Coterra Energy → Franklin Mountain Energy, LLC,Avant Natural Resources- One-Page Deal Sheet

Calculated Metrics( EV/Category)

Transaction Details:

Coterra Energy announced the acquisition of Permian Basin assets from Franklin Mountain Energy and Avant Natural Resources for $3.95 billion (comprised of $2.95 billion in cash and $1.0 billion in Coterra common stock). Franklin is backed by EnCap Investments, and Avant is backed by KKR, marking another significant private equity-backed upstream transaction.

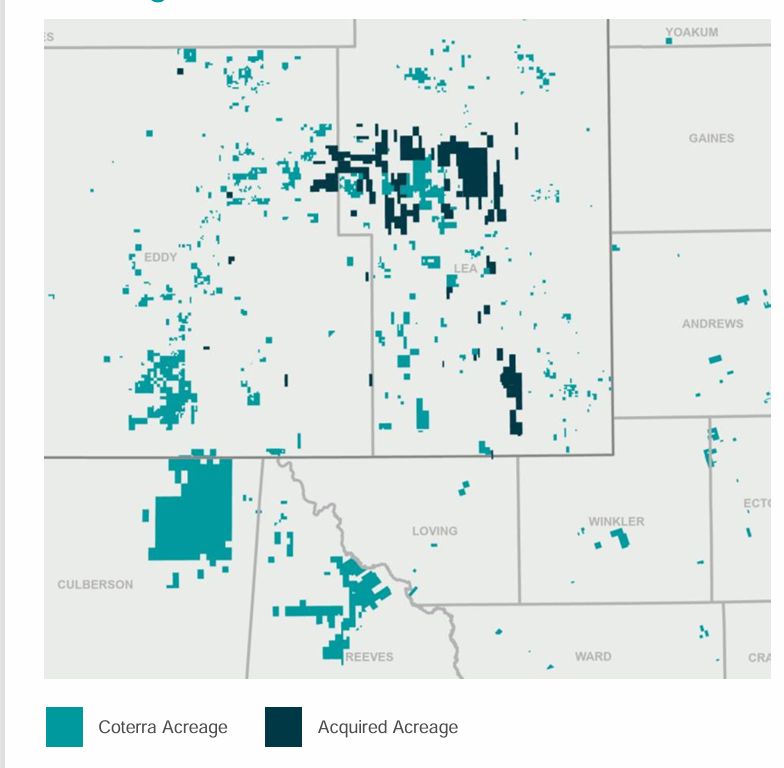

The acquired assets include approximately 49,000 net highly contiguous acres in Lea County, New Mexico, and are expected to produce 70–80 Mboe/d in 2025, including 40–50 Mbbl/d of oil, representing an oil mix of approximately 50%–71%. The package adds 400–550 net drilling locations, targeting oil-rich formations such as Bone Spring, Avalon, Harkey, and the emerging Lower Wolfcamp/Penn Shale.

Transaction Benefits:

-

Accretive Financial Impact: The deal is estimated to be >15% accretive to 2025–2027 per share Discretionary Cash Flow and Free Cash Flow, and accretive to Net Asset Value.

-

Enhanced Scale & Inventory: Expands Coterra’s Permian footprint to an ~83,000 net acre focus area and increases Permian net locations by ~25%, with 15+ years of inventory

- Acquisition valued at 3.8x estimated 4Q24 annualized EBITDAX and approximately 13% estimated 2025 Free Cash Flow yield at $70/bbl WTI and $3.00/MMBtu Henry Hub price assumptions

- Coring up position in the northern Delaware Basin with approximately 49,000 net highly contiguous acres concentrated in Lea County, New Mexico, creating a new approximately 83,000 net acre focus area within the Coterra portfolio

Permian - Delaware Basin Deal Activity In Last 12 Months

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Sep-02-2025 |

-  |

-  |

Click here | Texas | E&P |

| May-07-2025 |

-  |

-  |

Click here | New Mexico | E&P |

| May-03-2025 |

-  |

-  |

Click here | New Mexico | E&P |

| Jul-30-2024 |

-  |

-  |

Click here | Texas | E&P |

| Jul-28-2024 |

-  |

-  |

Click here | Texas | E&P |

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Sep-02-2025 | Crescent Energy Acquires Vital | -  |

-  |

| Jul-10-2025 | Mach Enters Permian Basin, Buys PE_backed Sabinal Assets for $500 Million | -  |

-  |

| May-07-2025 | Permian Resources Bolt-On Assets From APA Corp | -  |

-  |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Sep-26-2018 |

-  |

-  |

Click here | New Mexico | E&P |

| Sep-06-2018 |

-  |

-  |

Click here | New Mexico | E&P |