an effective date of October 1, 2021 and it closed on December 21, 2021.

Transaction Summary

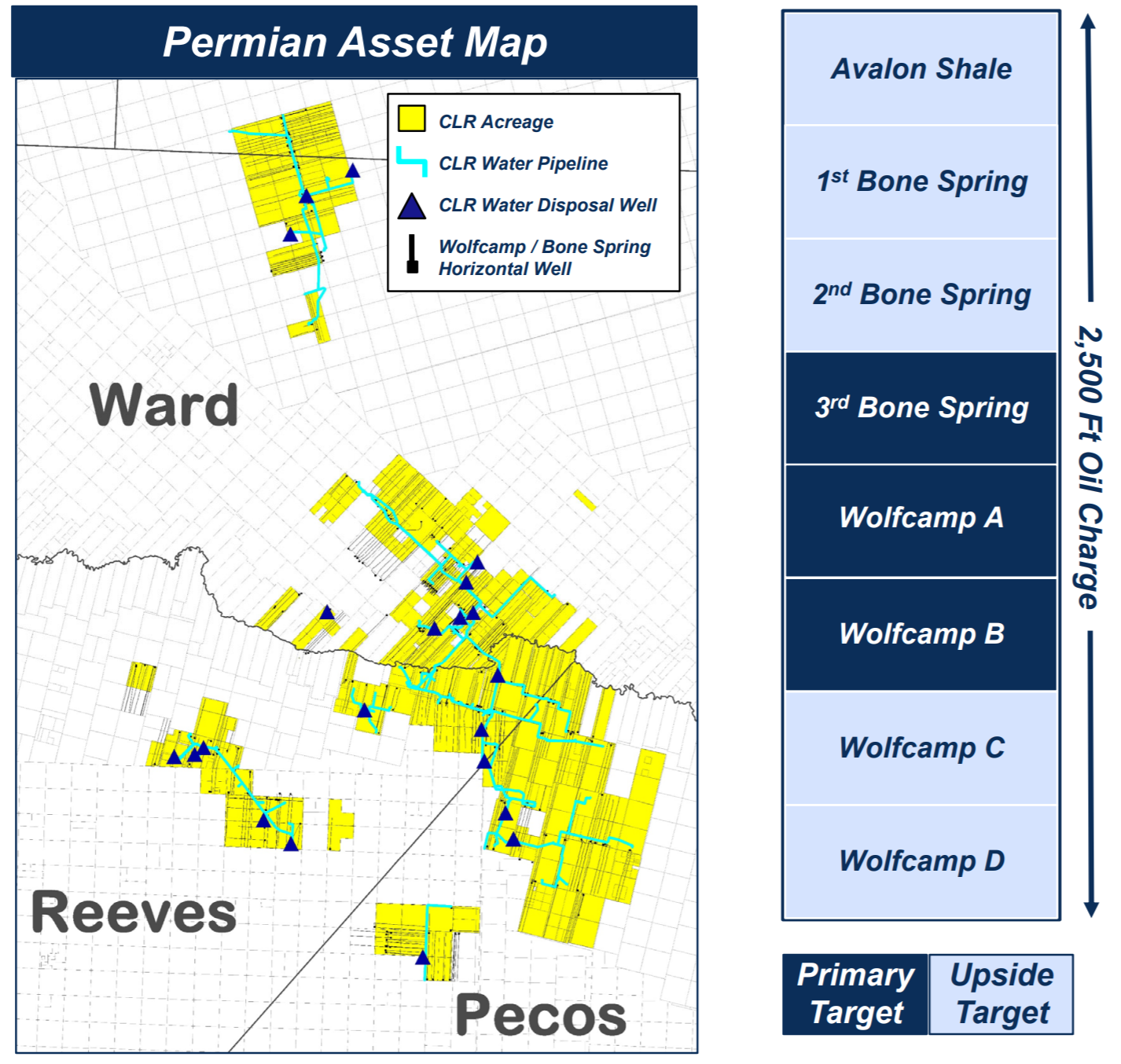

- Land: 92,000 net acres (50k net royalty & 31k net surface)

- Production: 55,000 boe/d (~70% oil), 98% operated with over 90% of acreage held by production

- Locations: 650 Gross Locations in Third Bone Spring/Wolfcamp A & B; over 1,000 total locations

Key Transaction Highlights:

- Projected to generate $750 MM of annual cash flow from operations & $500 MM of annual free cash flow (non-GAAP) in 2022 at current prices

- PDP represents ~75% of transaction price; ~55 MBoepd (~70% oil).

- 92, K contiguous net leasehold acres.

- 98% operated with over 90% of acreage held by production.

- 50 K net royalty acres and 31 K net surface acres.

- Extensive water infrastructure in place.

- Over 650 gross operated locations in Third Bone Spring/Wolfcamp A & B; over 1,000 total locations, including additional zones producing in the basin.

Map

"Continental's foundation has always been built upon a strong geology-led corporate strategy. This continues today and has directly led us to our new strategic position in the Permian Basin. This acquisition will complement our existing deep inventory portfolio in the Bakken, Oklahoma and most recently, the Powder River Basin. In addition to the competitive geologic attributes, this transaction is accretive on key financial metrics and supports our long term target of 1.0x net debt to EBITDAX by year end 2022 at $60 WTI," said Bill Berry, Chief Executive Officer.

"These Permian assets contain the key strategic components common to all of our assets with significant untapped potential to enhance performance through optimized density development, wellbore placement, operational efficiencies and further exploration," said Jack Stark, President & Chief Operating Officer.

Citi Global Market, Inc. is serving as the Company's financial advisor and White & Case LLP is serving as the Company's legal advisor with respect to this transaction.

Permian - Delaware Basin Deal Activity In Last 12 Months

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Sep-02-2025 |

-  |

-  |

Click here | Texas | E&P |

| May-07-2025 |

-  |

-  |

Click here | New Mexico | E&P |

| May-03-2025 |

-  |

-  |

Click here | New Mexico | E&P |

| Nov-13-2024 |

-  |

-  |

Click here | New Mexico | E&P |

| Jul-30-2024 |

-  |

-  |

Click here | Texas | E&P |

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Jul-30-2024 | Permian Resources Acquires More Delaware Basin Property | -  |

-  |

| Jul-28-2024 | Vital Energy Acquires Delaware Basin Property From PE-Backed E&P | -  |

-  |

| Jun-12-2024 | Matador Resources Acquires PE-Backed Ameredev For $1.9 Billion | -  |

-  |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Oct-11-2023 |

-  |

-  |

Click here | Texas | E&P |

| Sep-20-2021 |

-  |

-  |

Click here | Texas | E&P |

| Apr-01-2021 |

-  |

-  |

Click here | Texas | E&P |

| Oct-20-2020 |

-  |

-  |

Click here | Texas | E&P |

| Dec-09-2019 |

-  |

-  |

Click here | Texas | E&P |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Jan-25-2022 |

-  |

-  |

Click here | Wyoming | E&P |

| Feb-17-2021 |

-  |

-  |

Click here | Wyoming | E&P |

| Jul-31-2019 |

-  |

-  |

Click here | Oklahoma | E&P |

| Aug-09-2017 |

-  |

-  |

Click here | Oklahoma | E&P |

| Aug-09-2017 |

-  |

-  |

Click here | Oklahoma | E&P |