EQT Corp → Chevron Corp- One-Page Deal Sheet

Calculated Metrics( EV/Category)

Transaction Details:

Asset Highlights:

- Current net production of approximately 450 MMcfe per day; 75% gas / 25% liquids

- Approximately 100 work-in-progress wells

- Purchase price : $735 million

- Approximately 125,000 core net Marcellus acres; 335,000 total net Marcellus acres

- 31% ownership interest in Laurel Mountain Midstream

- Two water systems and associated infrastructure located in PA and WV

President and CEO Toby Rice stated, "This acquisition is a natural bolt-on extension of EQT's dominant position in the core of the southwest Marcellus and supplements our already impressive asset base. With the purchase price underpinned by PDP value, the extensive work-in-progress well inventory, core undeveloped acreage and water assets provide material value upside. Our unique knowledge of these assets, coupled with our superior operating model, puts these assets in the right hands to maximize the embedded value."

Rice continued, "The digital work environment and business processes that we have created will allow for the seamless integration of these assets into our existing portfolio, while the favorable financial impacts will benefit both equity and debt holders. This transaction represents another strategic step this team is taking to create value for all stakeholders, while enhancing the durability and sustainability of our business."

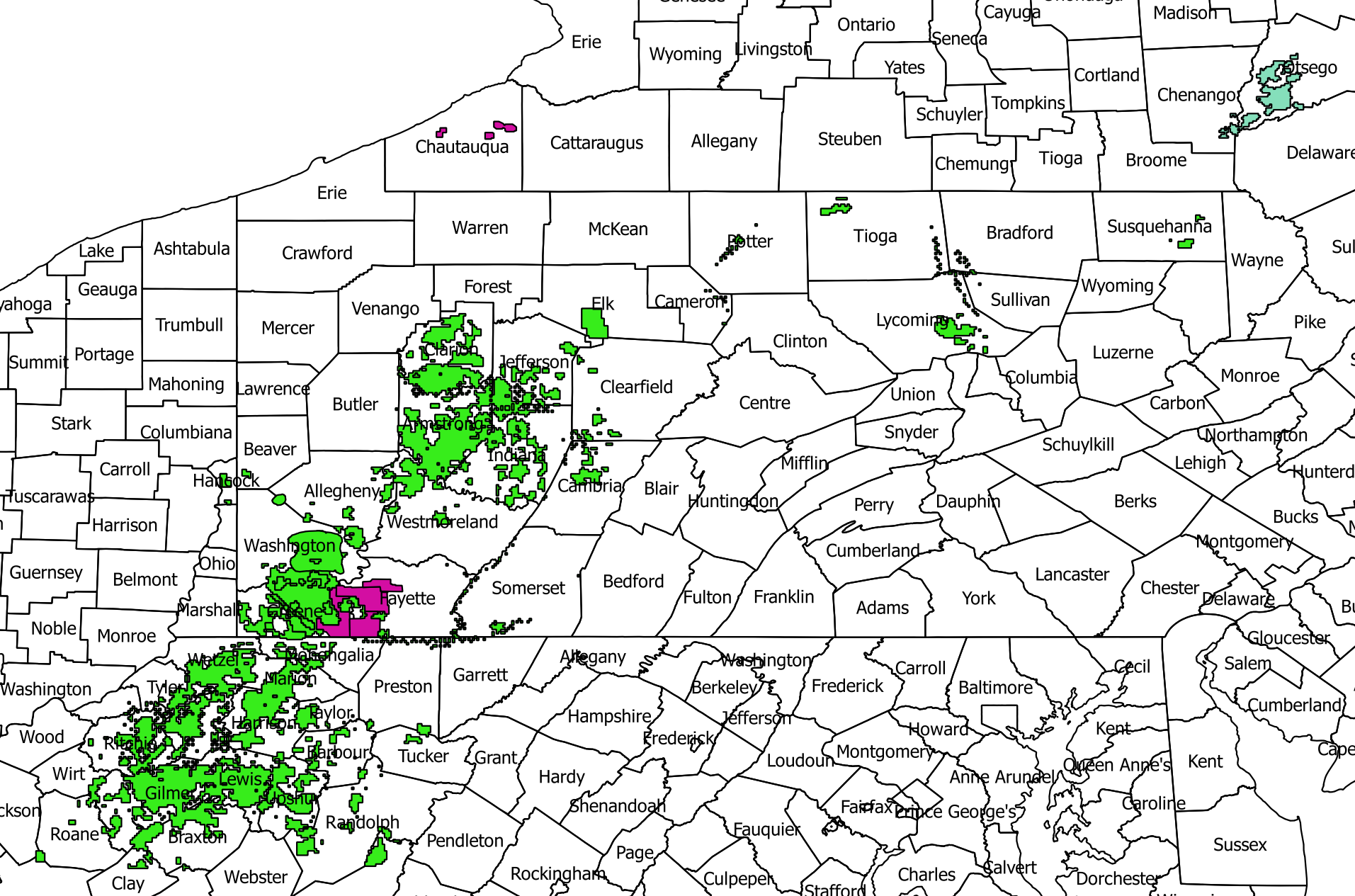

Proforma - Map (EQT + Chevron)

Northeast - Appalachia Deal Activity In Last 12 Months

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| May-30-2025 |

-  |

-  |

Click here | Ohio | E&P |

| Apr-22-2025 |

-  |

-  |

Click here | Pennsylvania | E&P |

| Dec-05-2024 |

-  |

-  |

Click here | Pennsylvania | E&P |

| Jan-11-2024 |

-  |

-  |

Click here | West Virginia | E&P |

| Sep-08-2022 |

-  |

-  |

Click here | West Virginia | E&P |

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Apr-22-2025 | EQT Acquires Olympus Energy Assets For $1.8 Billion | -  |

-  |

| Dec-05-2024 | CNX Acquires Apex’s Appalachian Gas & Midstream Assets for $505MM | -  |

-  |

| Jan-11-2024 | Chesapeake To Acquire Southwestern Energy | -  |

-  |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Apr-01-2025 |

-  |

-  |

Click here | Texas | E&P |

| Oct-23-2023 |

-  |

-  |

Click here | North Dakota | E&P |

| May-25-2022 |

-  |

-  |

Click here | E&P | |

| Dec-30-2021 |

-  |

-  |

Click here | Texas | E&P |

| Jul-20-2020 |

-  |

-  |

Click here | Colorado | E&P |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Apr-22-2025 |

-  |

-  |

Click here | Pennsylvania | E&P |

| Oct-29-2024 |

-  |

-  |

Click here | Pennsylvania | E&P |

| Sep-08-2022 |

-  |

-  |

Click here | West Virginia | E&P |

| May-06-2021 |

-  |

-  |

Click here | Pennsylvania | E&P |

| May-14-2020 |

-  |

-  |

Click here | Pennsylvania | E&P |