Diamondback Energy, Inc. → Energen Corp.- One-Page Deal Sheet

Calculated Metrics( EV/Category)

Transaction Details:

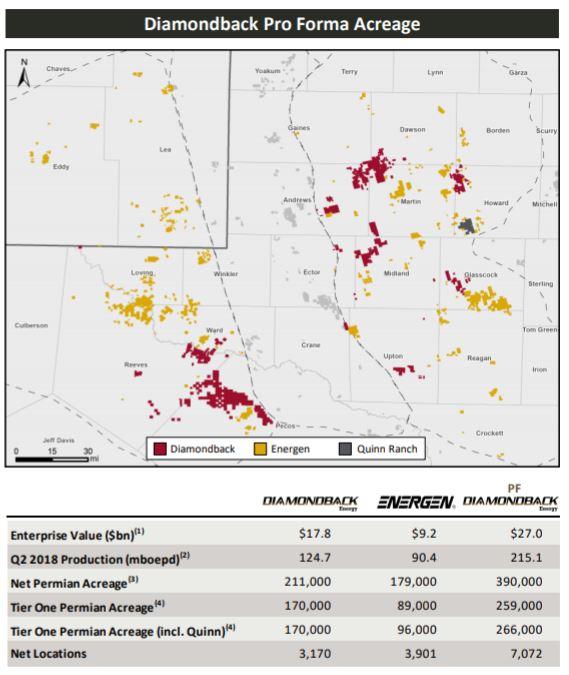

Diamondback Energy has inked a mega-merger deal with Energen, where Diamondback will acquire Energen in an all-stock transaction valued at approximately $9.2 billion, including Energen's net debt of $830 million as of June 30, 2018.

This deal closed on November 29, 2018.

Asset Summary

- Q2 2018 daily production of 90.4 Mboe/d

- 179,000 net acres in Peco, Reeves, and Ward, New Mexico. Dawson, Margin, Andrews, Midland and Glasscock, Texas.

- 3901 net locations.

- 444 MMBOE (YE-2017) Proved Reserves.

Acquisition Metrics

- Purchase Price : Stock : $9.2 billion (including $830 million in debt)

Metrics

- Daily Production (boe/d) : 90,400

- Net Acres : 179,000

- Locations : 3,901

Multiples

- Production ($/boe/d) : $101, 770

- $Price/ Net Acre : $51,397

- $Price/Adj. Net Acre * : $29,027

- $Price/Location : $2,358,370

- $Price/Adj. Location * : $1,331,966

* Value adjusted by $35,000 per flowing boe/d, and $830 million debt.

The merger will create a large cap Permian independent with over 266,000 net acres in across the Permian Basin.

The combination will result in:

- Over 266,000 net Tier One acres in the Permian Basin, an increase of 57% from Diamondback's current Tier One acreage of approximately 170,000 net acres (pro forma for previously announced Ajax acquisition)

- Over 7,000 estimated total net horizontal Permian locations, an increase of over 120% from Diamondback's current estimated net locations (pro forma for previously announced Ajax acquisition)

- Combined pro forma Q2 2018 production of over 222 Mboe/d (67% oil), third largest production for a pure play company in the Permian Basin, an increase of 79% from Diamondback's Q2 2018 production of 124.7 Mboe/d (includes production from the previously announced Ajax acquisition)

- 390,000 net acres across the Midland and Delaware basins, an increase of 85% from 211,000 net acres as of June 30, 2018 (pro forma for previously announced Ajax acquisition)

The consideration will consist of 0.6442 shares of Diamondback common stock for each share of Energen common stock, representing an implied value to each Energen shareholder of $84.95 per share based on the closing price of Diamondback common stock on August 13, 2018.

The transaction was unanimously approved by the Board of Directors of each company.

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Feb-12-2024 | Diamondback To Acquire Endeavor Energy In $26 Billion Transaction | -  |

-  |

| Jan-04-2024 | APA Corp to Acquire Permian Pure Player- Callon In All Stock Deal | -  |

-  |

| Dec-15-2023 | Fury Resources Takes Battalion Private In Transaction Worth $450 Million : Map | -  |

-  |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Feb-10-2017 |

-  |

-  |

Click here | Texas | E&P |

| Jul-25-2016 |

-  |

-  |

Click here | New Mexico | E&P |

| Feb-13-2015 |

-  |

-  |

Click here | New Mexico | E&P |

| Oct-08-2014 |

-  |

-  |

Click here | Texas | E&P |

| Aug-29-2013 |

-  |

-  |

Click here | Alabama | E&P |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Feb-18-2025 |

-  |

-  |

Click here | Texas | E&P |

| Jan-30-2025 |

-  |

-  |

Click here | Texas | E&P |

| Feb-12-2024 |

-  |

-  |

Click here | Texas | E&P |

| Nov-16-2022 |

-  |

-  |

Click here | Texas | E&P |

| Oct-11-2022 |

-  |

-  |

Click here | Texas | E&P |